Back

LIKHITH

•

Medial • 1y

PE is just a metric to measure Investors confidence and risk appetite if PE is 30, then Investors are ready to invest 30rs for earning of 1 rupee it doesn't represent any kind of crash or future events that's gonna happen 🙃

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

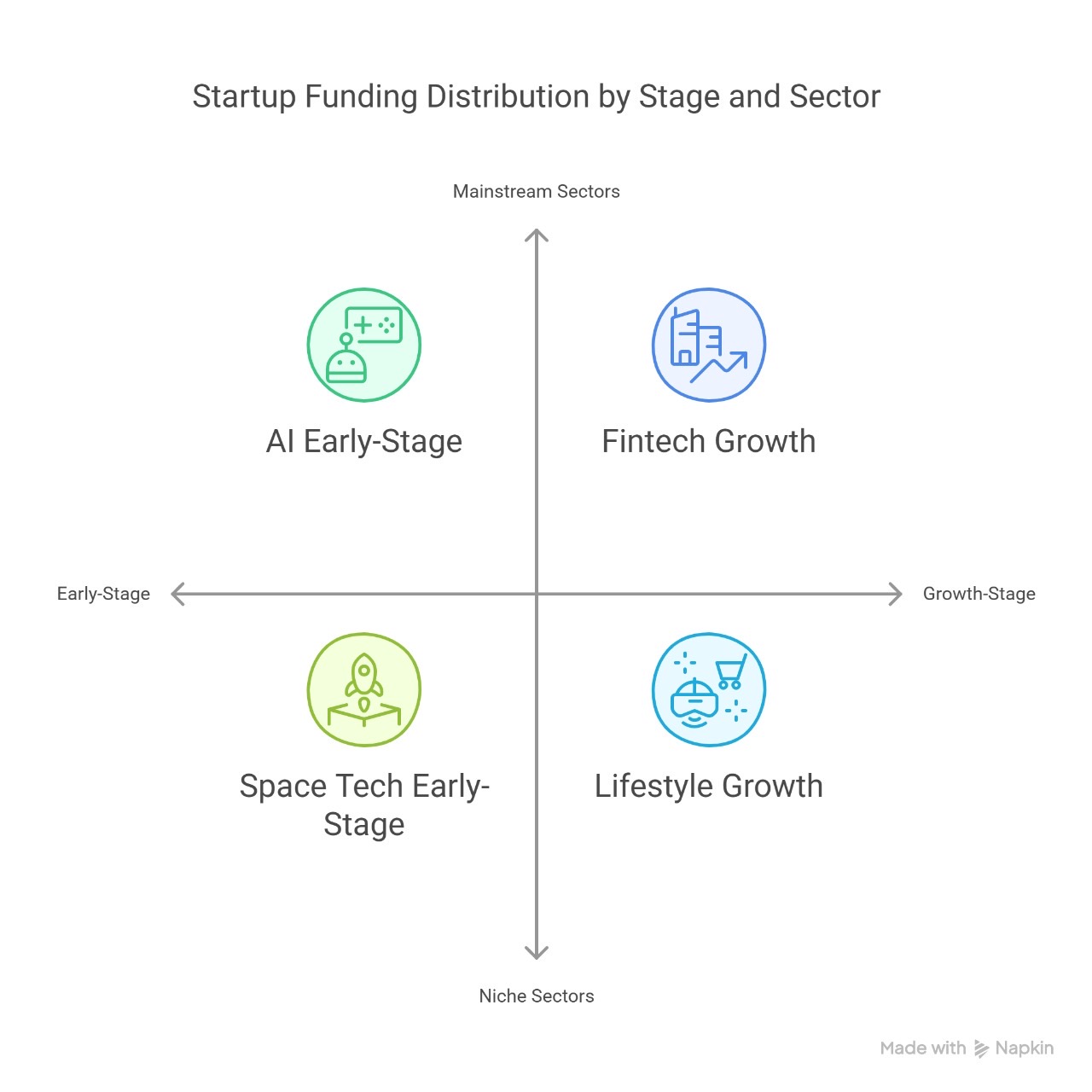

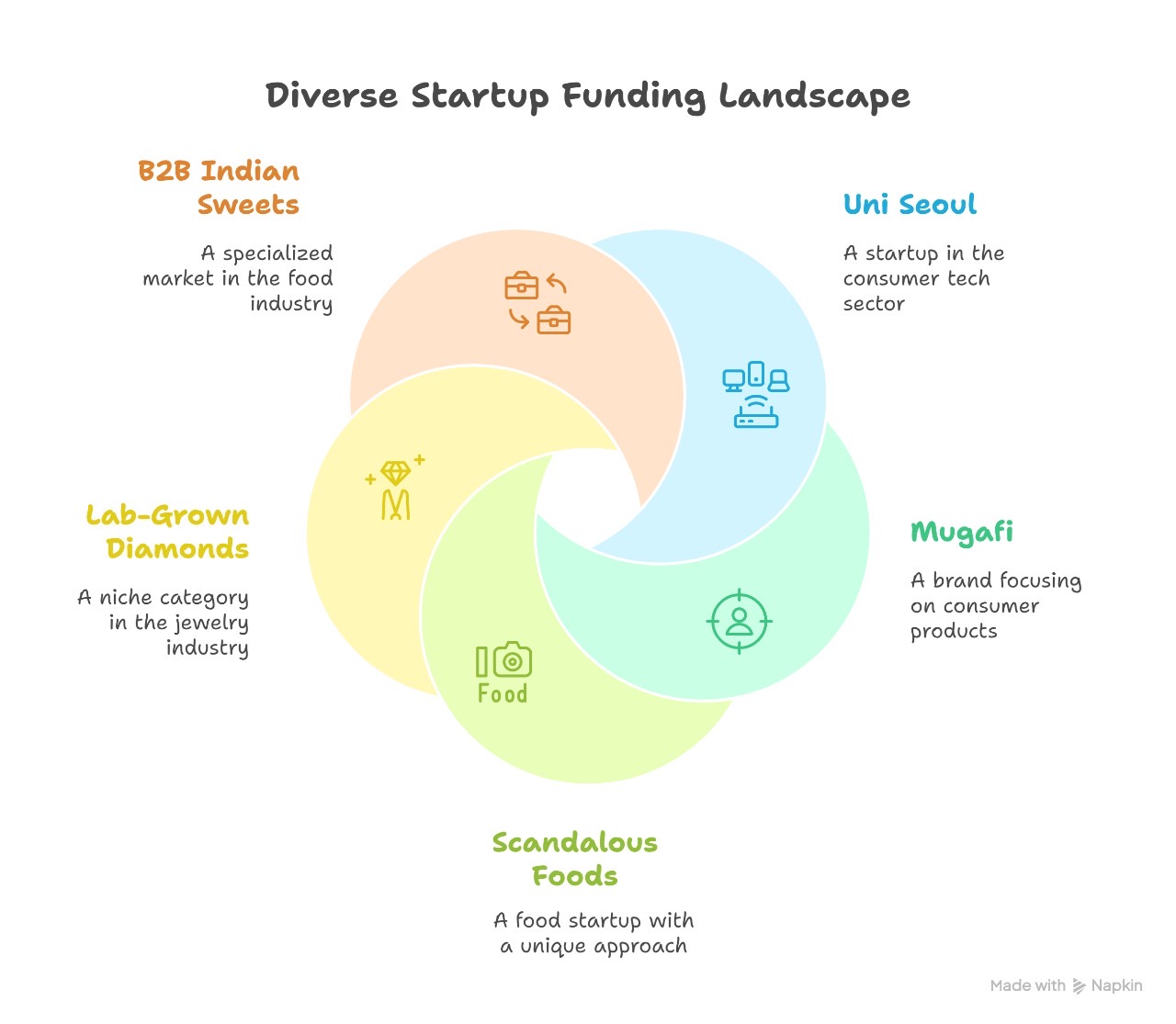

The last week of April was active for Indian startups, with funding across lifestyle, fintech, AI, healthtech, and space tech. There was a healthy mix of seed and Series A rounds, reflecting cautious optimism. Seed-stage bets like Uni Seoul, Mugafi,

See More

CA Jasmeet Singh

In God We Trust, The... • 10m

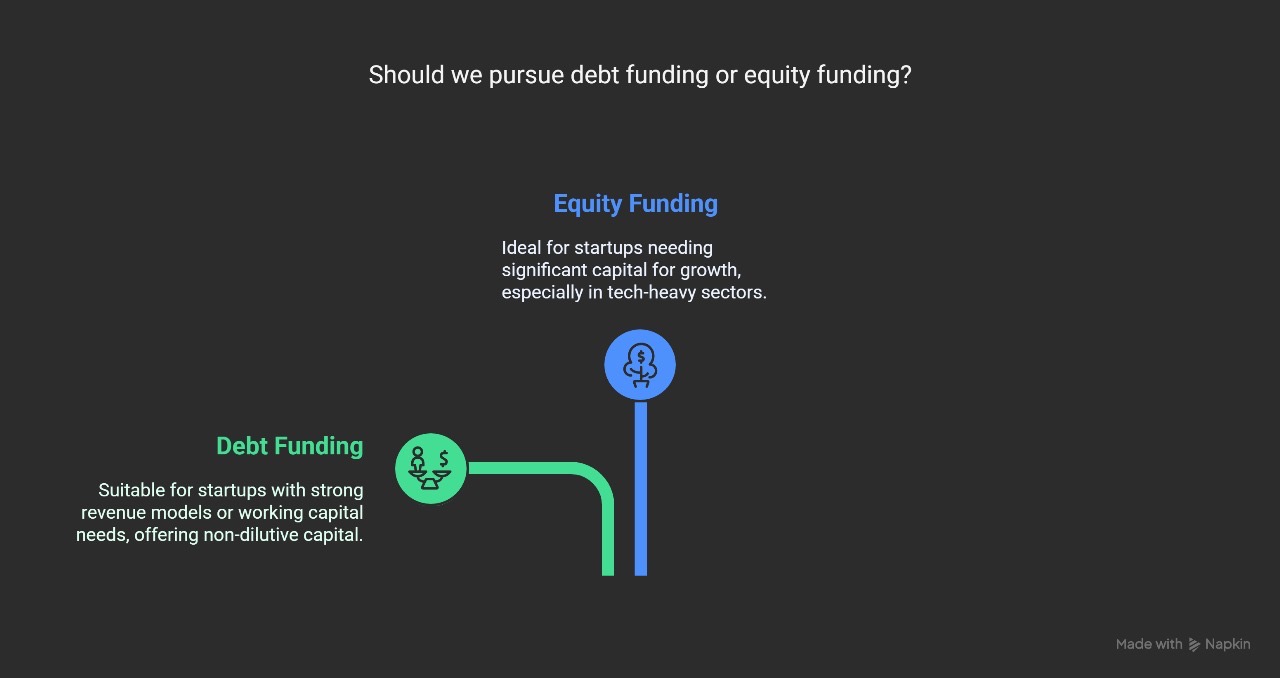

Startups, before you build the next unicorn… READ THIS! (From your friendly neighborhood CA) 🚨 Founders, are you guilty of: ❌ Mixing personal & business expenses? ❌ Ignoring compliance till it's urgent? ❌ Thinking GST & ROC are optional side quests

See MoreYash S

Founder @ Innovzeal ... • 9m

In 2025, India officially became the world’s fourth-largest economy by nominal GDP, overtaking Japan. For those who recall similar headlines from the 2009–2014 period, the distinction lies in what’s being measured. Back then, India rose to third plac

See More

Tushar Aher Patil

Trying to do better • 8m

🚀 Startup Surprise – Day 7: From Broom to Boardroom! Forget unicorns and VC funding. Some of the most extraordinary empires are built quietly, with ingenuity and grit. Meet Narayan Reddy, a social entrepreneur from rural Karnataka. His story is a po

See More

Ketan Sojitra SMEDOST

•

Gujarathi Empire Group • 2m

✴️ Why Tier-2 India Will Drive the Next Decade More Than You Think? - Evidence from City Intelligence and Country Reports! 🚀 PART-4 💡 Strategy Blueprint: How PE Should Enter Tier-2 India 🚀 ☑️ 1. Start with TAM–SAM–SOM That Is “Cluster-Specific,”

See More

Vamshi Yadav

•

SucSEED Ventures • 9m

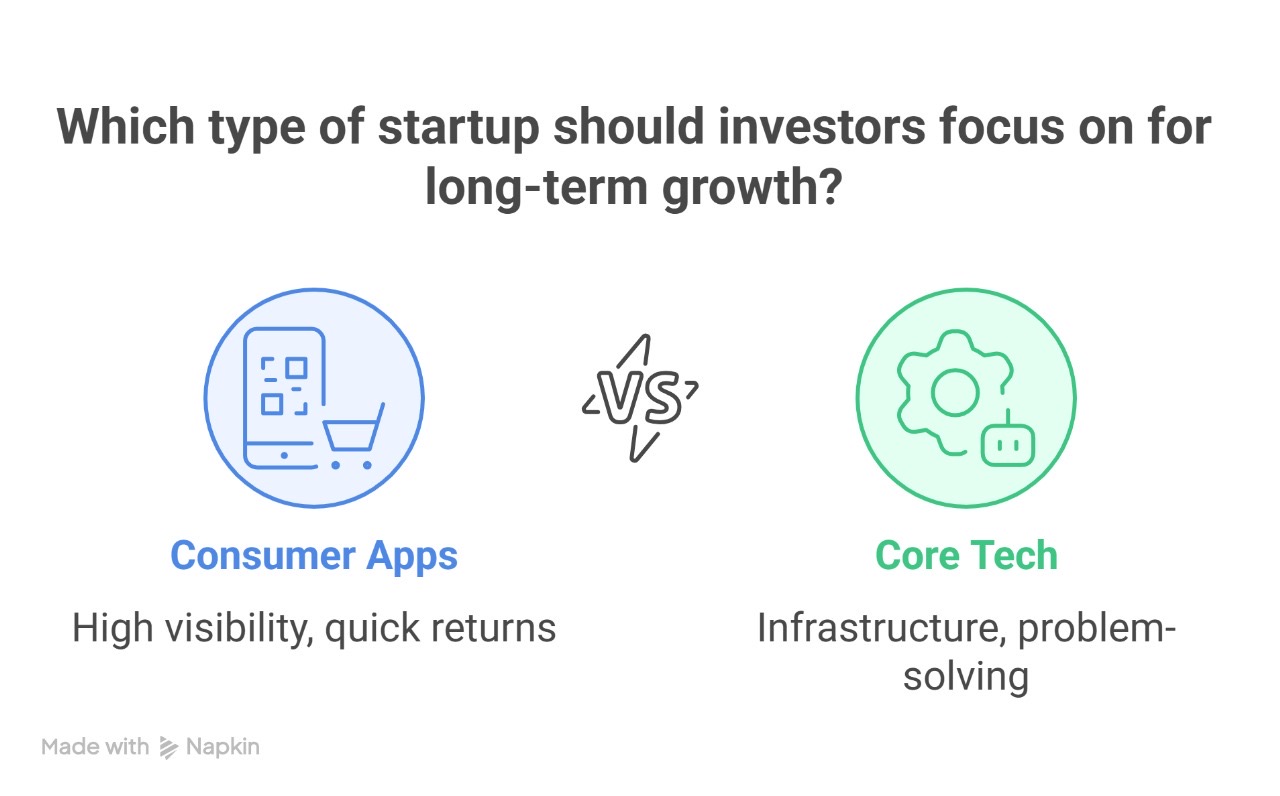

The VC Playbook Is Getting Rewritten, So Here's What's Next The biggest names in Silicon Valley—Lightspeed Ventures, a16z, Sequoia, and Thrive—are no longer mere veil of ventures. They are morphing into tech-powered private equity titans with seism

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)