Back

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

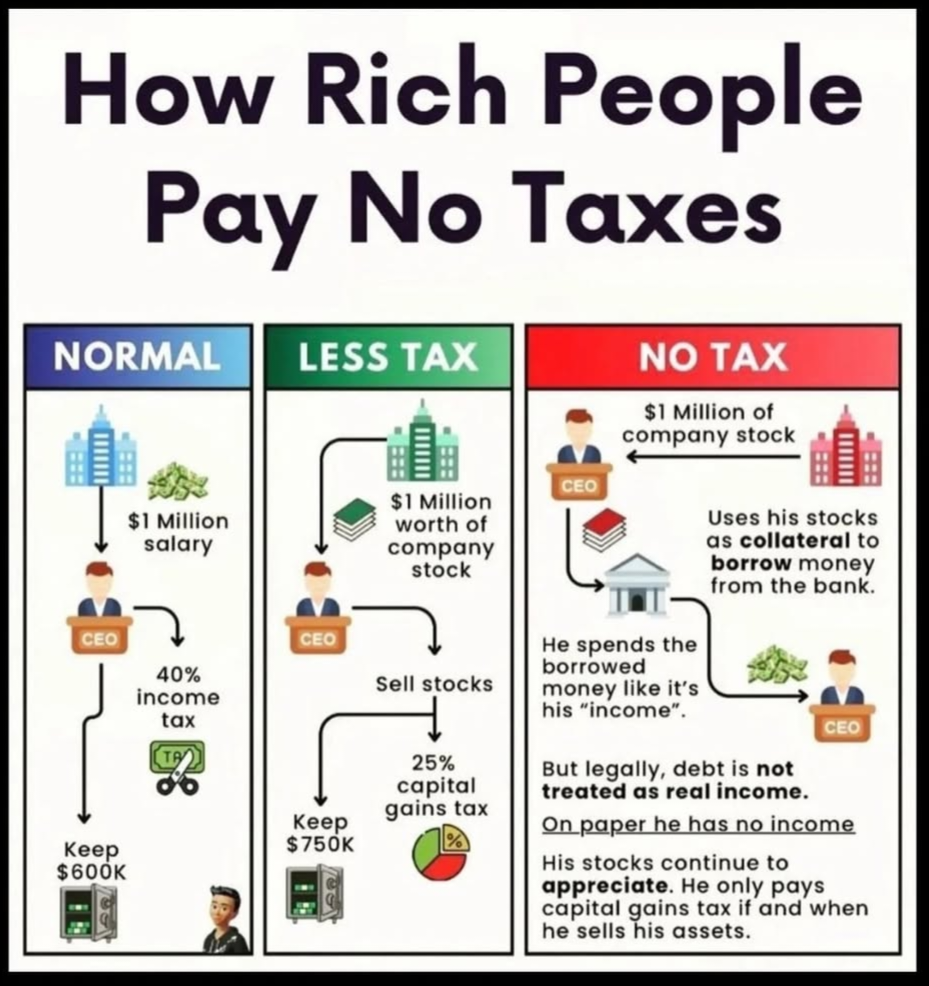

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Omkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

Before You Raise Money, Decide What Kind of Company You Want to Build Founders often chase capital without asking the real question: What type of funding actually matches your strategy? Because equity, debt, and hybrid instruments don’t just finance

See More

Tushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Daya Juwatkar

Founder at Mridakran... • 1m

Le’Udhaar (Bindaas De Udhaar) is a fintech infrastructure startup building repayment and trust rails for India’s informal credit economy. This is not a lending app — it sits behind lending. India doesn’t have a credit problem. It has a trust + repay

See MoreAnonymous

Hey I am on Medial • 1y

Aye Finance Secures INR 110 Cr in Debt Ahead of IPO Delhi, India- IPO-bound lending tech startup Aye Finance has successfully secured INR 110 Cr (approximately $12.8 Mn) in debt from a group of investors, including Northern Arc, ASK Financial Holdin

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)