Back

T Ganesh

Science • 1y

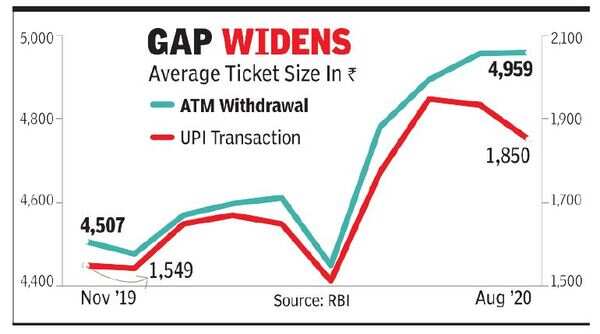

1. I think this rule is to make people use Cash under payments of Rs. 2000. 2. So that, people will have cash for flexibility with no network areas. 3. People will use digital wallets. Then we have less bank transactions as there is no small transactions in bank statements. Please comment your views on my opinion.

Replies (1)

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 10m

3 DIY Health Checks Every Founder Should Do Monthly 1. Cash Flow Pulse Check → Ask: Did I collect more than I spent this month? → If unsure, review bank statements & tally collections vs payments. Why it matters: Profitable on paper ≠ cash in bank.

See More Reply

7

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)