Back

Sagar Anantwar

•

SimpliFin • 1y

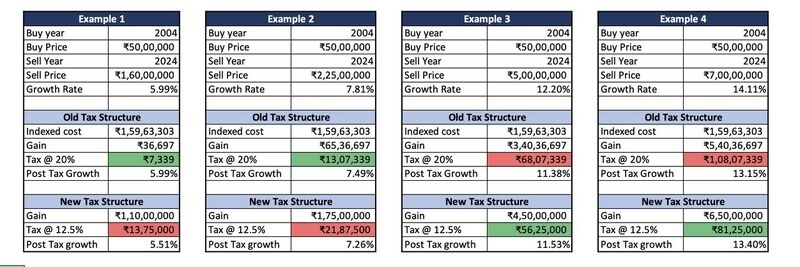

You Will Have to Take Higher Risks to Generate Real Returns. Here's Why… When it comes to growing wealth, inflation and taxation are two silent killers that erode the value of your money faster than you realize. Here’s what most investors overlook: 🔹 Inflation Isn’t 6% for Everyone ▪️ If you live in a Tier-1/2 city, the real inflation could be closer to 10% due to higher living costs ▪️ This means your investments must generate at least 10% post-tax returns just to maintain your purchasing power. 🔹 Taxation Adds Another Layer ▪️ Nifty50’s average returns are 12-14% annually, but once you account for taxation, the effective return barely keeps up with real inflation. ▪️ If you’re investing in FDs or other low-return products, your post-tax returns likely don’t even match inflation, leading to a decline in the real value of your money. So, what’s the solution? 🔹 Take Calculated Risks ▪️ To generate real returns, investors must look beyond traditional products and take on higher risks with mid-cap, small-cap, or other alternative investments. ▪️ These asset classes can provide the potential for higher returns to outpace inflation and taxation. 🔹 Seek Professional Guidance ▪️ This is where a good professional—whether it’s an RIA (Registered Investment Advisor) or MFD (Mutual Fund Distributor)—can add immense value. ▪️ They help you build a portfolio that balances higher returns with risk management and ensures you stay on track toward your financial goals. Are your investments beating inflation and taxes? If not, it’s time to reassess your strategy. You can checkout SimpliFin's AlphaIQ feature to generate a diversified portfolio that helps you generate real returns (Download Link - https://onelink.to/9r75pv)

Replies (4)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

This Thing Will Actually Blow Your Mind. Click on This. "Inflation is taxation without legislation." - Milton Friedman Inflation: A Major Concern in India Inflation remains a pressing issue in India, with the state of Odisha facing the highest r

See More

Manish M Tulasi

•

Mitra Robot • 12m

Mutual Funds: A Closer Look at the Real Returns Many people say that mutual funds are a great investment, but have we truly calculated the real returns, considering all factors like inflation and taxes? Let me break it down with a simple example.

See Morefinancialnews

Founder And CEO Of F... • 1y

Equities Projected to Deliver 8%-12% Returns in 2025 The year 2025 brings a mixed bag of challenges and opportunities, marked by macroeconomic turbulence, global trade uncertainties, and policy changes. Investors can benefit from well-planned asset

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)