Back

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

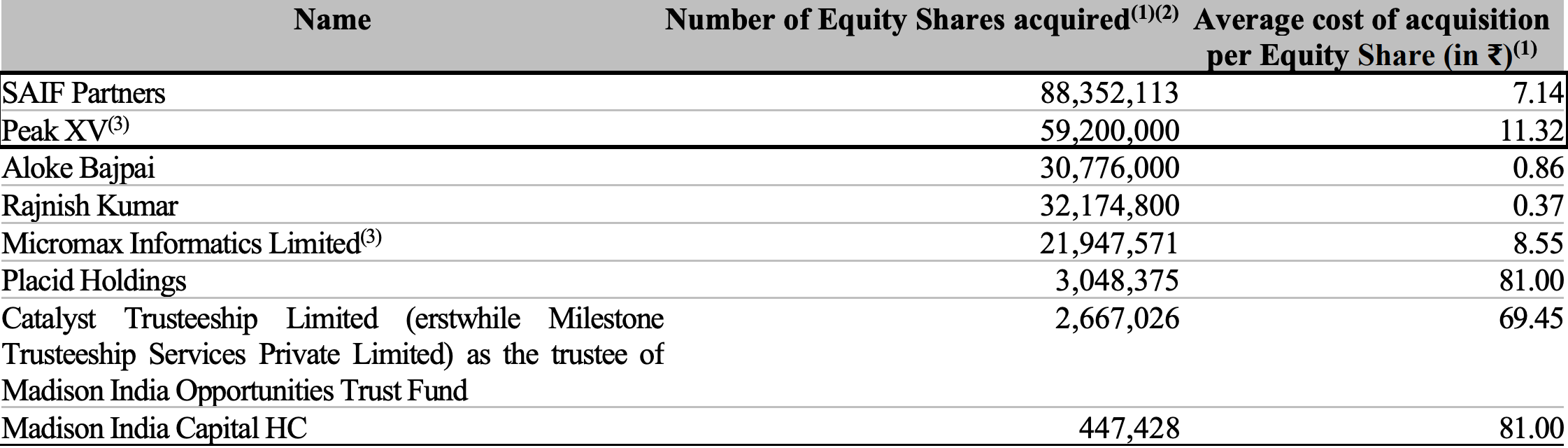

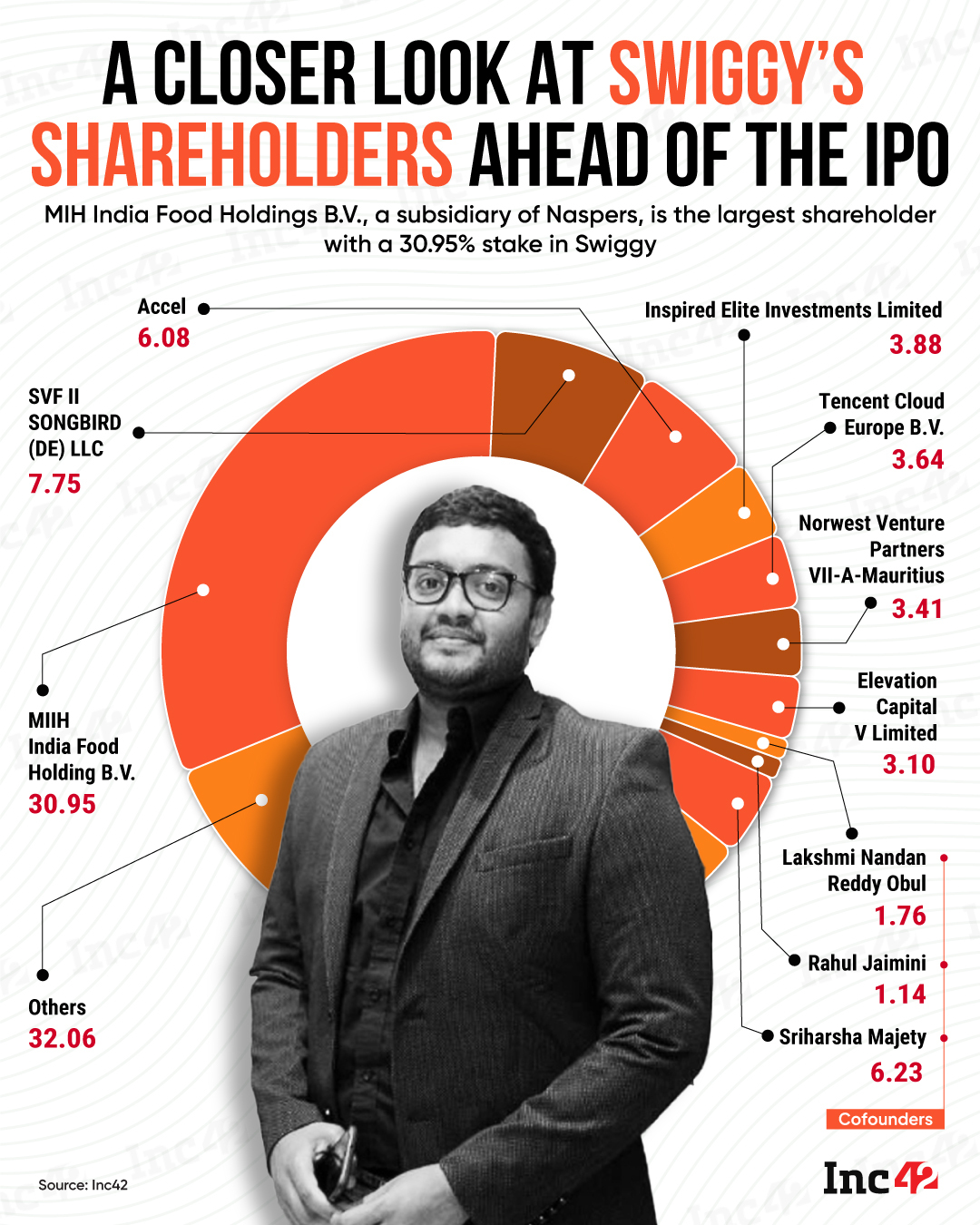

Swiggy's upcoming IPO will be a multibagger win for early VC investors. 🎯Detailed insights will be available once their DRHP is public, but if you look at the history - - Elevation Capital: Investment of $5.9 M turned into $61.8 M (~10x returns) -

See MoreSanjay Kohli

Security Engineer In... • 11m

The IPL isn’t just cricket—it’s a billion-dollar spectacle powered by the BCCI. Here’s what IPL 2025 looks like in numbers: 💰 ₹6,000-₹7,000 crore in ad revenue (TV, digital, sponsorships, on-ground ads). 📱 ₹4,500 crore from digital streaming (Jio

See More

Vamshi Yadav

•

SucSEED Ventures • 9m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-

See MoreSaket Sambhav

•

ADJUVA LEGAL® • 8m

Rejected by 100 VCs, Almost Died, Then a $14.5 BILLION IPO. Chime's Story is a Masterclass in Resilience! 🔥 For any founder who's ever faced rejection, I just saw a TechCrunch headline that puts it all in perspective: Fintech giant Chime was report

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 7m

🚀 Inside a VC Mentorship: What I Learned About How VCs Think. Recently, I had the privilege of attending a focused mentorship session from VC Partner Manik Gruver at Macwise Capital, alongside a few fellow founders. The session offered deep, behind

See More

Ansh Kadam

Founder & CEO at Bui... • 10m

Here’s how the founders of Snapdeal quietly turned ₹57 lakhs into ₹110 Cr without building a new product. They were early investors in Urban Company, which is now valued at a whopping $2.6 billion, and that gave them a 200x return in under a decade.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)