Back

Anonymous 3

Hey I am on Medial • 1y

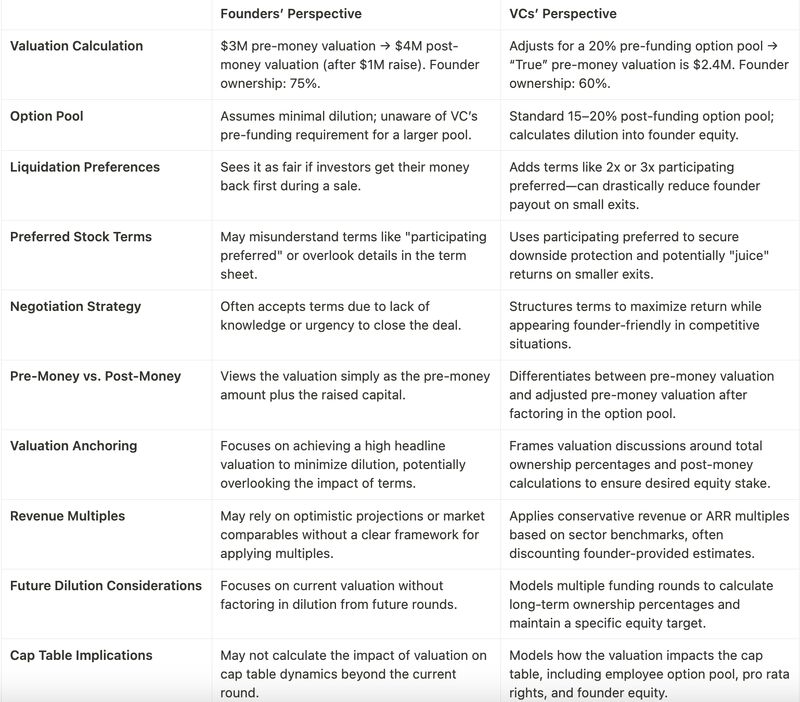

Standard angel terms: 5-15% equity for 25L-1Cr Keep 10% ESOP pool Clean cap table No special rights Monthly updates Basic board seat Get termsheet reviewed by lawyer.

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

What is an ESOP from a Company’s Perspective?🚀 An Employee Stock Ownership Plan (ESOP) is a tool companies use to attract, retain, and motivate talent by offering them ownership in the business. You’re not just giving away shares, you’re building

See More

Kishan Kabra

•

Guava Trees Softech Pvt • 7m

A few months ago, they ran into a problem. A client had built something amazing on top of LLMs. It worked great in the sandbox. But when they opened the doors to real users - across orgs, domains, and workflows: everything changed. Latency became a

See MoreSamCtrlPlusAltMan

•

OpenAI • 6m

The Startup Fundraising Roadmap: A Complete Guide by Hissa Fundraising isn’t just about raising money, it’s about building momentum, choosing the right path, and navigating complexity without losing sight of what matters. Hissa’s guide breaks it dow

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)