Back

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Sanjeev Antal

OG Founder & CEO - P... • 1y

🚨 GST Council Introduces 'Track and Trace' Mechanism 🚨 The GST Council has approved a 'track and trace' system to combat tax evasion in specific industries. Cigarettes and pan masala are expected to be the initial focus of this initiative. Key H

See MoreRecouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

PEPOPULAR

Alt + Ctrl + Pepopul... • 10m

Startups, slide in! We’re down to help you market your products or services and cook up viral strategies that actually hit. From reels to reach — we got you. And don’t worry, our price is so nominal, even Sitharaman won’t bother taxing it. No GST,

See MoreAditya Arora

•

Faad Network • 5m

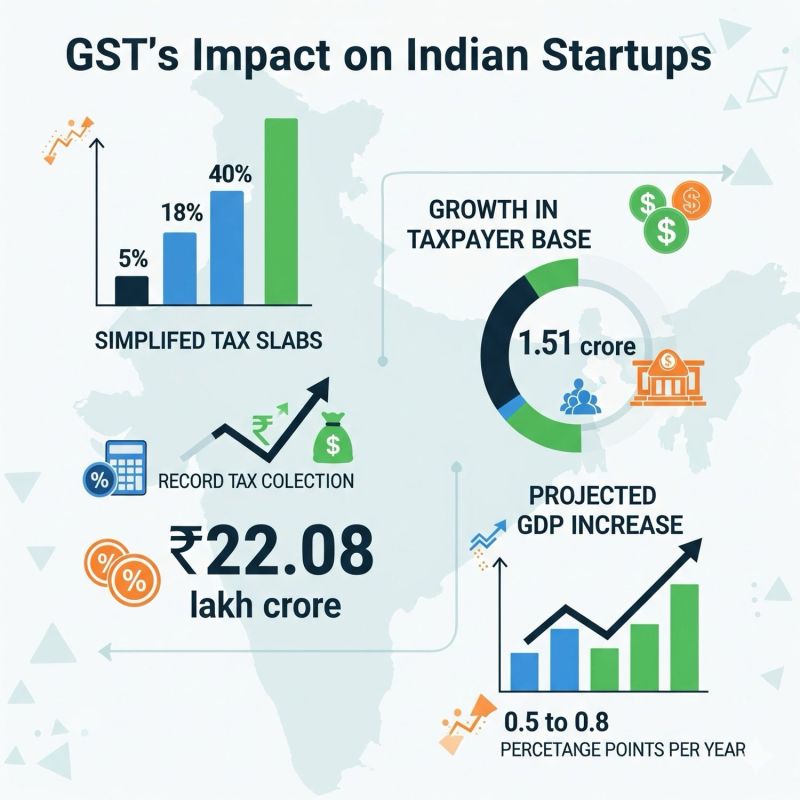

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)