Back

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 5m

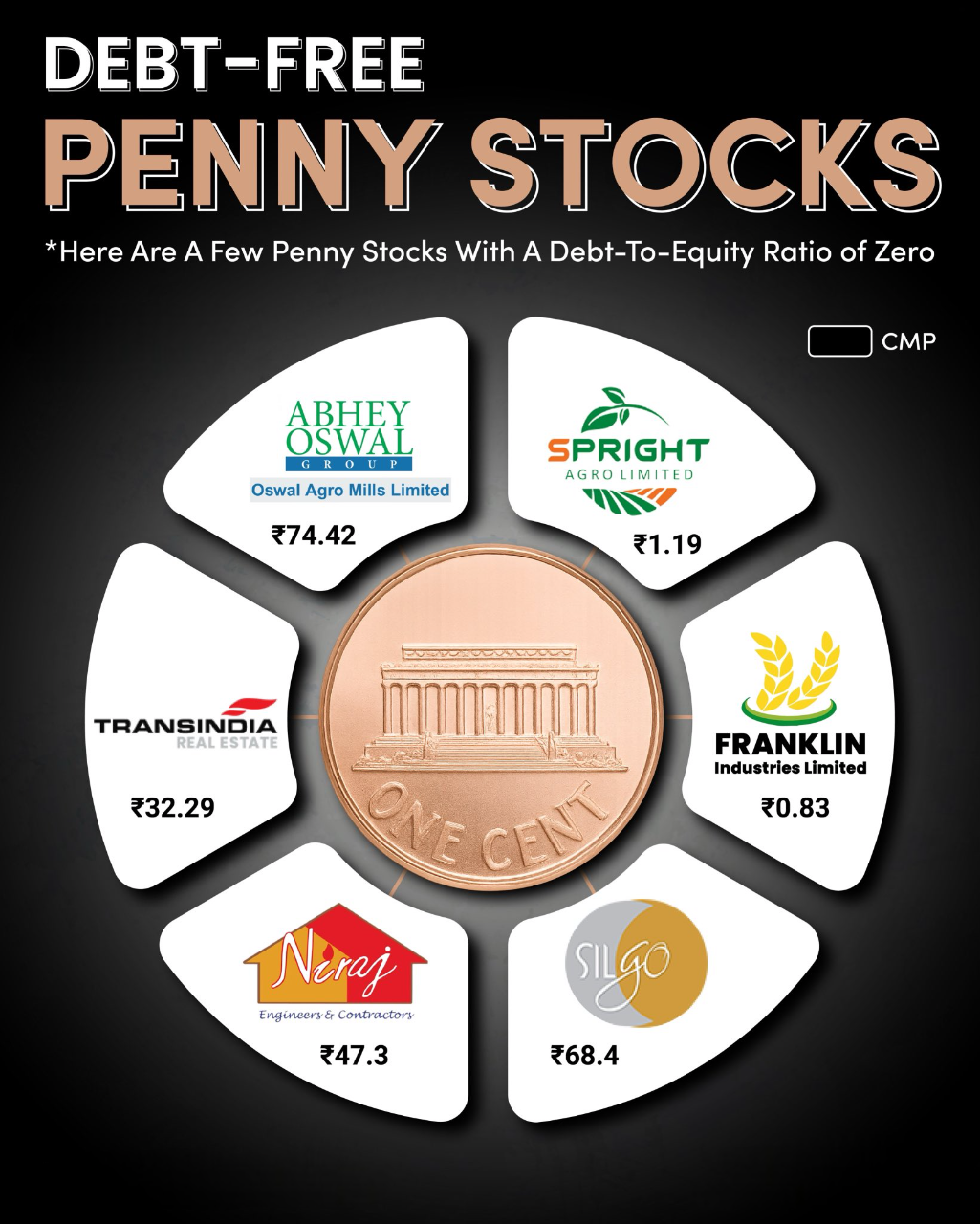

Debt-Free Penny Stocks to Watch in 2025 When it comes to penny stocks, financial health matters the most. One strong indicator is the Debt-to-Equity Ratio – and a zero debt ratio signals a company with no debt burden. Here are a few debt-free penn

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreRohan Saha

Founder - Burn Inves... • 7m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreVIJAY PANJWANI

Learning is a key to... • 5m

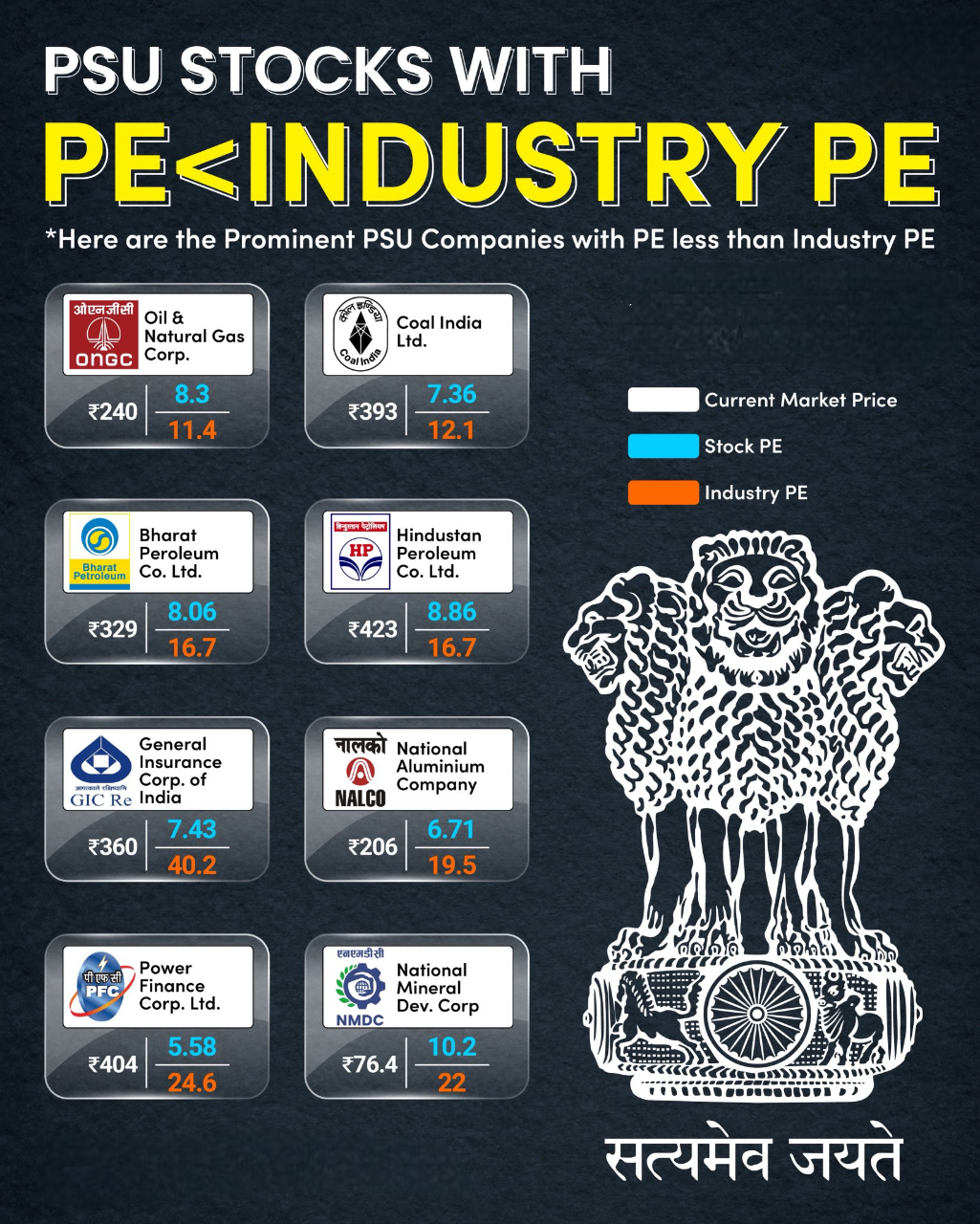

PSU Stocks with PE < Industry PE In the current market, valuation matters more than ever. One strong indicator is the Price-to-Earnings (PE) ratio. When a company’s PE is below the industry average, it can signal undervaluation and opportunity for i

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

VIJAY PANJWANI

Learning is a key to... • 1m

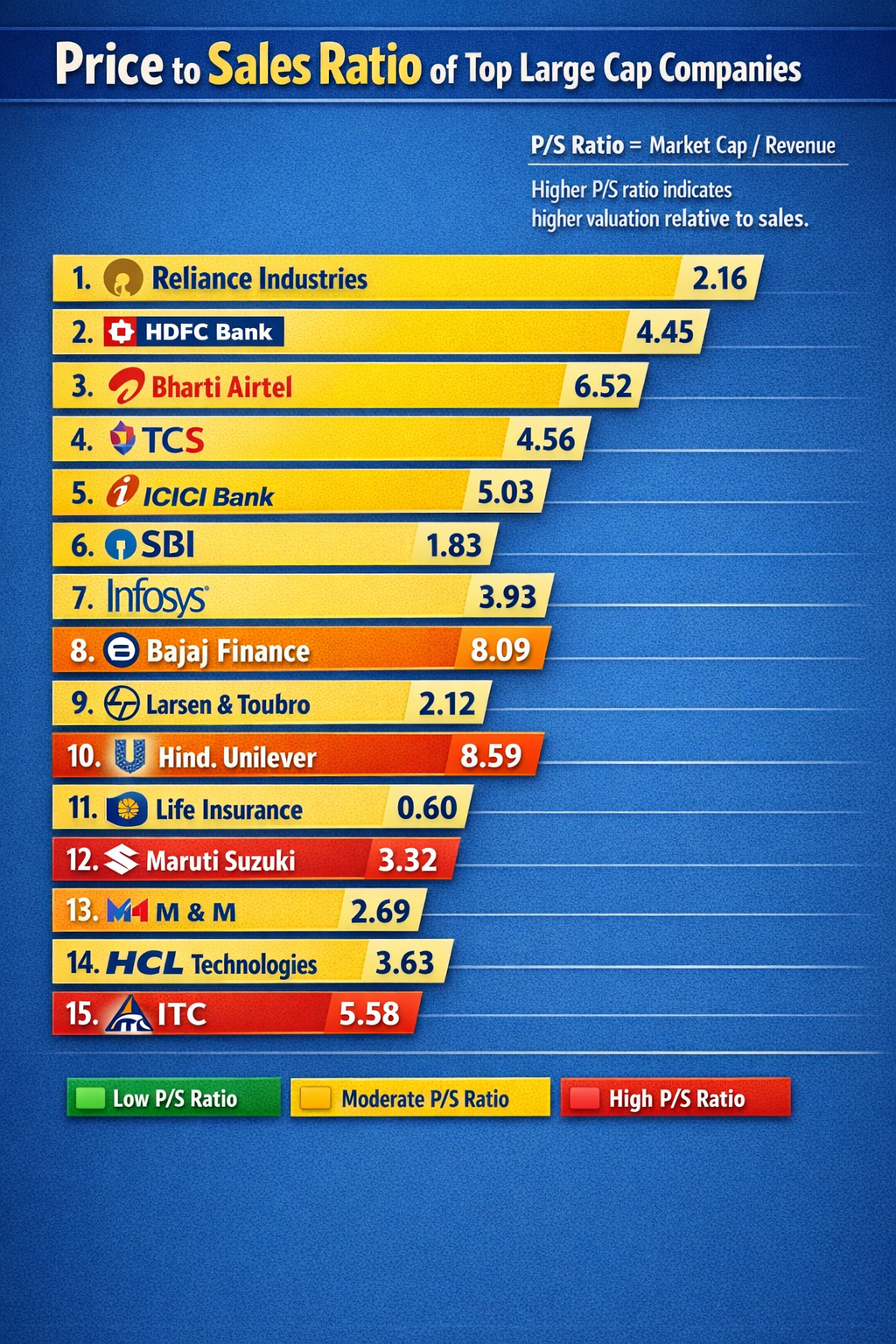

Price to Sales (P/S) Ratio of India’s Top Large-Cap Stocks 🇮🇳 Ever wondered which big companies are cheap vs expensive relative to their sales? That’s where P/S Ratio helps 👇 🔹 Low P/S → Potentially undervalued 🟡 Moderate P/S → Fairly valued �

See More

Rohan Saha

Founder - Burn Inves... • 8m

Right now, the condition of defence stocks in the market is such that people want to invest, but still they aren't doing it. I never imagined defence stocks would become this overvalued, the kind of PE expansion they've seen is unbelievable. The enti

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)