Back

T Ganesh

Science • 1y

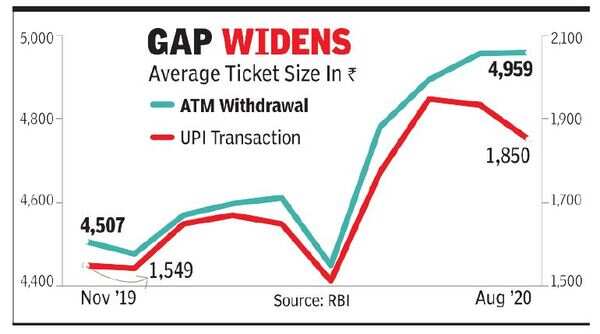

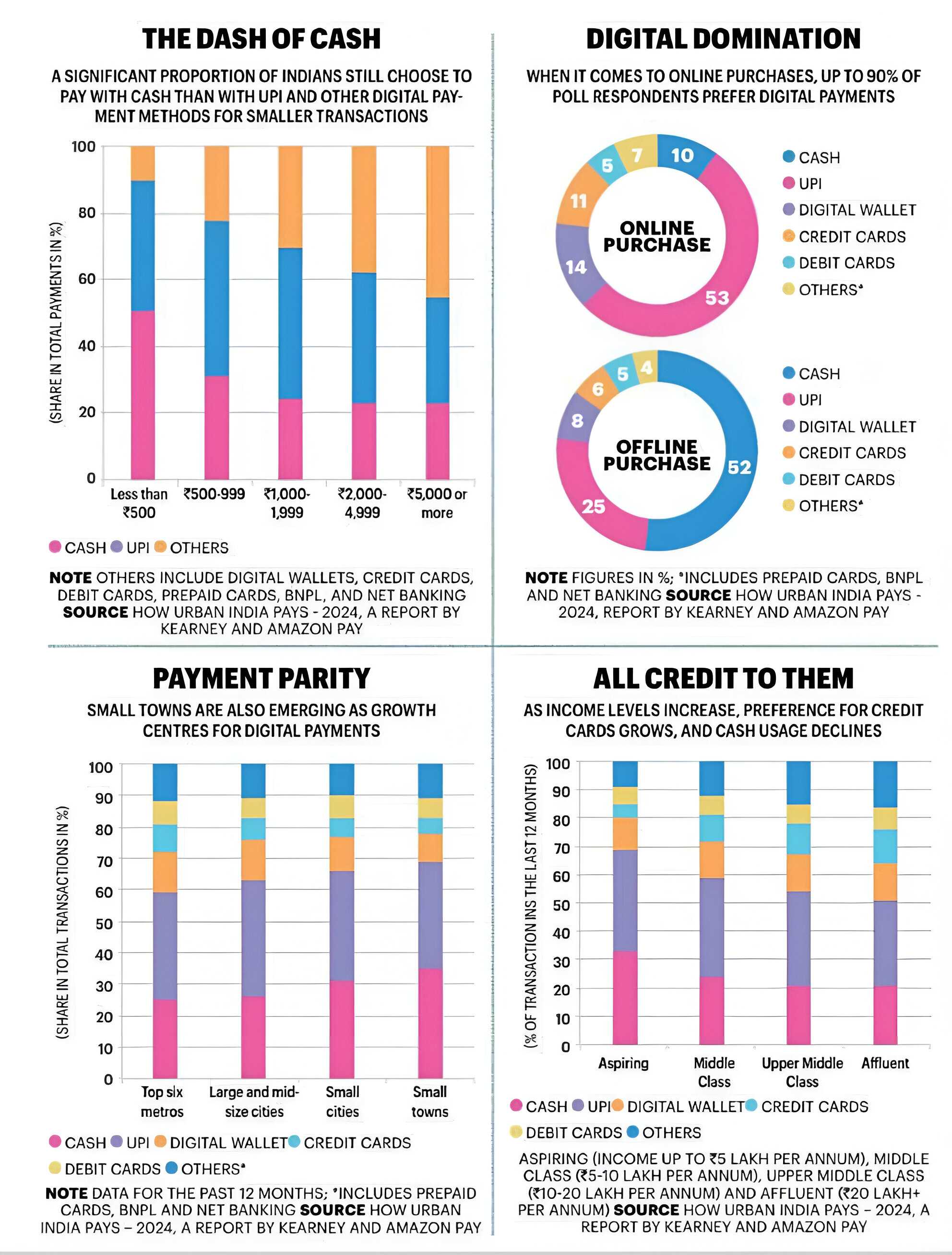

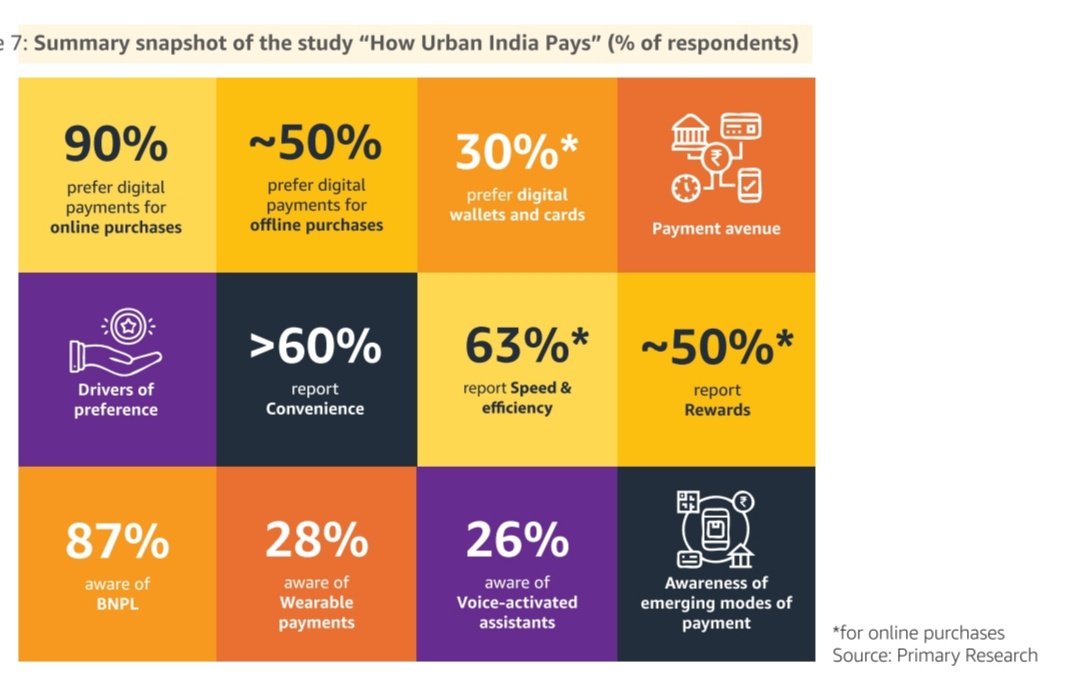

This is what I mentioned with simple terms. As Frequent smaller transactions below 2000 make it difficult to check transactions (loop hole) as it mentioned in the picture. And I mentioned that use of digital wallets. As the aim of digital Indian is to go cashless as you mentioned

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 2m

Top Digital Payment Stocks to Watch in 2025! 🚀 India’s digital payment ecosystem is booming, and these companies are playing a major role in shaping the future of cashless transactions. Here are some key players👇 ✨ AGS – Transaction processing, m

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreAnsh Sarkar

Software, Physics, P... • 11m

Everyone wants a seamless, instant digital payments system — until it fails. UPI processes over 580 million transactions daily, silently powering India’s cashless economy. But today’s outage was a stark reminder: even the most advanced systems are o

See MorePoosarla Sai Karthik

Tech guy with a busi... • 7m

As of 2025, ₹500 notes dominate India’s cash system, making up 86 percent of the total value and 40.9 percent of all notes by volume. But while they’re everywhere, they’re not always practical. For everyday use, smaller denominations like ₹100 and ₹2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)