Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

🎯 200 Most Consumed Financial Terms In Business And Startup World 🌍 Part ( 5 ) 801. Sustainable Competitive Advantage 802. Price Target 803. Consensus Estimate 804. Closed-End Fund 805. Open-End Fund 806. Private Placement 807. Book Value per Share 808. Stock Beta 809. Backward Integration 810. Liquidity Trap 811. Full-Cost Pricing 812. Transfer Pricing 813. Cross-Border Financing 814. Offshore Banking 815. Holding Period Return 816. Down Payment 817. Swing Trading 818. Debt Restructuring 819. Treasury Inflation-Protected Securities (TIPS) 820. Retained Earnings 821. Venture Debt 822. Block Pricing 823. Current Maturity 824. Market Arbitrage 825. Buyback Ratio 826. Enterprise Risk Management (ERM) 827. Risk Appetite 828. Replacement Cost 829. Bond Call Provision 830. Yield Spread 831. Bank Run 832. Green Bond 833. Long Hedge 834. Short Hedge 835. Mark to Future 836. Price Maker 837. Fiscal Multiplier 838. Incremental Borrowing Cost 839. Accretion of Discount 840. Tax Deferment 841. Stock Repurchase 842. Subscription Rights 843. Paid-In Capital 844. Fringe Benefits 845. Mean Reversion 846. Event-Driven Strategy 847. Excess Cash Flow 848. Stochastic Modeling 849. Leverage Ratio 850. Discounted Spread 851. Risk-Free Arbitrage 852. Cross Holding 853. Economic Stimulus 854. Consumption Tax 855. Trade Receivables 856. Customs Duty 857. Working Capital Turnover 858. Pre-Money Valuation 859. Pro Forma Financials 860. Disinflation 861. Cross Margin 862. Retail Price Index (RPI) 863. Tax Shelter 864. Commodity Hedge 865. Debt-for-Equity Swap 866. Operational Leverage 867. Cash Matching 868. Trading Desk 869. Time Value of Money (TVM) 870. Realizable Value 871. Financial Engineering 872. Employee Stock Option Plan (ESOP) 873. Total Return Swap 874. Tax Equity 875. Investment Club 876. Authorized Capital 877. Form S-1 878. Self-Funding 879. Market Intelligence 880. Market Mechanism 881. Crowdlending 882. Creditworthy 883. Phantom Stock 884. Normal Distribution 885. Management Buy-In (MBI) 886. Exchange Fund 887. Blue Sky Laws 888. Sidecar Investment 889. Residual Dividend 890. Financial Benchmarking 891. Income Splitting 892. Performance Fee 893. Risk Parity 894. Angel Investor 895. Cross-Border Merger 896. Concentration Ratio 897. Dual-Class Stock 898. Involuntary Liquidation 899. Benchmark Yield 900. Distressed Debt 901. Basis Point Spread 902. Currency Hedging 903. Revolving Loan Fund 904. Penetration Pricing 905. Interest Coverage Ratio 906. Strategic Costing 907. Revaluation Reserve 908. Risk Assessment Matrix 909. Ex-Dividend Date 910. Management Incentives

Replies (3)

More like this

Recommendations from Medial

Gangesh Rameshkumar

Figure it out • 8m

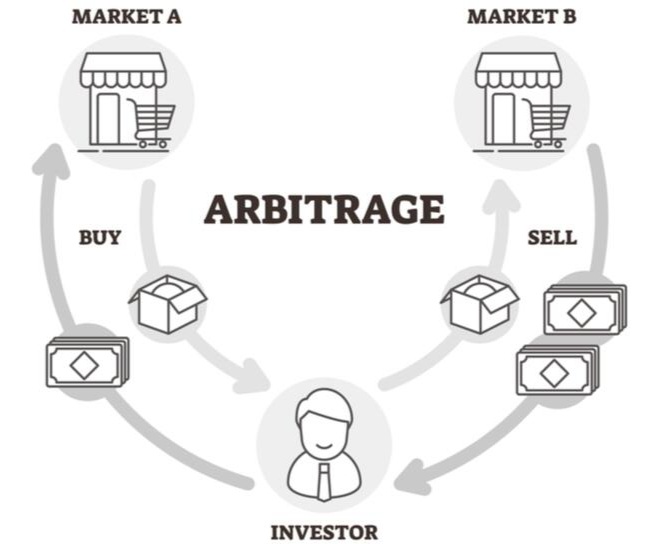

Term of the day: Arbitrage Arbitrage is the exploitation of market inefficiencies where the price of an asset is different in different markets For example, Company X's stock is listed at 20$ on the New York Stock Exchange(NYSE), but $20.05 on th

See More

PRATHAM

Experimenting On lea... • 6m

Top three investments with zero to low risk in which you can earn 7 to 9% are: first, FDs; second, Liquid Mutual Funds; and third, Arbitrage Funds. Liquid Fund is a day fund which invests in super ultra short-term instruments like T-Bills in the mon

See MoreMohd Rihan

Student| Passionate ... • 11m

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

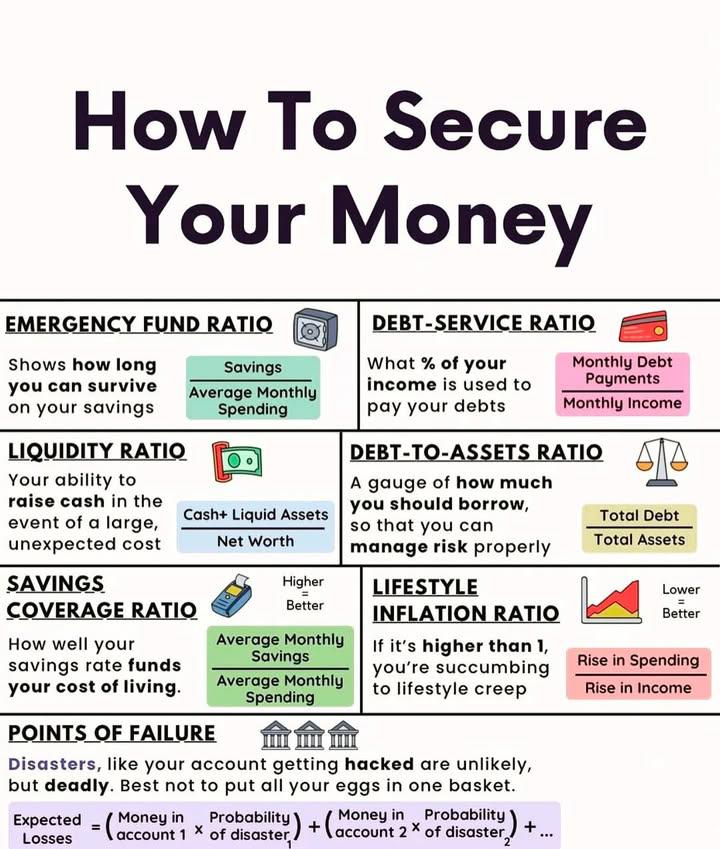

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)