Back

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 6m

No Investors. No Burn. Just Purpose. We know investors won’t fund us — and that’s okay. Why? Because we’re not trying to become a unicorn by burning cash. At Delfo, we're not building for hype. We're building for underrated local restaurants and ha

See More

Pankaj Joshi

Doing something • 5m

VCs are hypocrite. Bike Taxis were never legal under Motor Vehicle Act in any state. Still Rapido introduced it, VCs funded it heavily with nearly 5,000+ Crore. And now its banned. Why no cry from VCs now ? Did they not validate it before investing

See MoreDr Sarun George Sunny

The Way I See It • 3m

🔥Most Ads Are Dead Before They Even Launch. Honestly, they’re forgettable. They launch, people scroll, and… nothing happens. The problem isn’t the product. It’s that the ad is playing it safe. Safe ads don’t spark curiosity, don’t make people talk

See MorePRATHAM

Experimenting On lea... • 1y

Pw profit has declined 90% in fy23 . People say this is because they don't want to pay taxes and I think it's weird. I mean on that note every business should show less profit nah. Yea they may show less profit then actual figure but they showed 90

See MoreKunal Shinde

Turning Data Into De... • 4m

Not every “great idea” is a great business. I often see founders and teams rushing to launch campaigns or products without asking the most important question: 👉 Is there actual demand for this? Here’s my quick validation checklist before investi

See MoreRohan Saha

Founder - Burn Inves... • 6m

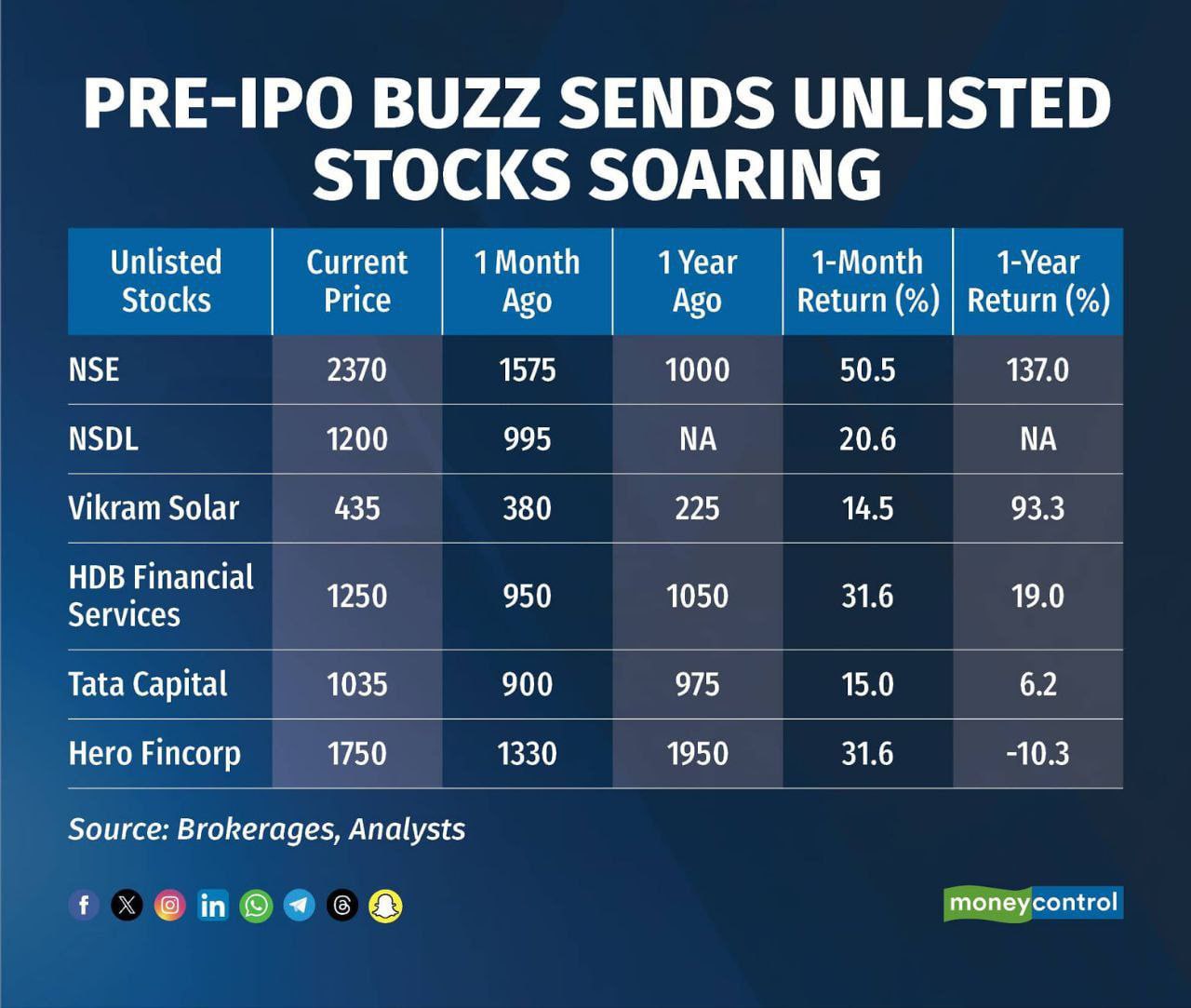

NSE has been on a crazy run in the unlisted market it's given over 100% returns in just a year, all because of the hype around its IPO. And the funny thing is, they haven’t even announced the IPO date yet. Once that happens, who knows how much higher

See More

Download the medial app to read full posts, comements and news.