Back

Replies (1)

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 11m

🤯Understanding Capital Gains – Don’t Miss This! Let’s take an example: Mr. A owns a building along with a large piece of land. He enters into a Joint Development Agreement (JDA) with a builder. 😄What is a Joint Development Agreement (JDA)? In a

See More

Rohan Saha

Founder - Burn Inves... • 1y

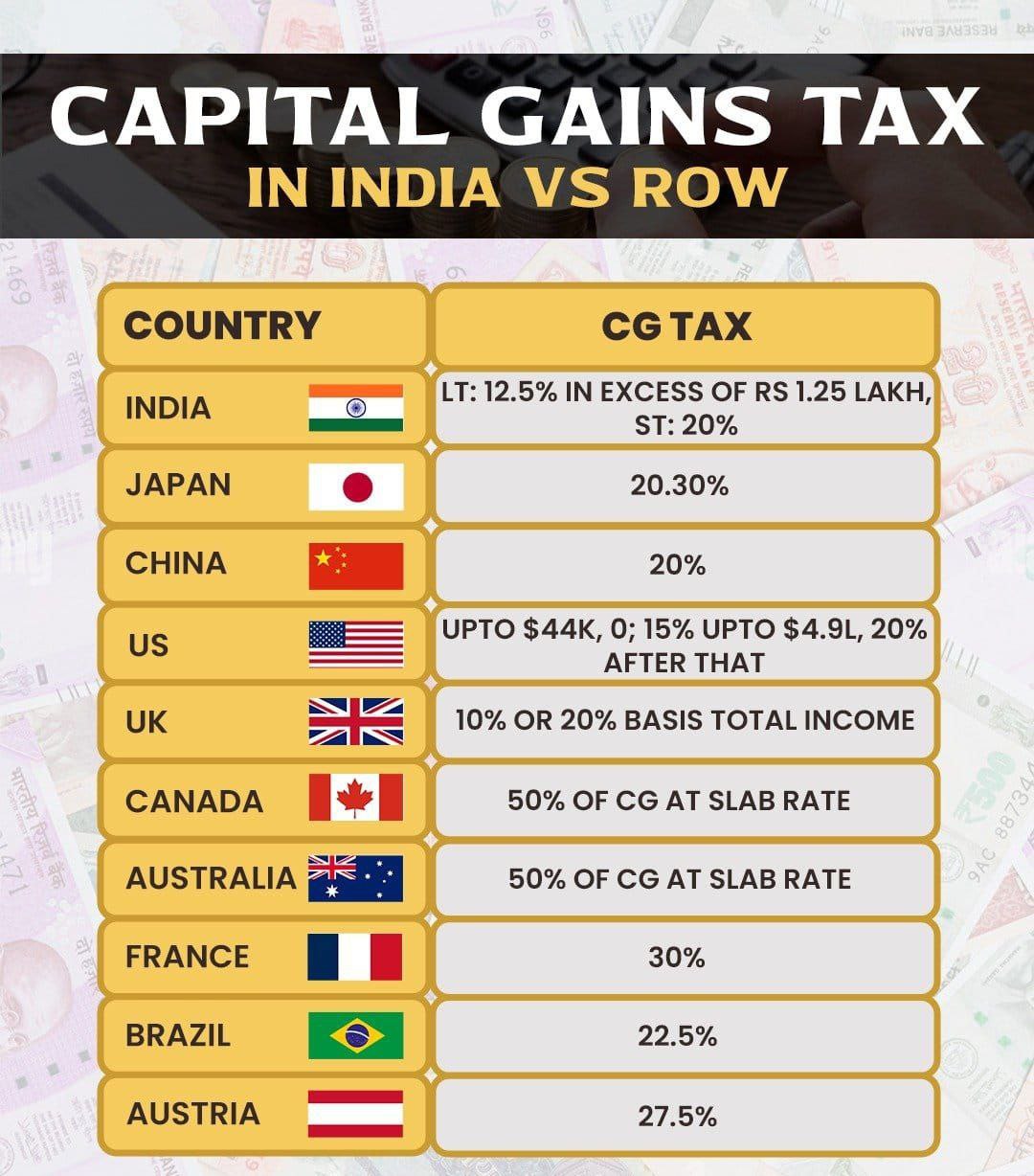

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Kimiko

Startups | AI | info... • 9m

Around 101 mainboard companies that raised money through IPOs since 2024 , majority of them haven't been able to improve upon their listing gains.. As per ETG analysis, about 16% of the companies earned 50% or higher listing gains, while around 9%

See More

Rohan Saha

Founder - Burn Inves... • 9m

Many people don't seem to understand one basic thing sometimes mutual fund (MF) returns appear higher than the returns from our individual stock trades. While looking at this, people often forget a very simple point: when we deposit money into a dema

See MoreManish M Tulasi

•

Mitra Robot • 1y

Fractional Real Estate Investment – Own a ₹10 Cr Property with Just ₹10 Lakh! Introduction: What if you could own a share of a ₹10 crore property with just ₹10 lakh? Our innovative real estate model allows 100 investors to co-own a premium property,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)