Back

Giggity

Memes,games, startup... • 1y

Investors really trust adani , Adani's shares are in the green as we speak looks like the toolkit didn't work this time either

Replies (4)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

🥺 India really don't deserve more Adani's , We have 140 Billion population and still if any foreign media says that our richest businessman is fraud then we Indian easily believe on that statements and start criticizing our businessman without check

See MoreSahil Bagwan

Learning New Things • 10m

Adani Group to Invest $10 Billion in India’s Digital Future! The Adani Group has announced a big investment of $10 billion. They will use this money to build large data centers across India. These data centers will support fast-growing technologies

See More

Account Deleted

Hey I am on Medial • 1y

Do you think that , Adani Group will dominate all traditional businesses like Airports,Ports, Energy and infrastructure and recently Semiconductor business with Qualcomm ? 🚀♥️ According to me, Due to Hindenburg Research false allegations, investors

See MoreSaket Sambhav

•

ADJUVA LEGAL® • 5m

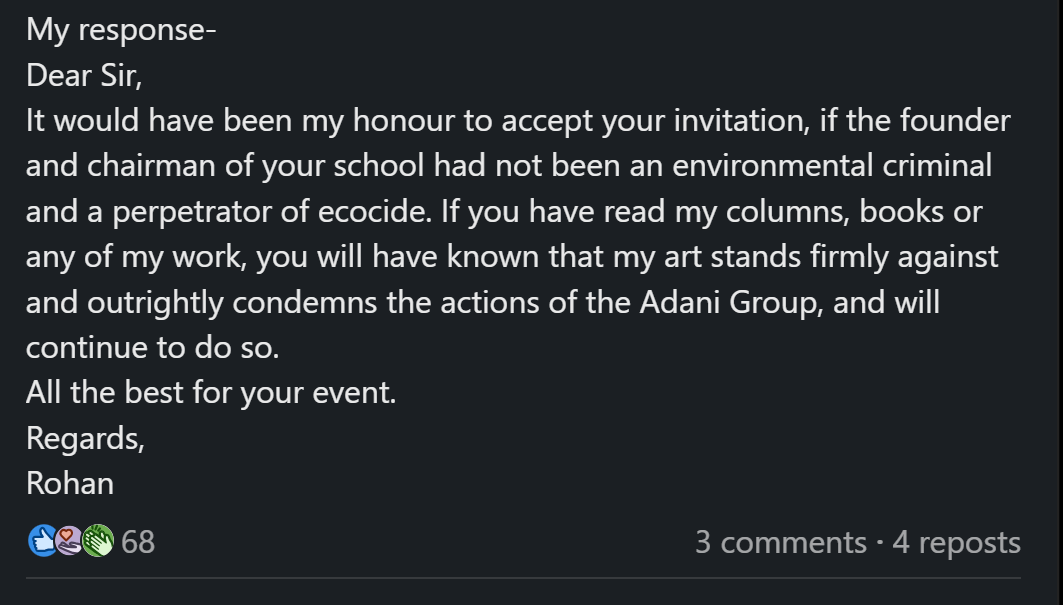

🚨 Cartoonist Rejects Adani School Invite, Calls Out “Environmental Criminal” In a bold stand against corporate greenwashing, award‑winning cartoonist Rohan Chakravarty has publicly declined an invitation to speak at Adani International School’s lit

See More

CA Chandan Shahi

Startups | Tax | Acc... • 12m

Why should a startup opt for a Private Limited Company only? 1. Easy Fundraising from Investors Investors & VCs prefer Pvt Ltd because they can get equity (shares) in exchange for investment. Proprietorships and LLPs cannot issue shares, making fun

See MoreYash

Trying to make thing... • 1y

If a Startup is really Tech Driven and needs a Huge Investment in Tech aspects then how can I have a prototype of it to pitch in front of VCs or Investors ? Either I can have a really basic Software and have very few people on it but for that too how

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)