Back

More like this

Recommendations from Medial

Utkarsh Mishra

Co-Founder @Trustopa... • 1y

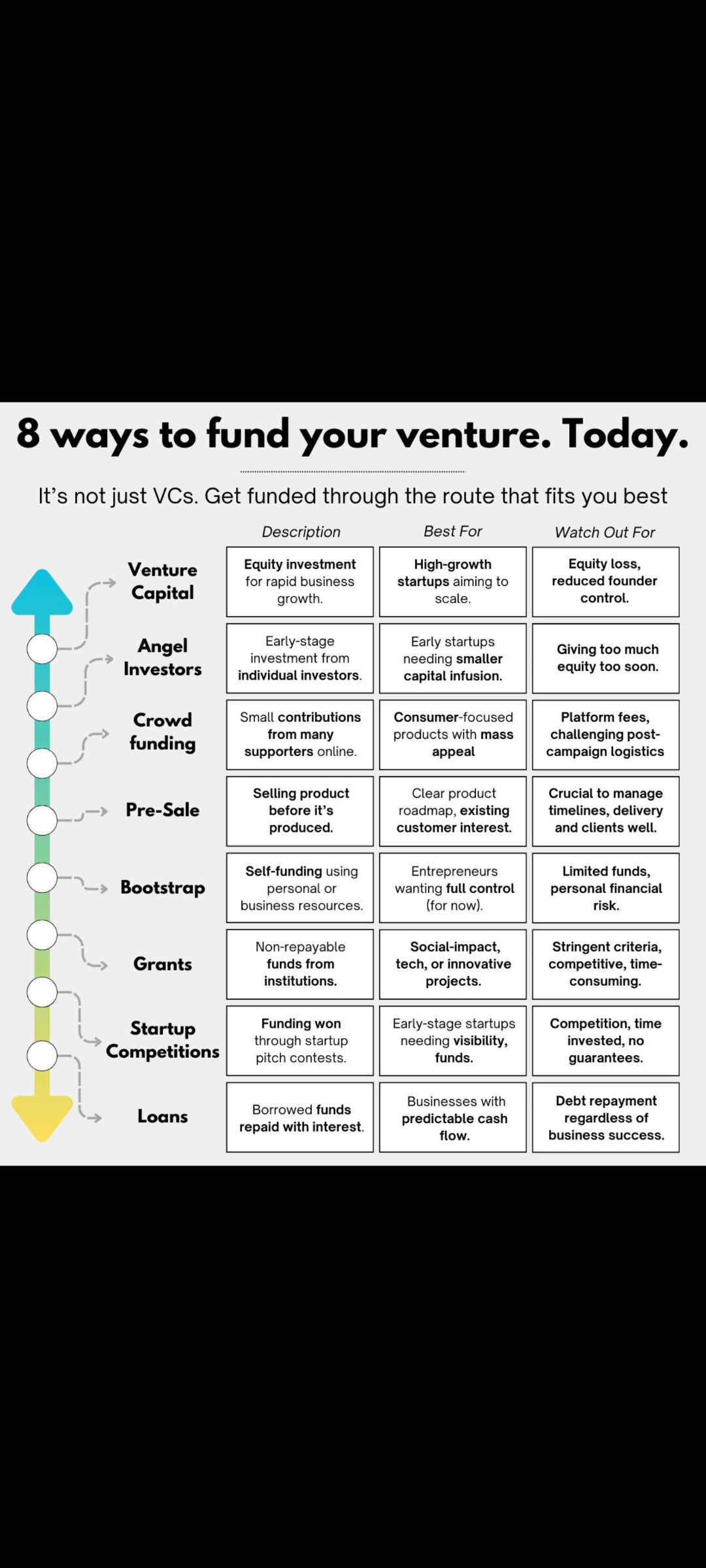

Less than 1% of startups get VC funding. But guess what? There are 7 more ways to fund your dream! Funding doesn’t have to be stressful, and it’s not just about VCs. There are smarter ways to get the money you need. From bootstrapping to crowdfund

See More

Aanya Vashishtha

Drafting Airtight Ag... • 10m

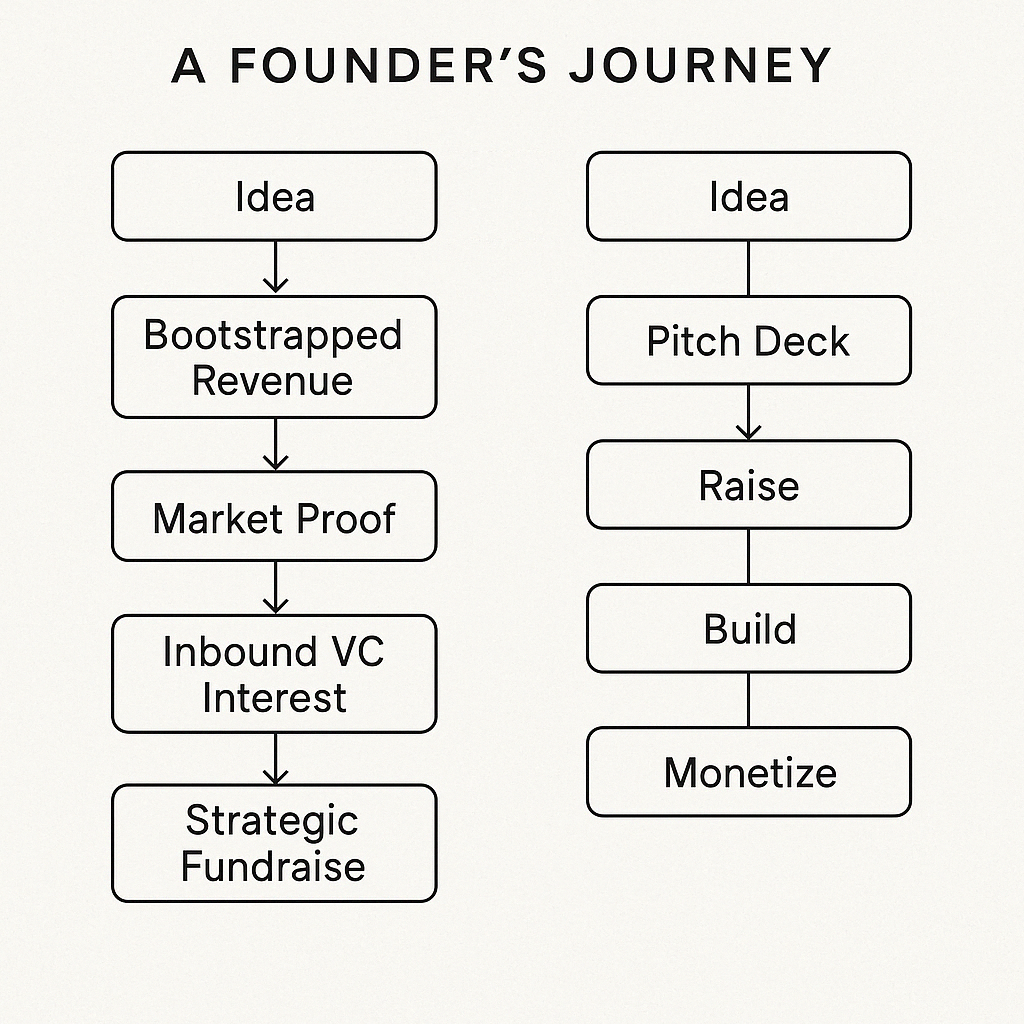

"Should You Raise Funds or Bootstrap? Here’s a Reality Check." Raising funds sounds glamorous—big checks, investor clout, fast growth. But it’s a trade-off. You get cash but lose equity and often control; investors expect results, not excuses.

See MoreVicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Vedant SD

Finance Geek | Conte... • 1y

Day 59: BLR Startup Funding: Beyond the Angel Investors Angel investors are the fairy godmothers of the startup world, but they're not the only funding option in Bengaluru. Here's a look beyond: * Bootstrapping Magic: Self-funding your startup wit

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Rejected by a VC? Good. Here’s Why. Every “no” from a VC isn’t the end—it’s redirection. The best founders use rejection as fuel. Here’s how: Ask for Feedback – A “no” with insight is a hidden win. Refine Your Pitch – It’s not just your idea, it’s

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)