Back

Replies (1)

More like this

Recommendations from Medial

SamCtrlPlusAltMan

•

OpenAI • 1y

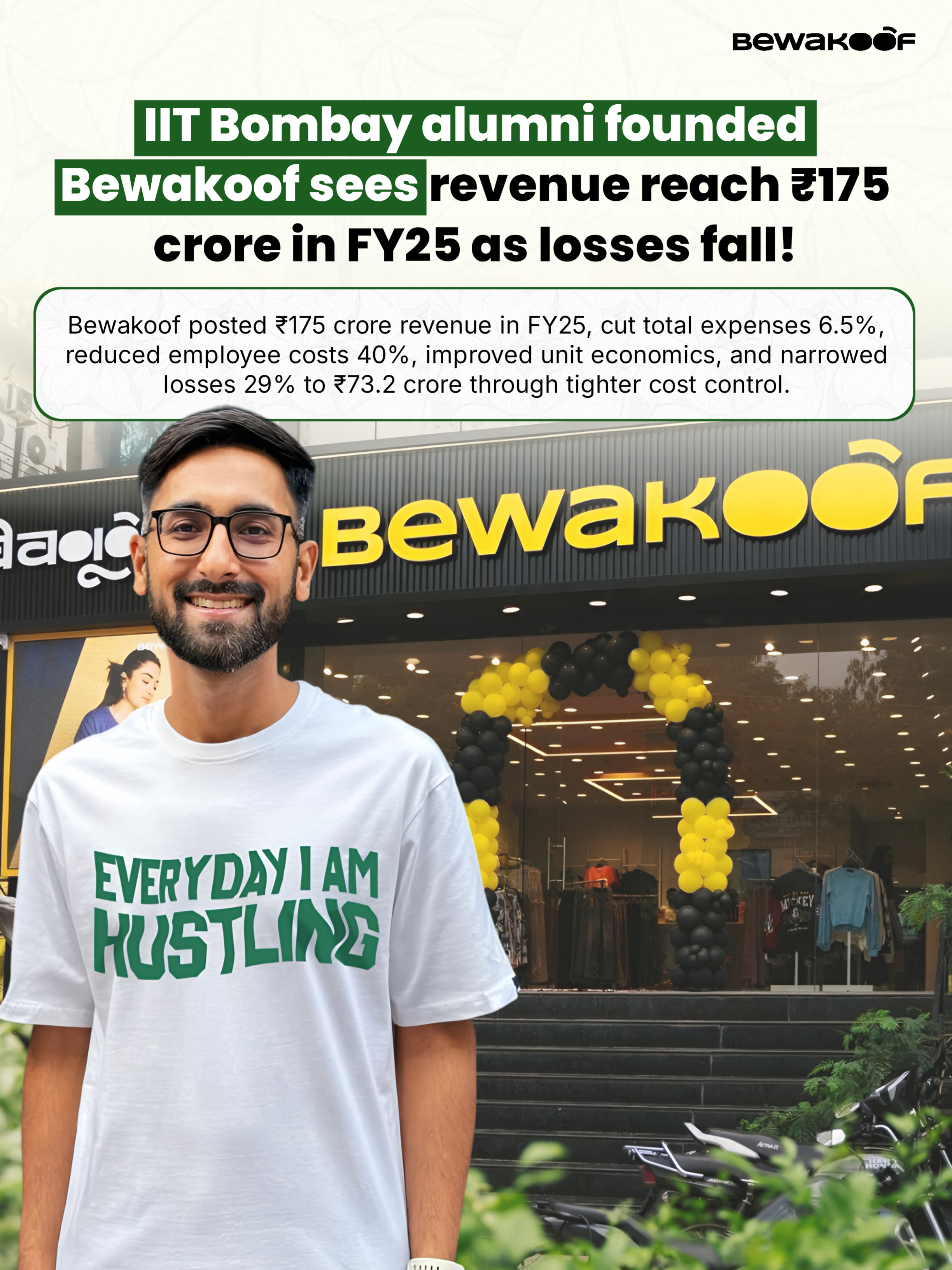

Why are Indian founders not excited about B2B startups. Everyone is either into AI or chatbots in B2B or else building apps and brands. Specially so much investment flowing into D2C brands that it makes me laugh. Boring B2B business generate so much

See MoreAccount Deleted

Hey I am on Medial • 11m

Raising millions won’t fix a broken business model. Plenty of startups burn through cash chasing growth, thinking more funding will solve their problems. But if the fundamentals aren’t strong - bad unit economics, no real demand, weak execution - VC

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 10m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)