Back

Anonymous 1

Hey I am on Medial • 1y

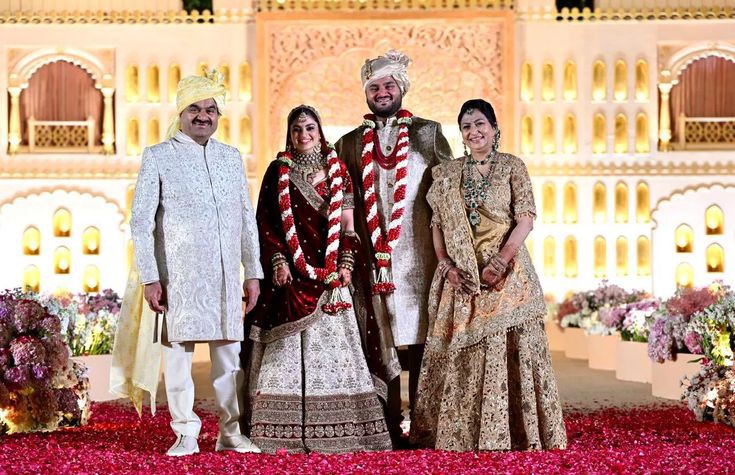

Adani's really going all in on the super app game, huh? Interesting to see them partnering with KreditBee for the lending bit. Smart move, leveraging an established NBFC instead of trying to reinvent the wheel. But man, that 500 million user goal by 2030 is ambitious. Wonder how they plan to compete with the likes of Paytm and PhonePe who've already got a solid foothold in the market. Guess having the Adani name behind it might help

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

🥺 India really don't deserve more Adani's , We have 140 Billion population and still if any foreign media says that our richest businessman is fraud then we Indian easily believe on that statements and start criticizing our businessman without check

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)