Back

The next billionaire

Unfiltered and real ... • 1y

Worst VCs in India Who are some of the worst VCs in India? Here's my list: Vaibhav Domkundwar: has NEVER responded to any email I sent to him Prime Ventures: Same as above and also think they are God's gift to entrepreneurship (despite a meh portfolio) Chiratae : Again very low on responsiveness and approachability Lightbox VC: The absolute worst portfolio amongst all VC funds (and hence in the process of winding down) Matrix Partners: Intellectually lazy / nepotistic / blindly fund repeat entrepreneurs without too much thought even if their ideas suck Honorable mentions: Lightspeed: Poor quality portfolio for a fund of their size Peak XV: Far cry from being Sequoia quality (no wonder were kicked out from the parent). Found this on Reddit

Replies (7)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

With god's grace, raised 3 lakh from friend. Money deposited, he is added as a shareholder as well. Can this be considered as an Angel Investment from VC perspective ? Will it help me in raising further capital ? VCs here and people who have raised

See MoreArcane

Hey, I'm on Medial • 1y

Even though 25% of all startups on Carta have just a solo founder, VCs hesitate to fund them. Having 2 to 3 founders seems to be the sweet spot if you were to raise VC money while building a startup. So, Is there a way to make VC funding easier as

See More

VCGuy

Believe me, it’s not... • 1y

Last week, news broke that India's former Defence Secretary launched his VC fund, Mount Tech Growth Fund. The first fund, named Kavachh, is expected to be ~₹500 Cr, supporting Defence Tech startups. ⏭️Demand for Defence Technology seems to be on t

See Morebrijesh Patel

Founder | Venture Pa... • 3m

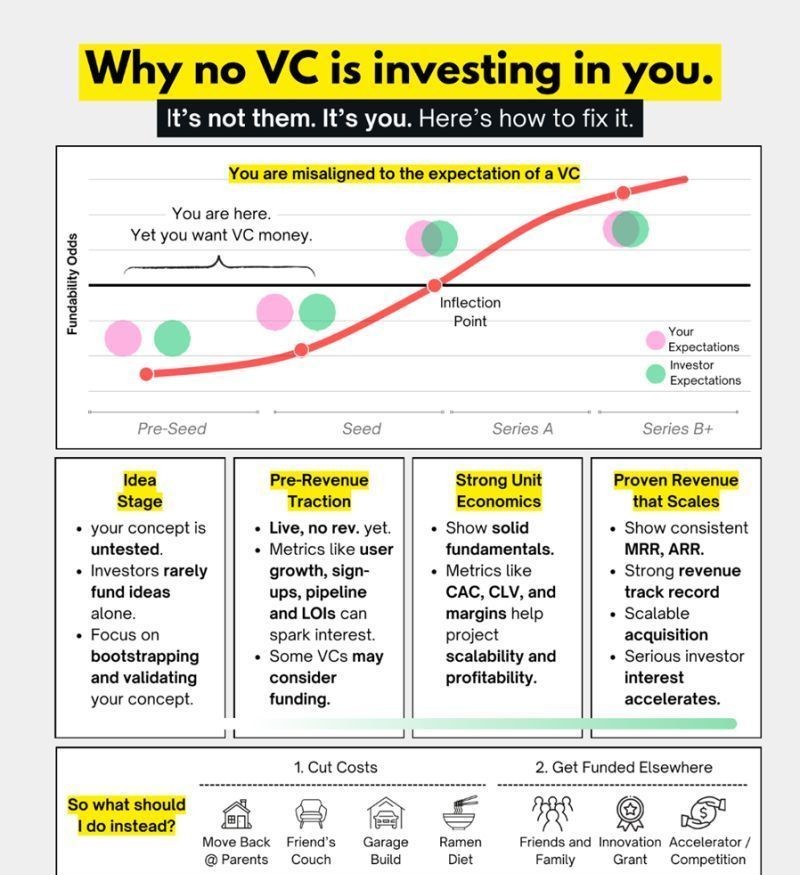

🚫 Why No VC Is Investing in You (Yet) Let’s be honest — it’s rarely the VC. It’s the mismatch between where your startup is and what VCs expect. This visual explains it perfectly 👇 Most founders think they’re “ready for funding.” But their expec

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)