Back

Account Deleted

Hey I am on Medial • 9m

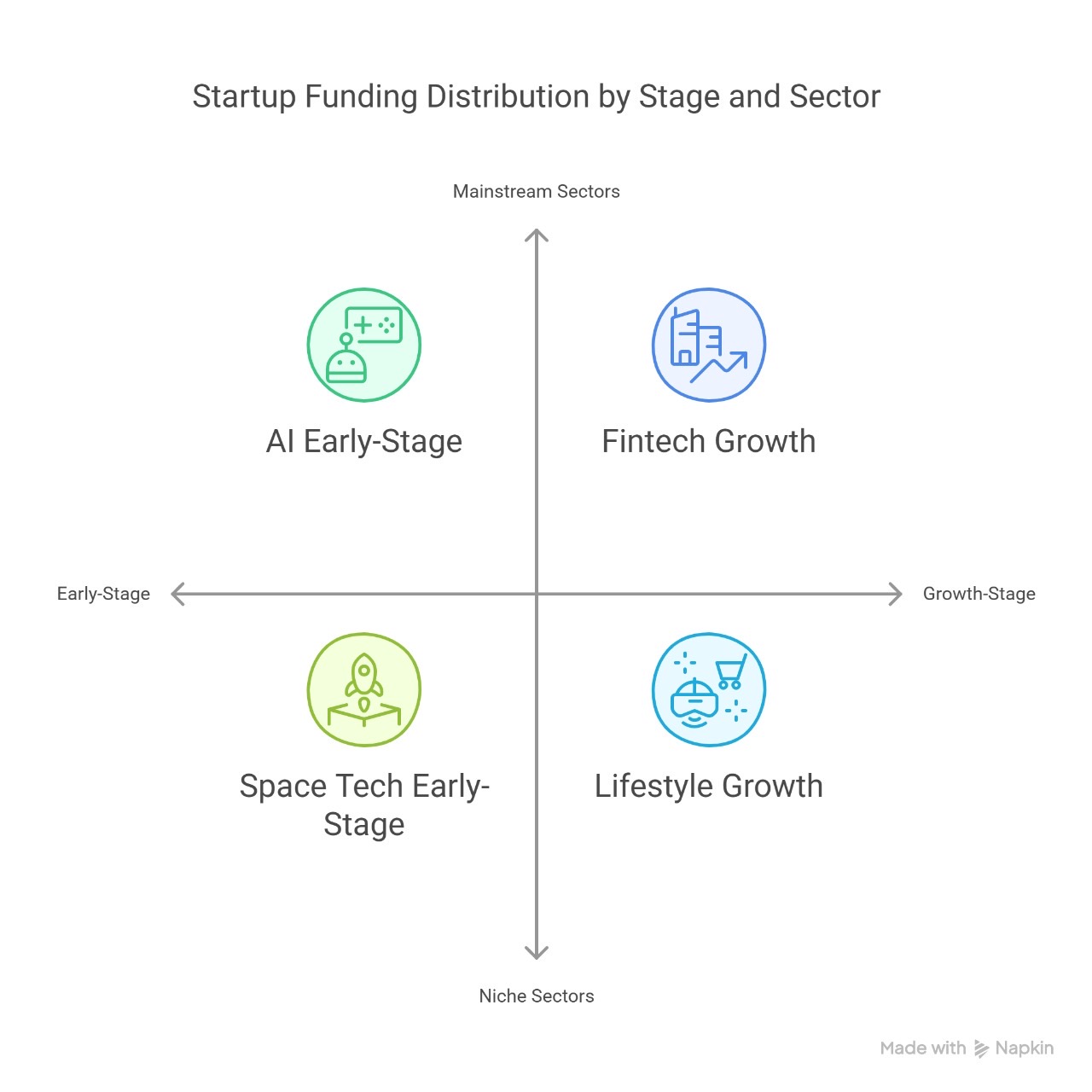

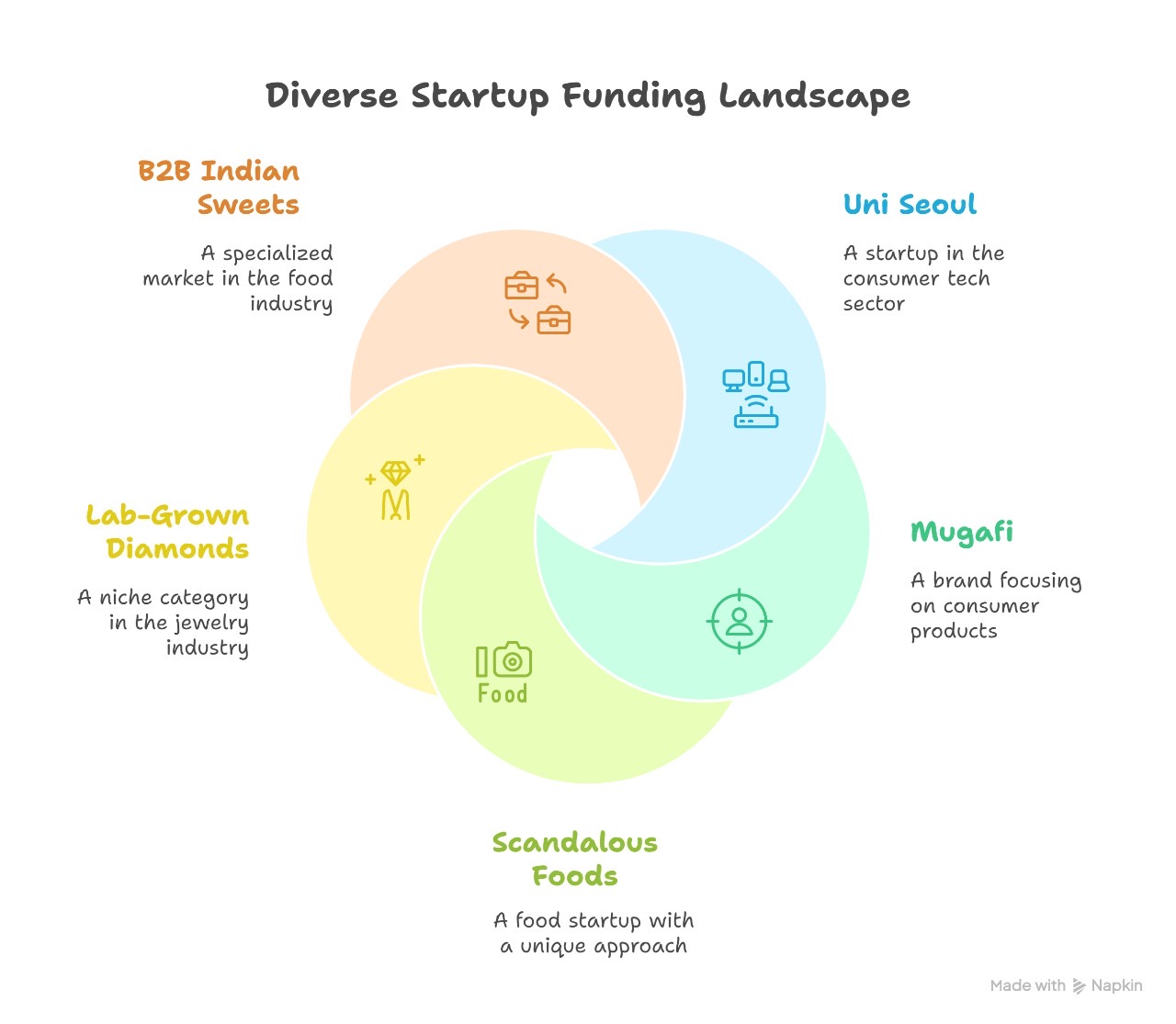

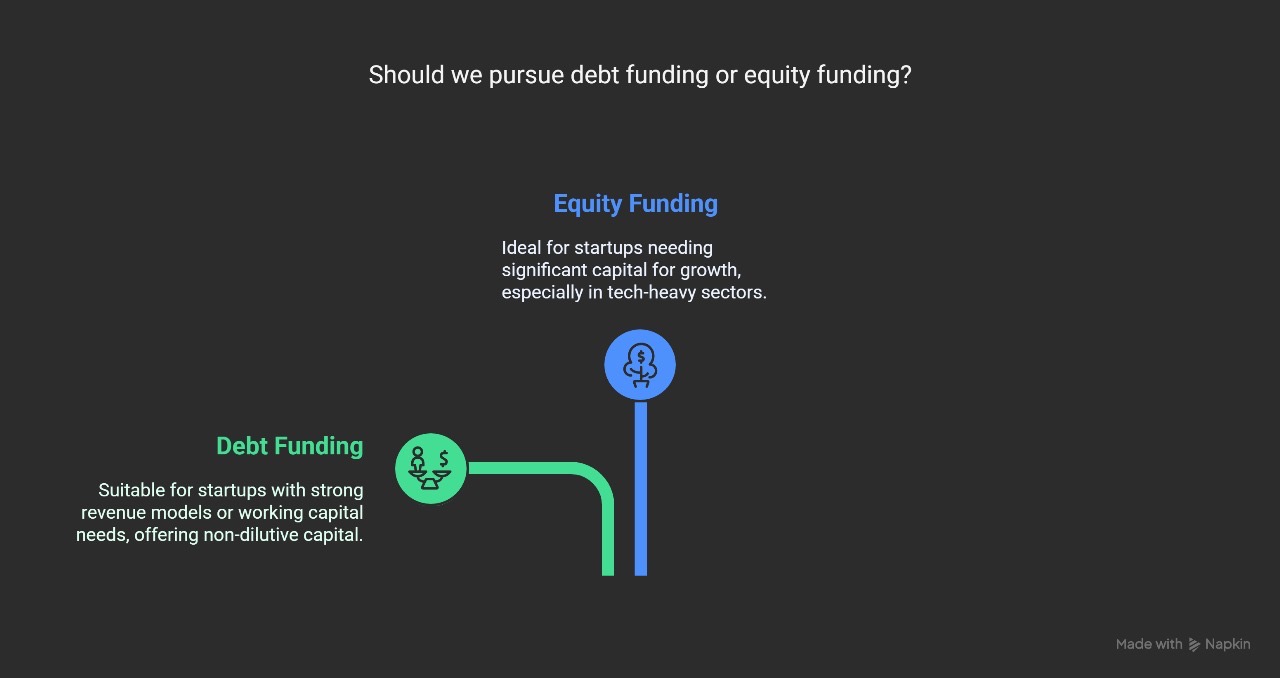

The last week of April was active for Indian startups, with funding across lifestyle, fintech, AI, healthtech, and space tech. There was a healthy mix of seed and Series A rounds, reflecting cautious optimism. Seed-stage bets like Uni Seoul, Mugafi, and SCANDALous Foods show appetite for unique consumer and tech-first brands. Even niche plays like lab-grown diamonds and Indian sweets found backing. Debt funding stood out too - Care.fi and CollegeDekho raised non-dilutive capital, signaling trust in their revenue strength. Bigger rounds in HexaHealth, QNu, and Fuze reflect long-term faith in core tech infrastructure. Kult’s $20M round and Anveshan’s Rs 48 Cr raise indicate growing interest in tech-led D2C. Meanwhile, SatLeo Labs and Vividobots represent investor curiosity in futuristic verticals. Overall, it’s not about flashy apps anymore - investors are chasing both fundamentals and innovation.

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

How to start business ? From zero to infinity Means how to create business plans? Idea validation? Market research, founders, documentation, and controlling cash flow , schemes ,how to apply seed funding rounds? Initiatsteps to do in businesses? Giv

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 7m

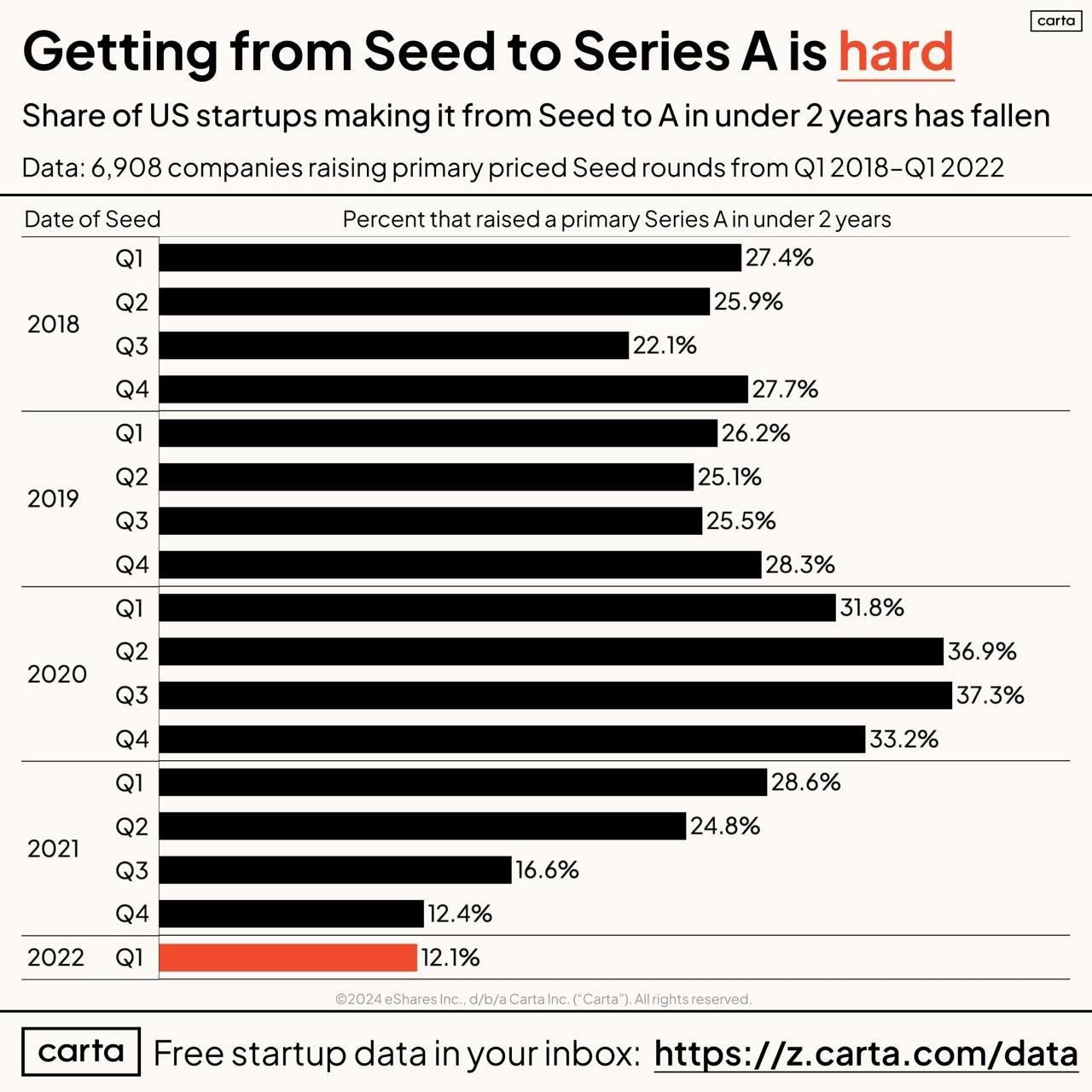

Understanding the "Seed-Strapped" AI Startup Revolution Ever wondered how some AI startups are reaching massive valuations without huge rounds of venture capital? It's called "seed-strapping," and it's redefining success in the tech world. What is

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)