Back

Anonymous 1

Hey I am on Medial • 1y

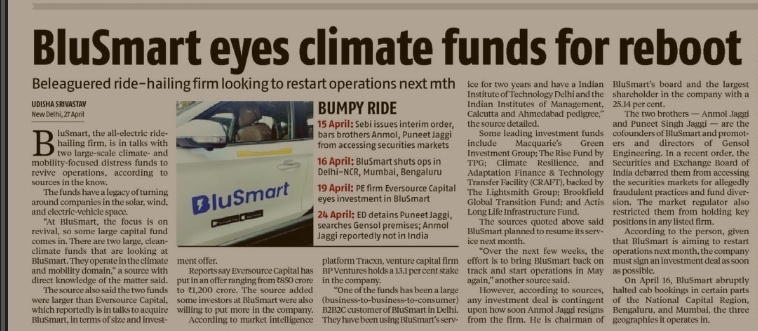

Classic blitzscaling strategy. Burn cash, grow fast, worry about profits later. Worked for Uber, but not every startup can pull this off.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 27d

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

Account Deleted

Hey I am on Medial • 8m

No Investors. No Burn. Just Purpose. We know investors won’t fund us — and that’s okay. Why? Because we’re not trying to become a unicorn by burning cash. At Delfo, we're not building for hype. We're building for underrated local restaurants and ha

See More

Samrat Kesharwani

19 | Founder & CEO @... • 1y

imp things - As a founder, don't play into others'expectations, which game you think would be right and best...... for example don't set false examples on yourself ...... like if you're doing marketing and the marketing campaign or graphic doesn't lo

See MoreKarnivesh

Simplifying finance.... • 28d

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)