Back

Niket Raj Dwivedi

•

Medial • 1y

In the current down market there are almost none. Only previously successful founders might get money at idea stage.

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

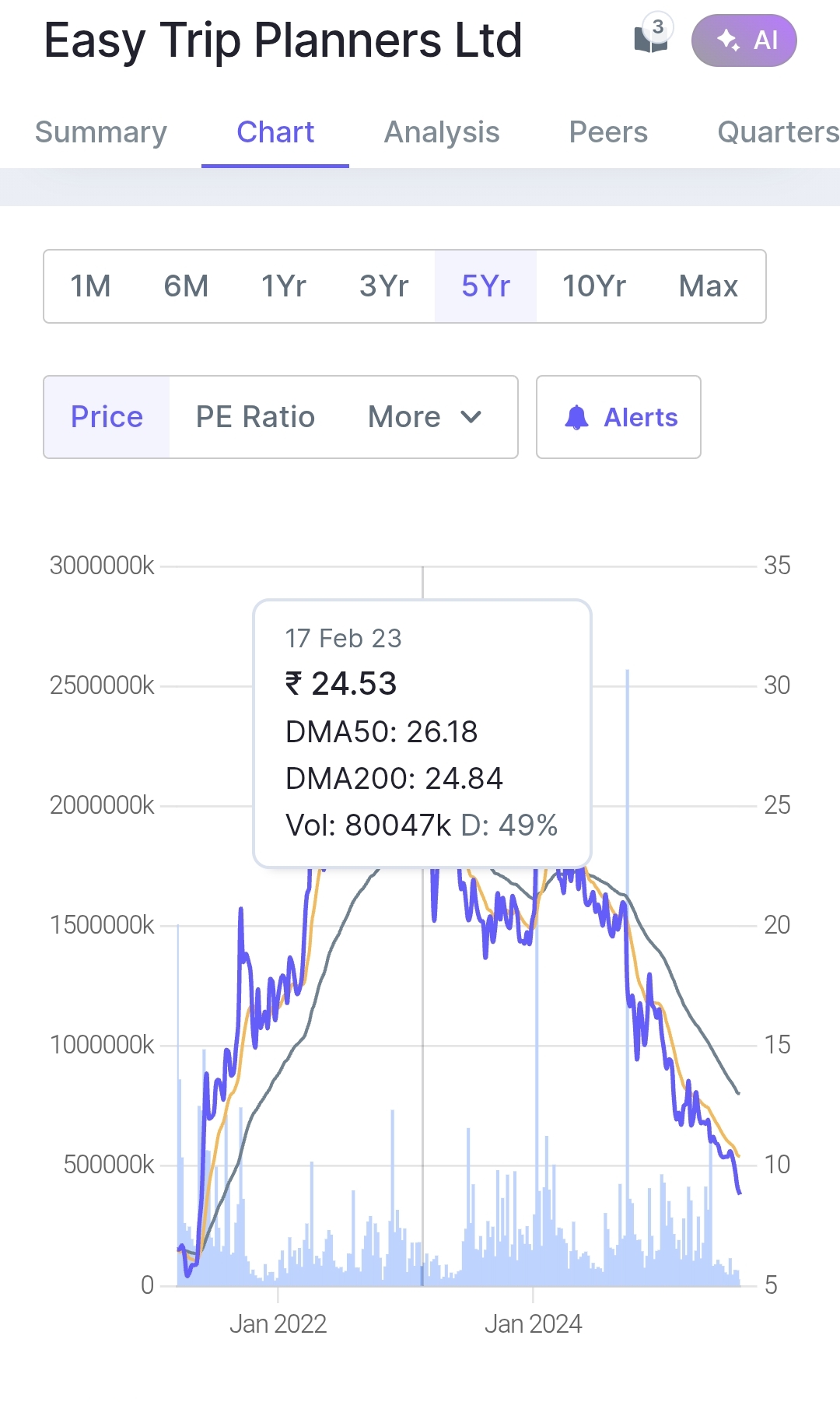

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See MoreAditi Sinha

Data Scientist turne... • 1y

Hi everyone! I’m Aditi, working for early stage investments (seed/series A) in India Quotient. Here to answer all your questions regarding startups, venture capital, funding, current market and anything else that you might have. Please put down you

See More

Account Deleted

Hey I am on Medial • 8m

Navigating the 2025 Fundraising Landscape Breaks down how early-stage founders should approach raising money in 2025 — with real strategies, pitfalls to avoid, and investor psychology. Link: https://www.rightsidecapital.com/blog/navigating-the-202

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)