Back

Anonymous 2

Hey I am on Medial • 1y

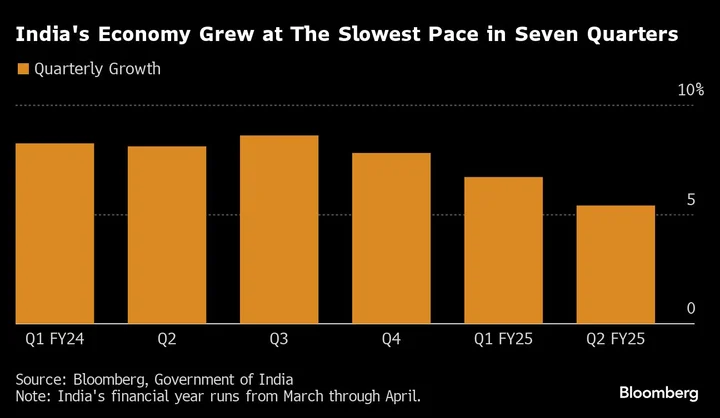

If inflation continues to climb while growth slows, it could pressure businesses and erode consumer purchasing power, triggering a downturn. Classic case of growth vc inflation.

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 10m

Indian stock market crashed by 4% today—and no, it’s not “just one of those days.” When the market drops this sharply, it shakes investor confidence, business decisions, and sometimes even your appraisals (sad reality). A fall like this makes compan

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Sairaj Kadam

Student & Financial ... • 1y

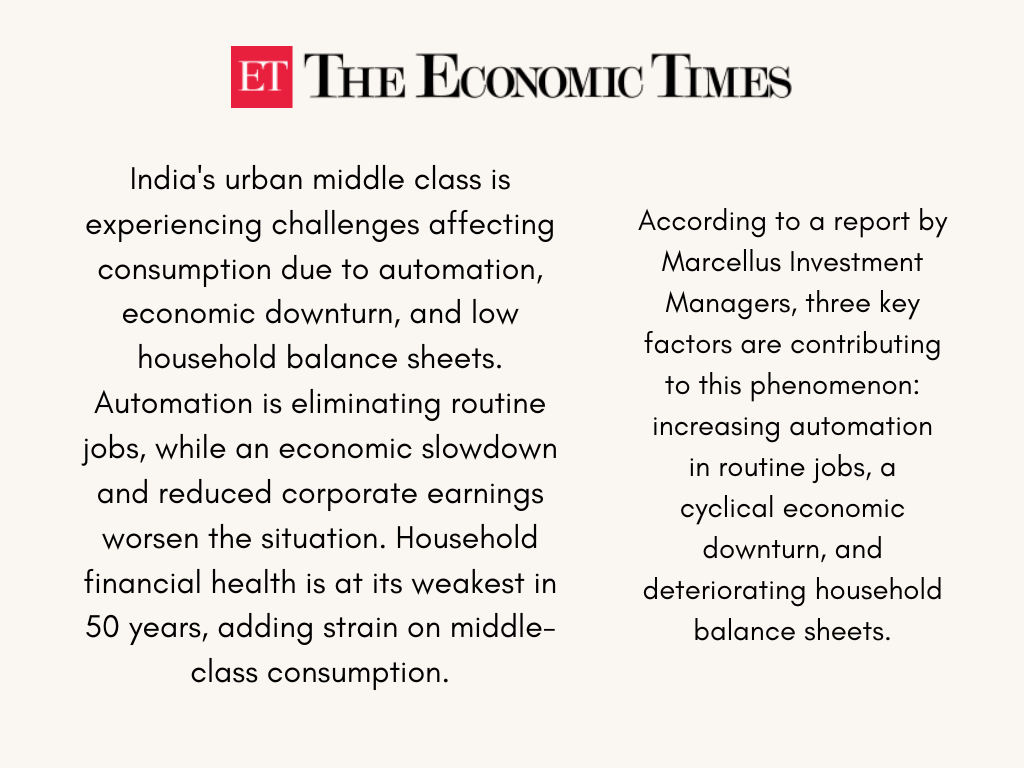

India's Two-Year Low: The Middle Class Squeeze Amid Economic Turmoil India's urban consumption has hit a two-year low in 2024, driven by persistent inflation and stagnant wages. Middle-class households, already struggling with rising costs, are cu

See More

Jagan raj

Founder & CEO of Tec... • 1y

Golden Nugget for Entrepreneurs In my POV, loans are ideal for early-stage businesses to build progress before pitching to VC, but remember, loans come with risk: • Loans help you establish your business, manage cash flow, and achieve short-term

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

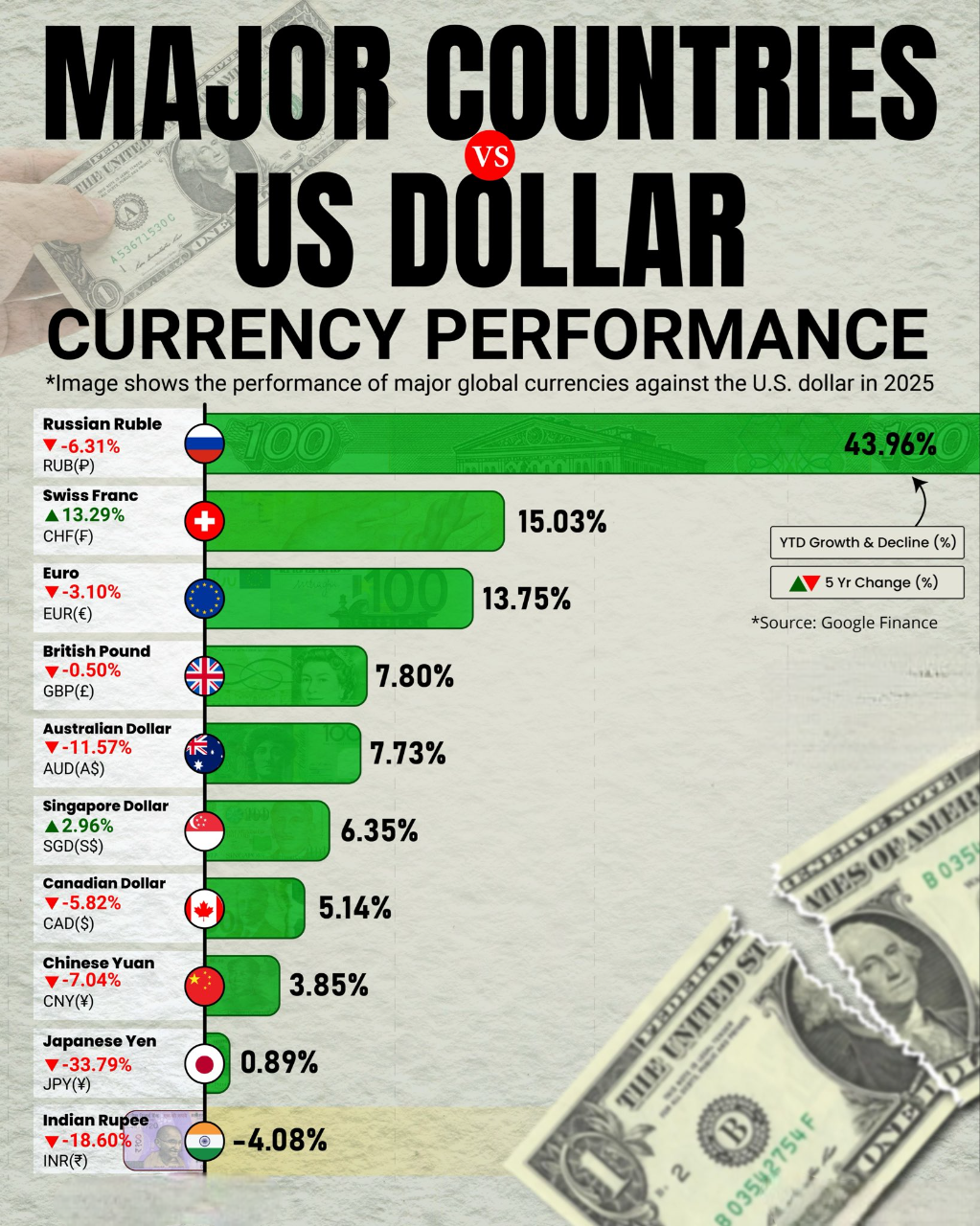

Major Countries vs US Dollar Currency Performance 2025 📊 The U.S. Dollar continues to dominate global markets in 2025. While some currencies like the Swiss Franc and Euro show resilience, others—including the Indian Rupee (₹) and Japanese Yen (¥)

See More

Manish M Tulasi

•

Mitra Robot • 12m

Mutual Funds: A Closer Look at the Real Returns Many people say that mutual funds are a great investment, but have we truly calculated the real returns, considering all factors like inflation and taxes? Let me break it down with a simple example.

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Vivek Joshi

Director & CEO @ Exc... • 4m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)