Back

Anonymous

Hey I am on Medial • 1y

681. Payroll Liabilities 682. Diluted Shares Outstanding 683. Employee Stock Purchase Plan (ESPP) 684. Downside Risk 685. Relative Value 686. Treasury Stock 687. Contra Account 688. Day Count Convention 689. Long Position 690. Short Position 691. Order Book 692. Market Order 693. Limit Order 694. Financial Ratios 695. Revaluation Model 696. Consignment Stock 697. Investment Grade 698. Non-Investment Grade 699. Gross Yield 700. Net Yield 701. Foreign Exchange Exposure 702. Cost Benefit Analysis 703. Sunk Cost Fallacy 704. Coverage Ratio 705. 200-Day Moving Average 706. Pivot Point 707. Derivative Contract 708. Interest Expense 709. Proprietary Trading 710. Default Premium 711. Price Discovery 712. Inflation Targeting 713. Bank Reconciliation 714. Residual Value 715. Swap Dealer 716. Capital Buffer 717. Interest Rate Collar 718. Loan Syndication 719. Absolute Risk 720. Relative Risk 721. Account Aggregation 722. Stakeholder Capitalism 723. Distributable Profits 724. Operating Ratio 725. Bank Draft 726. Financial Contingency 727. Monetary Aggregates 728. Ordinary Shares 729. Preference Shares 730. Trading Volume 731. Penny Stock 732. Margin Call 733. Knock-In Barrier Option 734. Knock-Out Barrier Option 735. Participation Rate 736. Callable Preferred Stock 737. Custodial Account 738. Lien Holder 739. Non-Operating Assets 740. Accounts Receivable Turnover 741. Coupon Bond 742. Currency Pegging 743. Discretionary Account 744. Fixed Deposit (FD) 745. Loan-to-Cost Ratio (LTC) 746. Participating Preferred Stock 747. Spot Rate 748. Stock Appreciation Right 749. Capital Lock-Up 750. Risk-Based Capital 751. Days Sales Outstanding (DSO) 752. Key Performance Indicator (KPI) 753. Revenue Mix 754. Premium on Bonds 755. Financial Spread 756. Revolving Debt 757. Intangible Assets 758. Operating Cash Flow (OCF) 759. Balance Sheet Reconciliation 760. Incremental Cost 761. Physical Capital 762. Accretive Acquisition 763. Abnormal Return 764. Maturity Mismatch 765. Bond Laddering 766. Corporate Spin-Off 767. Price Action 768. Peak Pricing 769. Volume-Weighted Average Price (VWAP) 770. Cost Overrun 771. Merchant Discount Rate 772. Vendor Consolidation 773. Debit Spread 774. Credit Spread 775. Credit Analysis 776. Fixed Income Investment 777. Collateral Trust Bond 778. Capital Reinvestment 779. Reserve Requirement 780. Prime Rate 781. Discount Factor 782. Horizontal Integration 783. Block Trade 784. Micro Cap Stock 785. Fiscal Cliff 786. Income Inequality 787. Emergency Fund 788. Tax Loss Harvesting 789. Revenue Accrual 790. Discounted Security 791. Home Country Bias 792. Currency Arbitrage 793. Repatriation of Profits 794. Growth Rate Sustainability 795. Stakeholder Theory 796. Expected Rate of Return 797. Bottom Line 798. Managed Futures

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Mohd Rihan

Student| Passionate ... • 1y

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

VIJAY PANJWANI

Learning is a key to... • 3m

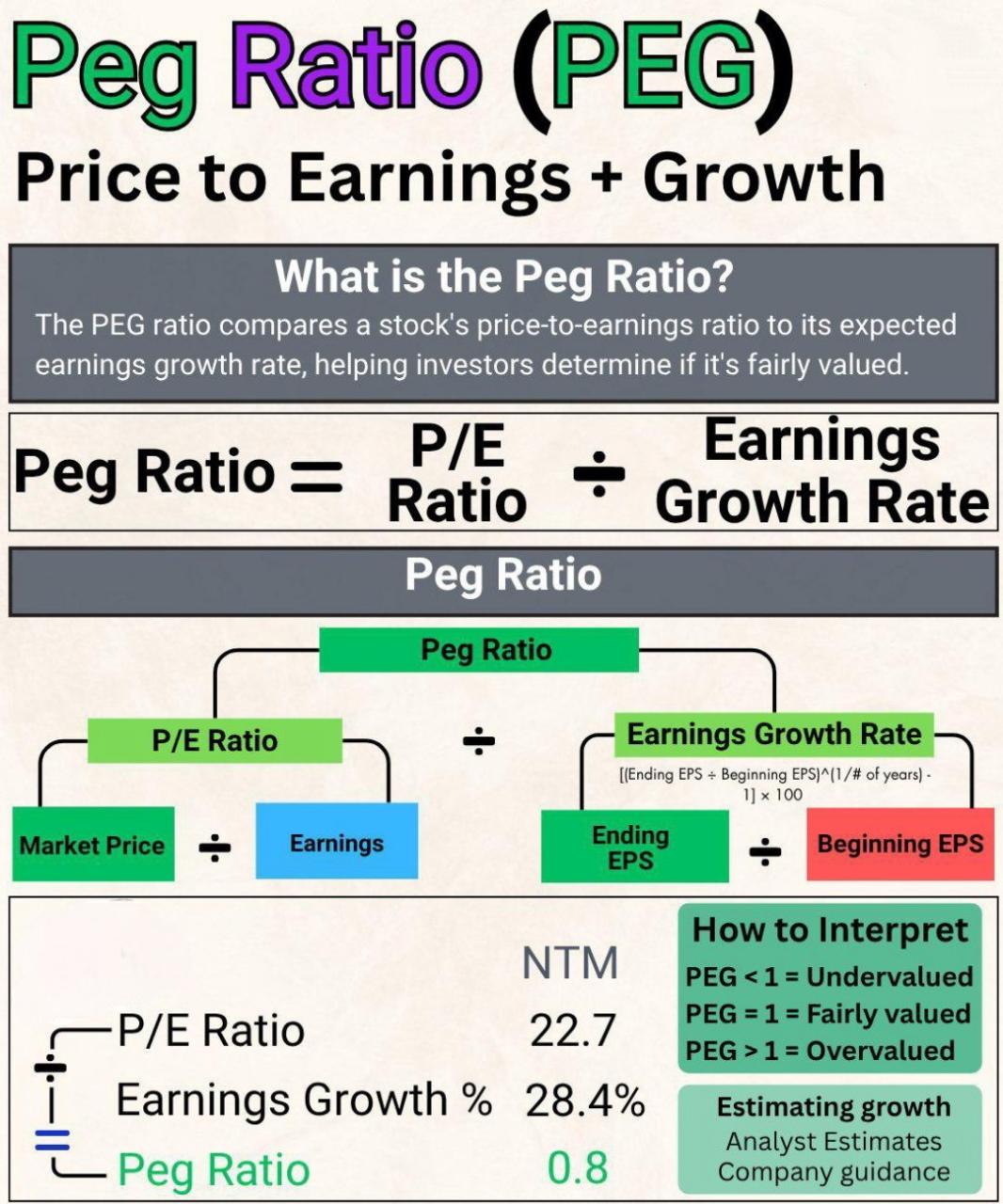

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fai

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)