Back

Hathoda Tyagi

Hmm. • 1y

[This post has been deleted by the creator]

More like this

Recommendations from Medial

Anup Thatal

IT enthusiastic | Fu... • 7m

Some glimpse of business full form ? GTM:- go to market LTV:- lifetime value MVP :- Minimum viable product GT:- General Trade SP:- selling price ROI:- return on investment ROAS:- Return on advertising spend DAU:- Daily Active user MAU:- Monthly A

See MoreSamCtrlPlusAltMan

•

OpenAI • 10m

Just read an awesome article from ZScale Capital on key metrics for business growth! 🚀📈 If you're building a company, you NEED to be tracking metrics like Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), Daily/Monthly Active Users (

See MoreShrijato Das

Co-founder of Mindsp... • 1m

Why raising $250k can feel harder than raising $4M. 20 year old taking about fund raising! (After examining 100+ fundraising deals) The founders who raise smoothly don’t sell harder They explain better. What is the actual reason? → They have str

See More

Anonymous

Hey I am on Medial • 2y

Is the concept of venture capital a bad thing. Because I have seen so many startup’s getting destroyed because once they start raising they are always chasing a funding round and grow for the investors and not their customers. Whereas if we see earli

See MoreKrish Jaiman

Passionate about tec... • 1y

Hi startup founders ,I wanted to ask something .Please help me with this. If I have an idea for a startup,what should be my first step? Should I start building it's prototype?How should I approach to VCs for funding? How can I contact them? Please an

See MoreMrityunjoy Saikia

Passionate About Bus... • 1y

Hey folks, I've noticed that many IITs organize pitch events with hefty rewards. If you've participated in one of these events or have insights, could you share your experience and the process involved? Also, when it comes to choosing between angel i

See MoreShishir

https://adritapps.in... • 4m

💡 Noticing a trend: there are so many posts looking for technical co-founders, and at the same time many tech folks seem focused on finding funding. But what’s often missing in the middle are the angels and VCs who can help close that gap. I believ

See MoreAccount Deleted

Hey I am on Medial • 1y

So if you've built a product, then here's how you could raise some VC money for it. 1.The first is show a working prototype. Show the VCs what it is that your product can do, what are the features that you've built. 2.The second is show some cust

See More

Harsh Dwivedi

•

Medial • 8m

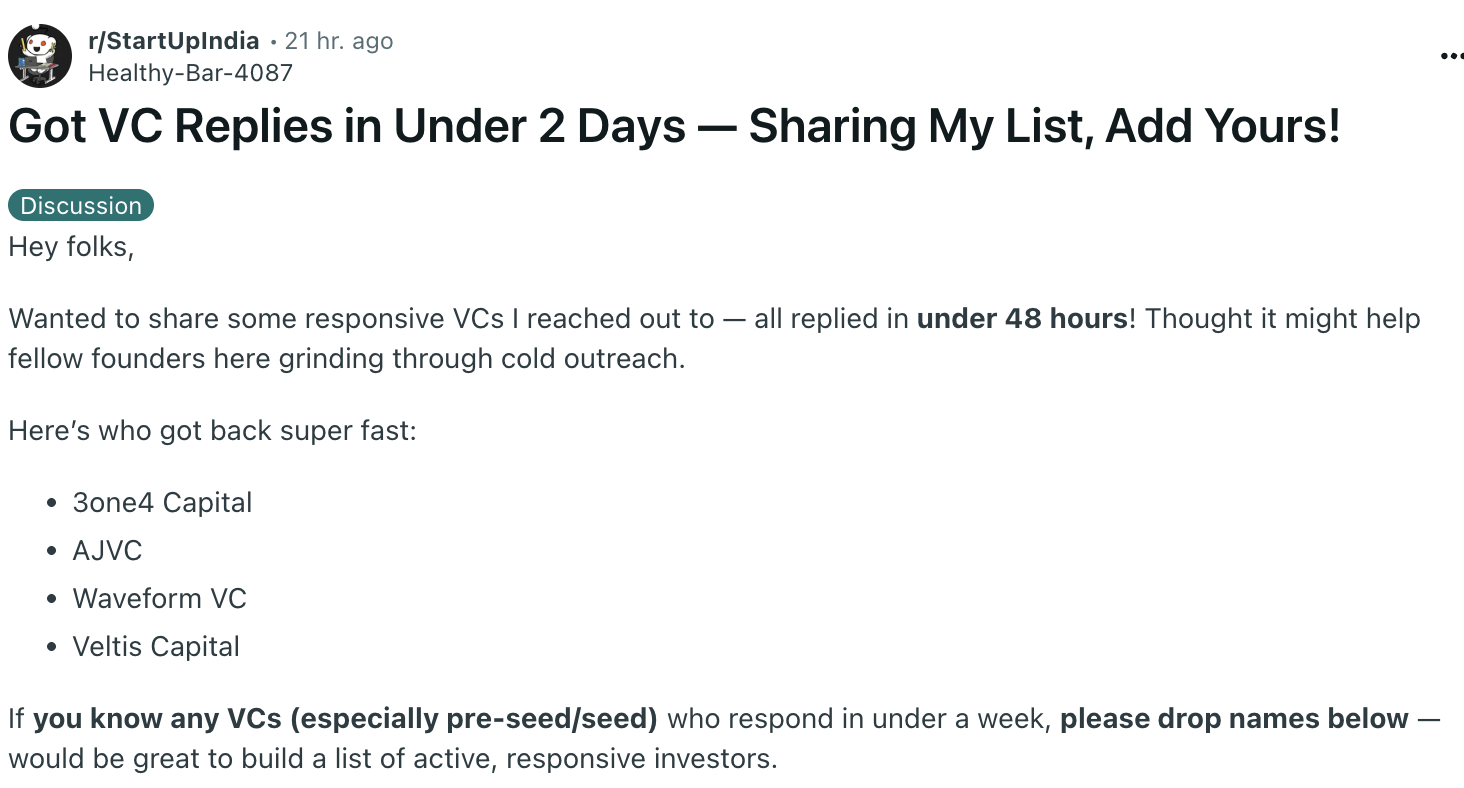

Hey folks apply to these VCs for instant replies. 3one4 Capital - https://3one4capital.typeform.com/to/fsVovi AJVC - https://ajuniorvc.typeform.com/phase1 Waveform VC - email here hello@waveform.vc Veltis Capital - https://veltiscapital.com/contact/

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)