Back

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

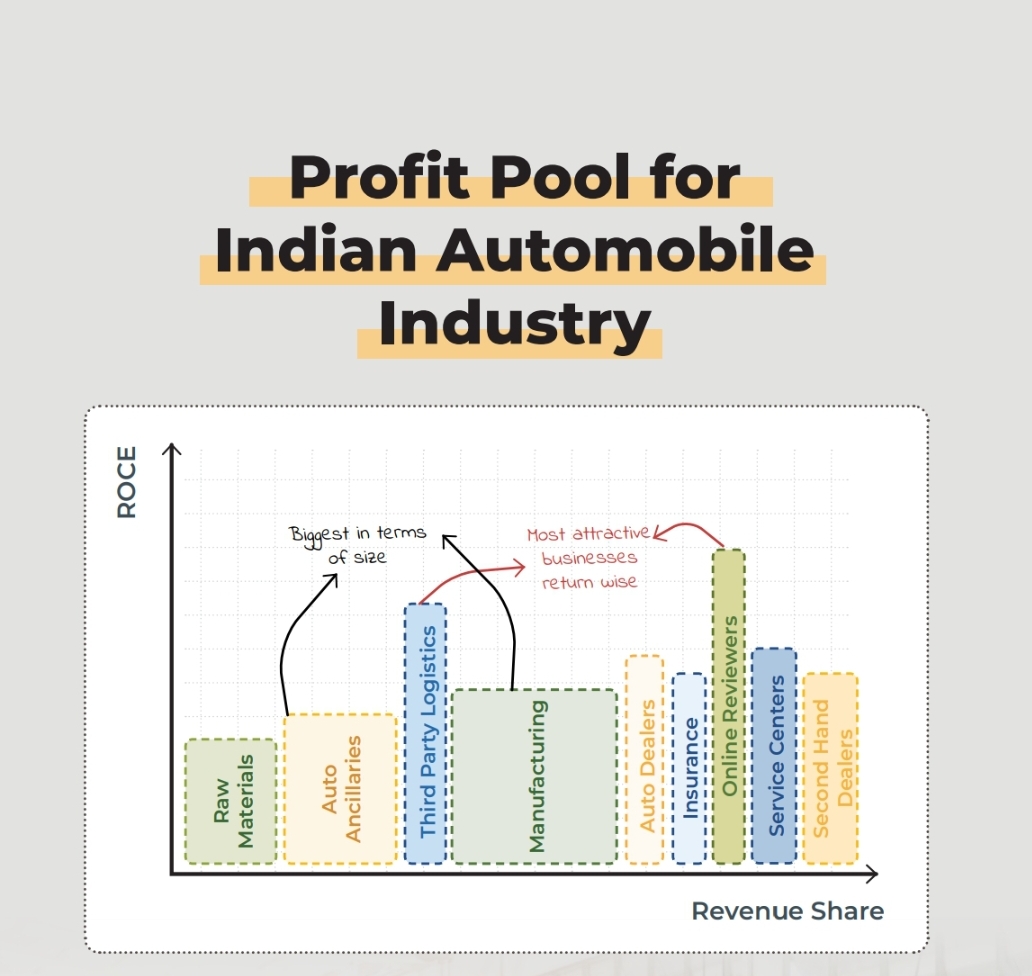

🚗💰 Where’s the Money in the Indian Automobile Industry? 💡 Not all auto businesses are created equal! 🔍 Some dominate in size, while others shine in returns. 📊 Biggest in size: 🚚 Third-Party Logistics & Manufacturing 💸 Most attractive return

See More

Madhur Achanta

Aspiring Entrepreneu... • 11m

The Costliest Investment Mistakes! Ever heard of investors who skipped billion-dollar opportunities just because they didn’t seem promising at the time? That’s called an Anti-Portfolio—a list of missed investments that turned out to be massive succes

See Morefinancialnews

Founder And CEO Of F... • 1y

Equities Projected to Deliver 8%-12% Returns in 2025 The year 2025 brings a mixed bag of challenges and opportunities, marked by macroeconomic turbulence, global trade uncertainties, and policy changes. Investors can benefit from well-planned asset

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)