Back

Replies (1)

More like this

Recommendations from Medial

Anwesha Sarkar

Hey I am on Medial • 3m

Hey founders! Need a bit of help - we’re looking for a CA who can handle our company registration and basic compliances (ITR, GST, TDS, MCA filings, etc.). If you have someone reliable that you personally work with or recommend, please share their co

See More

Anonymous

Hey I am on Medial • 1y

How can I reach ₹1 Cr by the time I'm 30? Help a total noob out! I'm 23, single, and earning around ₹18 LPA, living in the pricey city of Bangalore. Here’s my current monthly breakdown: Rent: ₹20K Food, groceries, and paying house help: ₹10K Swiggy

See More

Anonymous

Hey I am on Medial • 1y

Hello everyone, I am planning to start a Pvt Ltd along with my brother. So I need guidance regarding business registration. I have found that vakilsearch is good for registration but what about the audits and other filings . Do I really need a CA af

See MoreGituparna Sarma

Co-founding Entrepre... • 10m

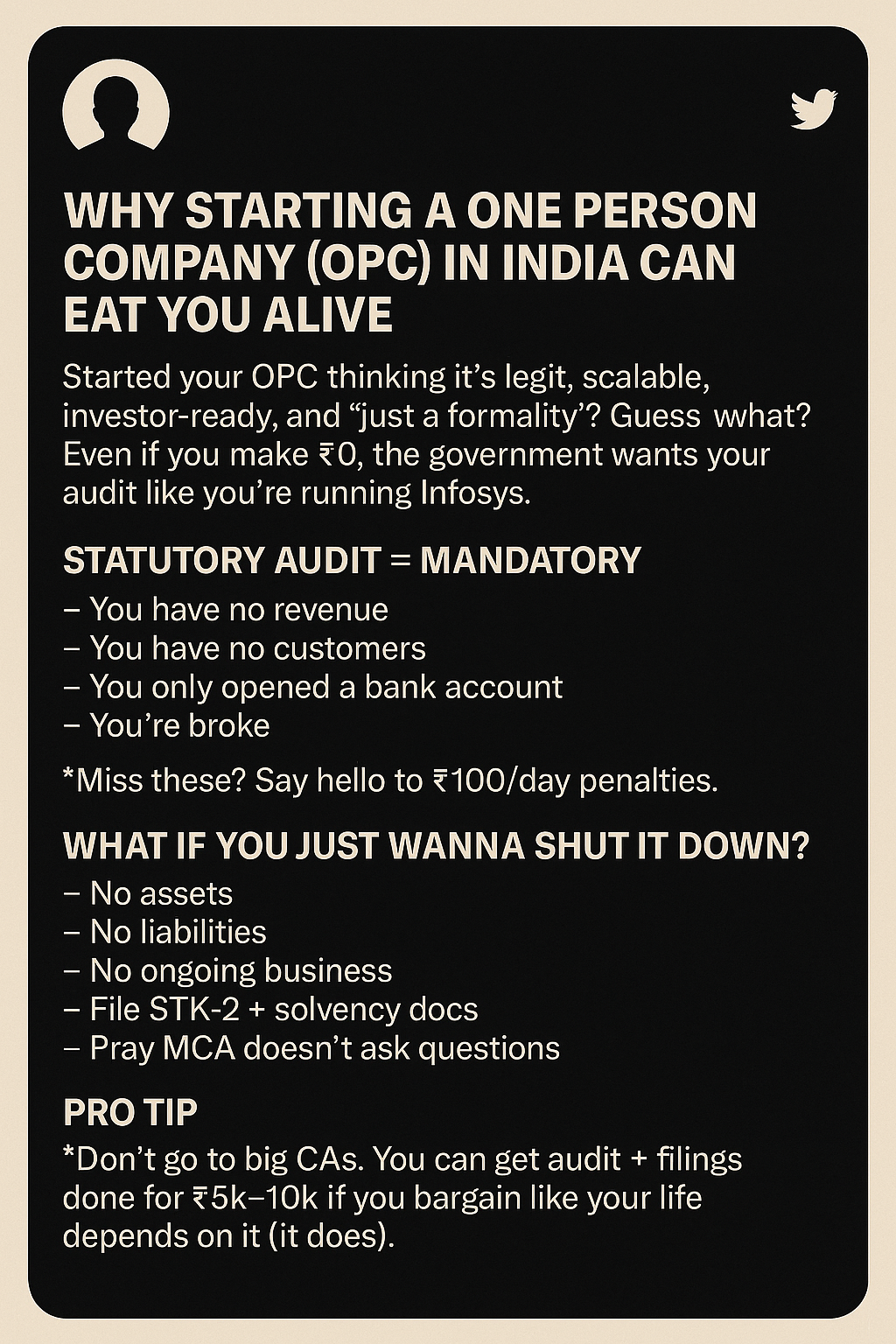

Starting a Company in India Can Eat You Alive — Even if You’re Broke Tag your CA friends, they’ll cry too. Started an OPC thinking it's "just a formality"? Even if you made ₹0, the govt wants an audit like you're Infosys. Statutory Audit = Manda

See More

Sanjeev Antal

OG Founder & CEO - P... • 1y

🚨 GST Council Introduces 'Track and Trace' Mechanism 🚨 The GST Council has approved a 'track and trace' system to combat tax evasion in specific industries. Cigarettes and pan masala are expected to be the initial focus of this initiative. Key H

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

Free Consultation From your CA Friend for your Startups. 🌸 Holi Special Offer from Your Trusted CA! 🌸 This Holi, let’s clear not just the colors but also your compliance worries! 🎨✨ I am offering a FREE Business Compliance Consultation until Su

See MoreRohan Kute

Business | infograph... • 10m

If you ever wonder to start a company, you should have to know this. There are three types of companies: 1) Private Limited Company Eligibility: Minimum 2 directors and 2 shareholders (at least 1 Indian resident). Pros: Limited liability protecti

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)