Back

Vishu Bheda

•

Medial • 1y

In 2010, Big Bazaar was ruling Indian retail, unstoppable at 250 stores. Then came DMart—with just 10 stores—and changed everything. Here’s how they did it: Big Bazaar brought the supermarket culture to India and became a household name. However, its aggressive expansion and high debt led to its downfall. Leasing stores in malls and acquiring other chains increased costs, making the business unsustainable. On the other hand, DMart focused on slow, steady growth. It owned most of its stores in suburban areas, keeping costs low. DMart prioritized sustainability by reinvesting profits, avoiding debt, and building strong supplier relationships. DMart’s core strategy was offering deep discounts consistently, not as a short-term tactic. It avoided costly products like perishables and electronics, further reducing expenses. This shows that long-term sustainability and customer loyalty are more important than rapid expansion or chasing market share. Follow for more content!

Replies (18)

More like this

Recommendations from Medial

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

“Powerhouse of Indian Retail to failure” Billions to Bankruptcy #4 Big Bazaar was started in 2001 by Kishore Biyani under future retail group.It was started as a one-stop shopping destination provided consumers with convenience and value, catering

See More

Biswajeet Sen

Founder & CEO | Gian... • 10m

Let's settle this once and for all - who's the REAL BOSS of Indian supermarkets? Rank them (1= total dominance): 1.DMart 2. Reliance Smart Bazaar 3. Vishal Mega Mart 4. More Retail Who's killing it with prices, crowds, and reach? #RetailWar #lndi

See MoreShyam Kumar

Startup as a dream • 9m

From ₹30 crore in a day to bankruptcy – the rise and fall of Big Bazaar 2001 – the year India witnessed a retail revolution. Big Bazaar’s first store opened and made ₹30 crore on the first day itself. The tagline? “Sabse Sasta, Sabse Best.” The r

See More

Ansh Kadam

Founder & CEO at Bui... • 9m

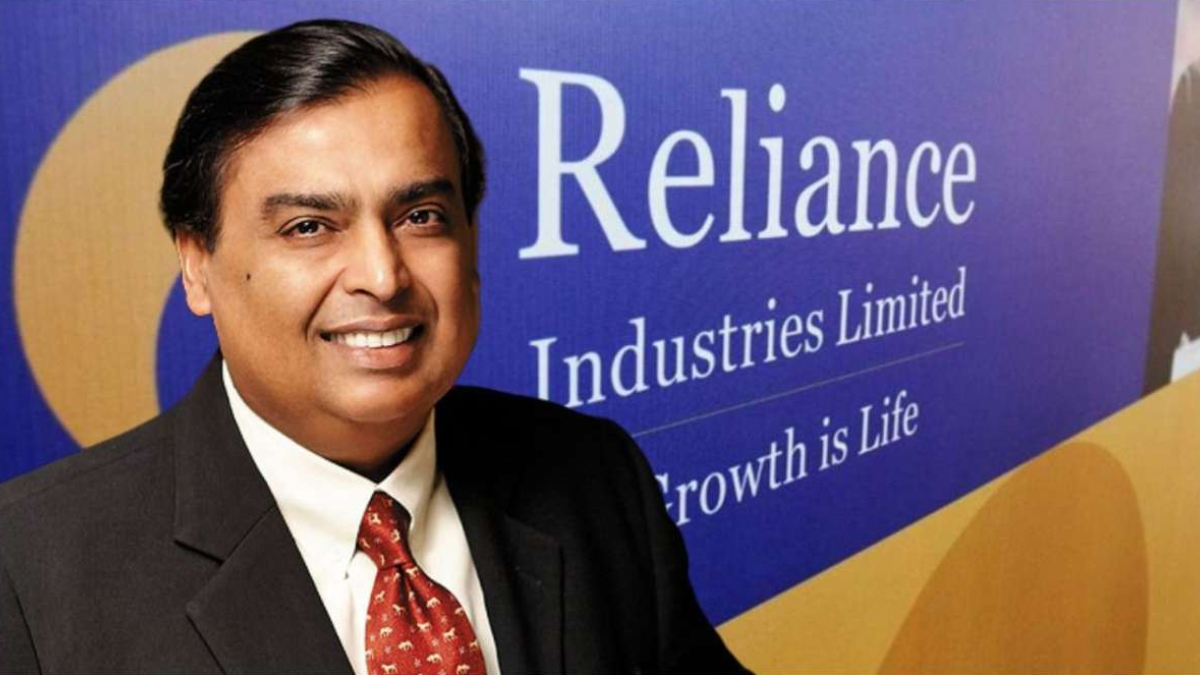

Here’s how Mukesh Ambani killed Big Bazaar and acquired almost for free. In 2020, Big Bazaar was on the verge of bankruptcy. Kishore Biyani, its founder, was looking for a lifeline, and Mukesh Ambani came forward with a bold ₹24,000 Cr buyout offe

See More

Vansh Khandelwal

Full Stack Web Devel... • 4m

Cafe Coffee Day (CCD), India's pioneering cafe chain, revolutionized coffee culture but suffered poor financial management and over-expansion, creating heavy debt and operational inconsistencies that hurt quality and loyalty. Recovery has focused on

See MoreJaswanth Jegan

Founder-Hexpertify.c... • 1y

Is Dmart a Scam? This weekend I went to Dmart it felt like the whole people from the city was inside it parking space is full,every shopping trolleys were taken,store is full cant even walk freely,bill counters were crowded.Prices of all the product

See More

Account Deleted

Hey I am on Medial • 1y

Quick Commerce: Investment Highlights • Swiggy is planning to invest ₹1,600 crores in its subsidiary Scootsy. This funding helps Scootsy enhance operational capabilities and expand dark stores. • Similarly, Zomato plans to raise $1 billion through

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)