Back

Nandha Reddy

Cyber Security | Blo... • 1y

Did you guys ever wondered? In India we pay most of the taxes and get nothing on return?. Eg: Let's assume a family earns 1.5 lac per month. And they buy groceries 20k enjoyment 10k Children's study 20k (both) Rent 15-20k (depends) Tax - 30% exceeding 10 lacs. 45k (highest) We pay tax (gst) on every thing on above mentioned costs, groceries, food, movies, fee etc.. If anything that's left over and though to invest anywhere, government even lay tax on long term capital gain tax, if you buy a property, etc.. everything where every you think tax exists there. And they expect not to run for another countries ??. In return what do we get as an Indian citizen?. Free healthcare? Free public transport? (Atleast better roads ?) Free food? Free education? Support on starting a new business ?. What are your thoughts on it ?. And how do india grow if there are these many things on a person who earns 1.5lac per month (which is way more than bpl in india). And we can't even think of BPL.

Replies (5)

More like this

Recommendations from Medial

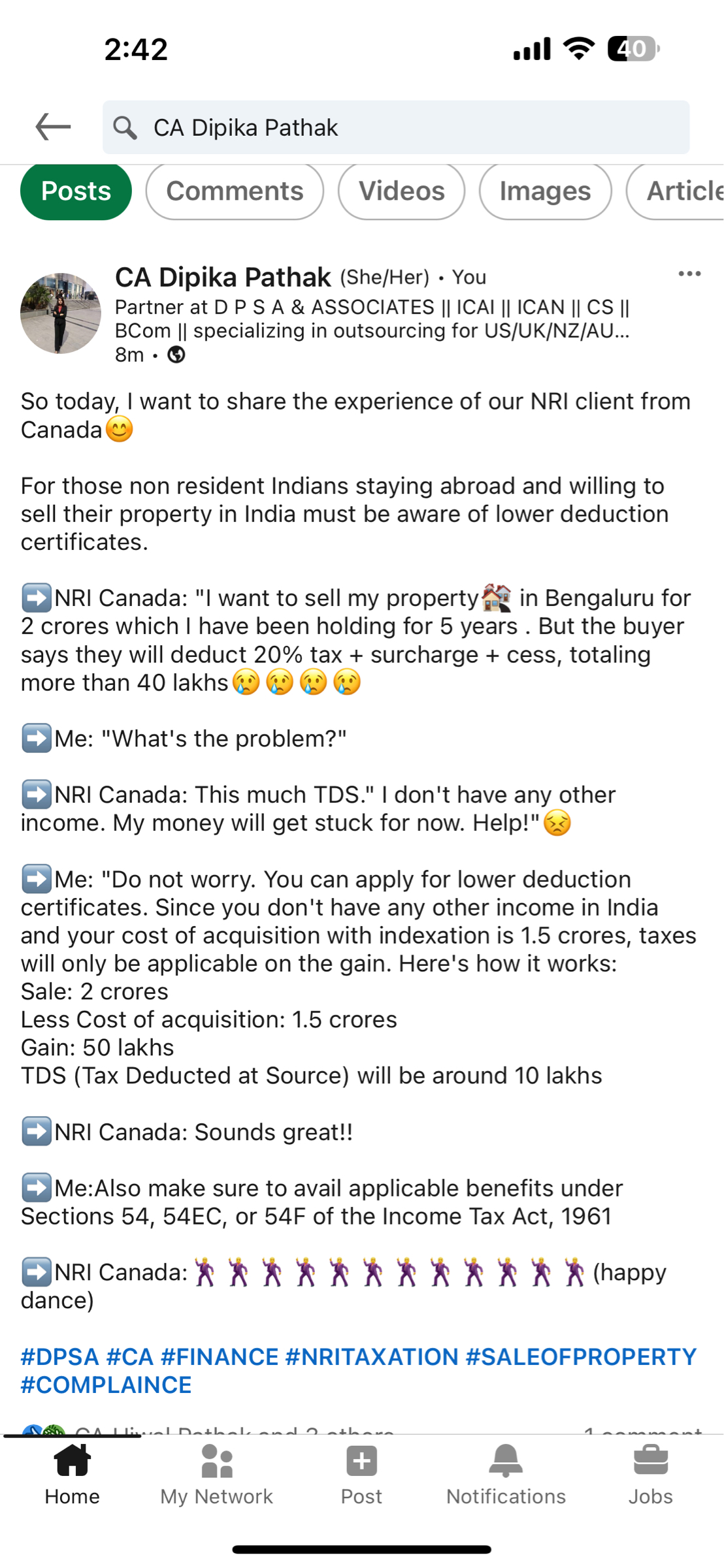

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)