Back

Anonymous

Hey I am on Medial • 1y

911. Market Neutral Fund 912. Monthly Active Users (MAU) 913. Founder’s Equity 914. Accelerated Depreciation 915. Constant Growth Model 916. Free Rider Problem 917. Pricing Strategy 918. Asset Quality 919. Risk-Adjusted Performance 920. Industry Multiplier 921. Covenant-Lite Loan 922. Double-Entry Bookkeeping 923. Green Shoe Option 924. Market Follower 925. Operational Budget 926. Financial Spread Betting 927. Price Cap 928. Total Return Index 929. Zero Sum Game 930. Retention Rate 931. Conversion Factor 932. Fiscal Year-End (FYE) 933. Parent Company 934. Co-Branded Credit Card 935. Transaction Costs 936. Currency Volatility 937. Stealth Marketing 938. Tax Bracket 939. Deadweight Loss 940. Loss Mitigation 941. Realized Capital Gain 942. Corporate Raider 943. Price Elasticity 944. Debt Securitization 945. Moral Hazard 946. Strategic Alliance 947. Business Model Canvas 948. Regulatory Arbitrage 949. Inventory Shrinkage 950. Deferred Payment 951. Tax Differential 952. Working Capital Deficit 953. Retail Investor 954. Corporate Restructuring 955. Take-Private Deal 956. Limit Down 957. Contingent Claim 958. Operating Profit Margin 959. Stabilization Fund 960. Progressive Tax 961. Negative Equity 962. Diversified Portfolio 963. Arbitrage Opportunity 964. Covered Call 965. Spread Betting 966. Predatory Pricing 967. Managed Account 968. Proprietorship Equity 969. Swing Loan 970. Trust Account 971. EBITDA Margin 972. Relative Strength Index (RSI) 973. Alpha Generation 974. Risk Management Framework 975. Defensive Stock 976. Rollover Loan 977. Regulatory Capital 978. Sustainable Growth Rate 979. Deferred Tax Liability 980. Net Capital 981. Blockchain Finance 982. Open Market Operations 983. Credit Risk Premium 984. Earnings Surprise 985. Return on Invested Capital (ROIC) 986. Revenue Bond 987. Foreign Subsidiary 988. Blue Ocean Strategy 989. Shareholder Dilution 990. Market Penetration 991. Interest Arbitrage 992. Securitization Trust 993. Option Adjusted Spread (OAS) 994. Industry Life Cycle 995. Cash Value Life Insurance 996. Trend Analysis 997. Payback Period 998. Exit Strategy 999. Hyperinflation 1000. Resource Allocation

More like this

Recommendations from Medial

PRATHAM

Experimenting On lea... • 6m

Top three investments with zero to low risk in which you can earn 7 to 9% are: first, FDs; second, Liquid Mutual Funds; and third, Arbitrage Funds. Liquid Fund is a day fund which invests in super ultra short-term instruments like T-Bills in the mon

See MoreBrayden Lucas

Hey I am on Medial • 3m

Top Benefits of Crypto Arbitrage Bot Development in Crypto Arbitrage Trading Crypto Arbitrage Trading Bot development enables traders to maximize profits through automated strategies. A Crypto Arbitrage Bot continuously monitors price differences ac

See More

Gangesh Rameshkumar

Figure it out • 8m

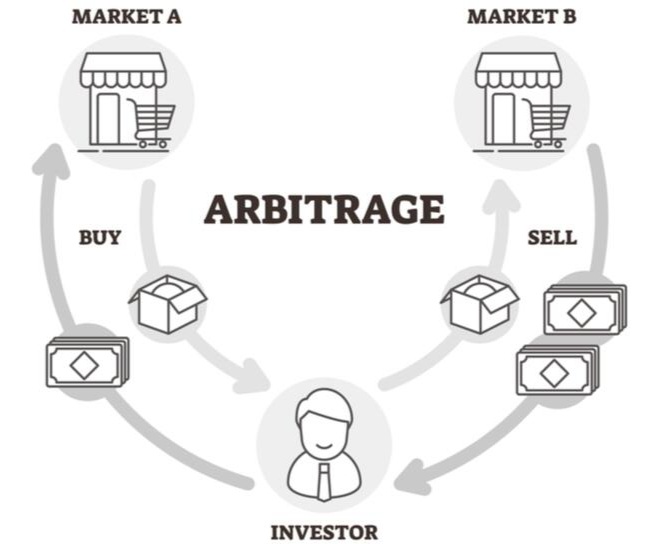

Term of the day: Arbitrage Arbitrage is the exploitation of market inefficiencies where the price of an asset is different in different markets For example, Company X's stock is listed at 20$ on the New York Stock Exchange(NYSE), but $20.05 on th

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)