Back

Jaswanth Jegan

Founder-Hexpertify.c... • 1y

“Powerhouse of Indian Retail to failure” Billions to Bankruptcy #4 Big Bazaar was started in 2001 by Kishore Biyani under future retail group.It was started as a one-stop shopping destination provided consumers with convenience and value, catering to the diverse needs of Indian households. It pursued an quick expansion strategy, rapidly opening new stores across India. Its aggressive approach allowed it to establish a strong presence.They diversified into new ventures like Food Bazaar, Fashion Bazaar & Electronic Bazaar. The Future Group accumulated substantial debt due to its aggressive expansion and acquisition strategies. Then Covid hit lockdown was implemented they can’t open their stores which resulted to decline of revenue then those debt became a burden. To alleviate pressure Future Group sold some of their assets including Bare Essentials,HomeTown,Future Capital Holdings,etc.Then reliance acquired them for $3.4 billion in 2022 after many legal battles.

Replies (13)

More like this

Recommendations from Medial

Shyam Kumar

Startup as a dream • 9m

From ₹30 crore in a day to bankruptcy – the rise and fall of Big Bazaar 2001 – the year India witnessed a retail revolution. Big Bazaar’s first store opened and made ₹30 crore on the first day itself. The tagline? “Sabse Sasta, Sabse Best.” The r

See More

Ansh Kadam

Founder & CEO at Bui... • 9m

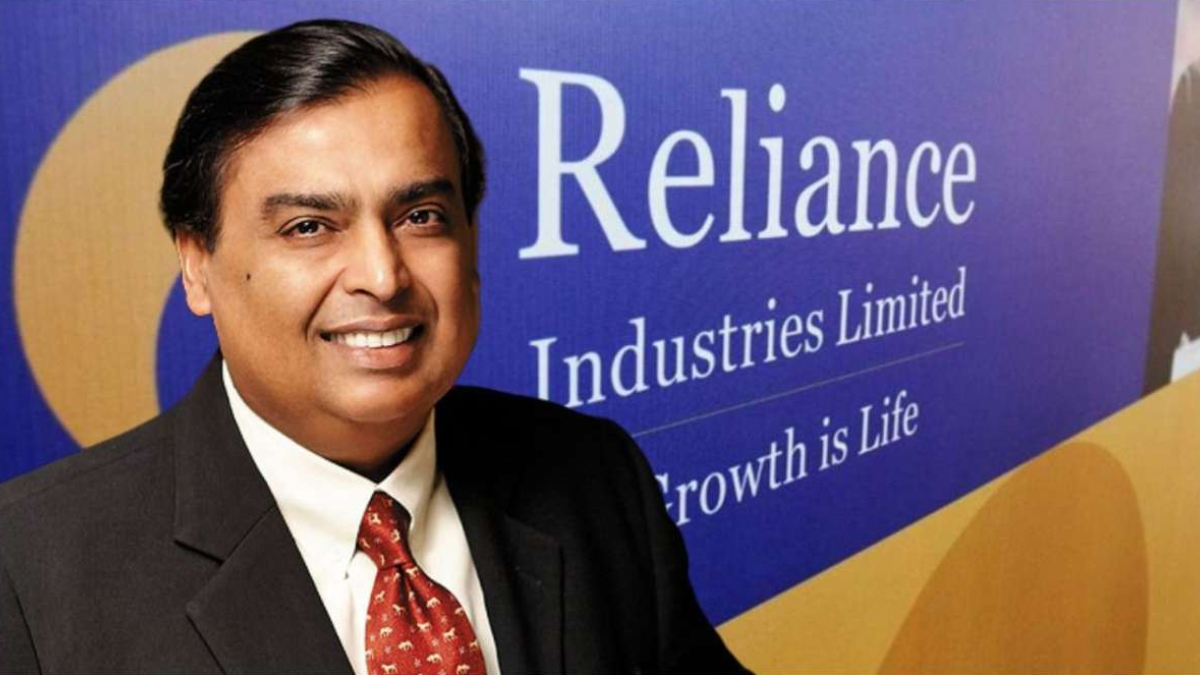

Here’s how Mukesh Ambani killed Big Bazaar and acquired almost for free. In 2020, Big Bazaar was on the verge of bankruptcy. Kishore Biyani, its founder, was looking for a lifeline, and Mukesh Ambani came forward with a bold ₹24,000 Cr buyout offe

See More

Dhandho Marwadi

Welcome to the possi... • 10m

Flipkart Minutes plans to scale up its dark stores from 300 to 800 by 2025 to dominate the quick commerce race! → Competing with Blinkit, Zepto, Instamart and Big-Basket QC → AI-powered catalog & focus on Tier-1 speed → Over 1 million orders already

See MoreSatyam Kumar

Pocket says nil.. Mi... • 10m

Top 15 Failed or Declined Indian Companies 👇 1. Kingfisher Airlines (2012) Cause: Heavy debt, poor financial planning, failed merger with Air Deccan. 2. Satyam Computers (2009) Cause: Major corporate fraud involving falsified accounts worth ₹7

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)