Back

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSuman solopreneur

Exploring peace of m... • 1y

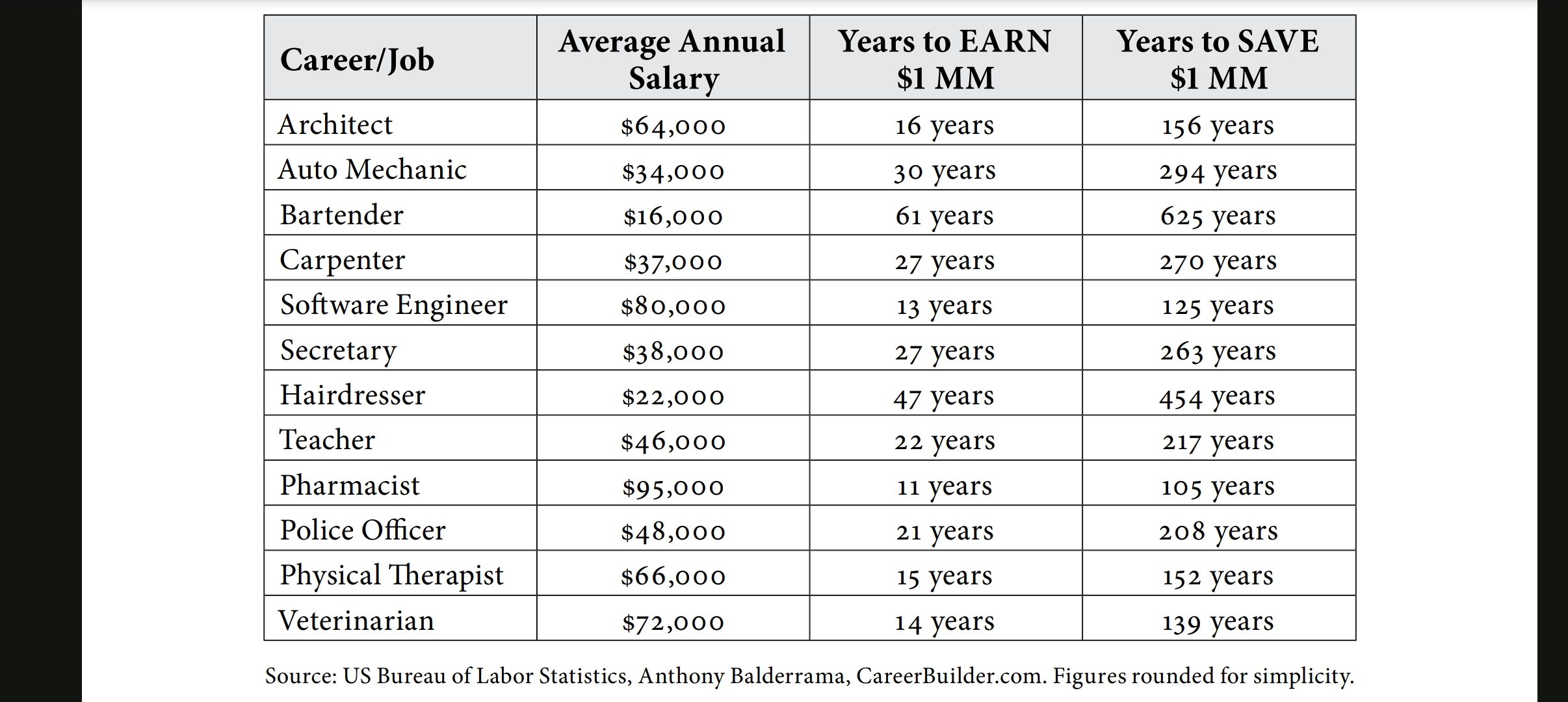

(millionaire fastlane) Jobs constrain learning, offer modest income growth, and exchange time for money, all of which reduce wealth. Workers are subject to office politics, pay high taxes, and have no influence over their income. Since there are so f

See More

Vamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

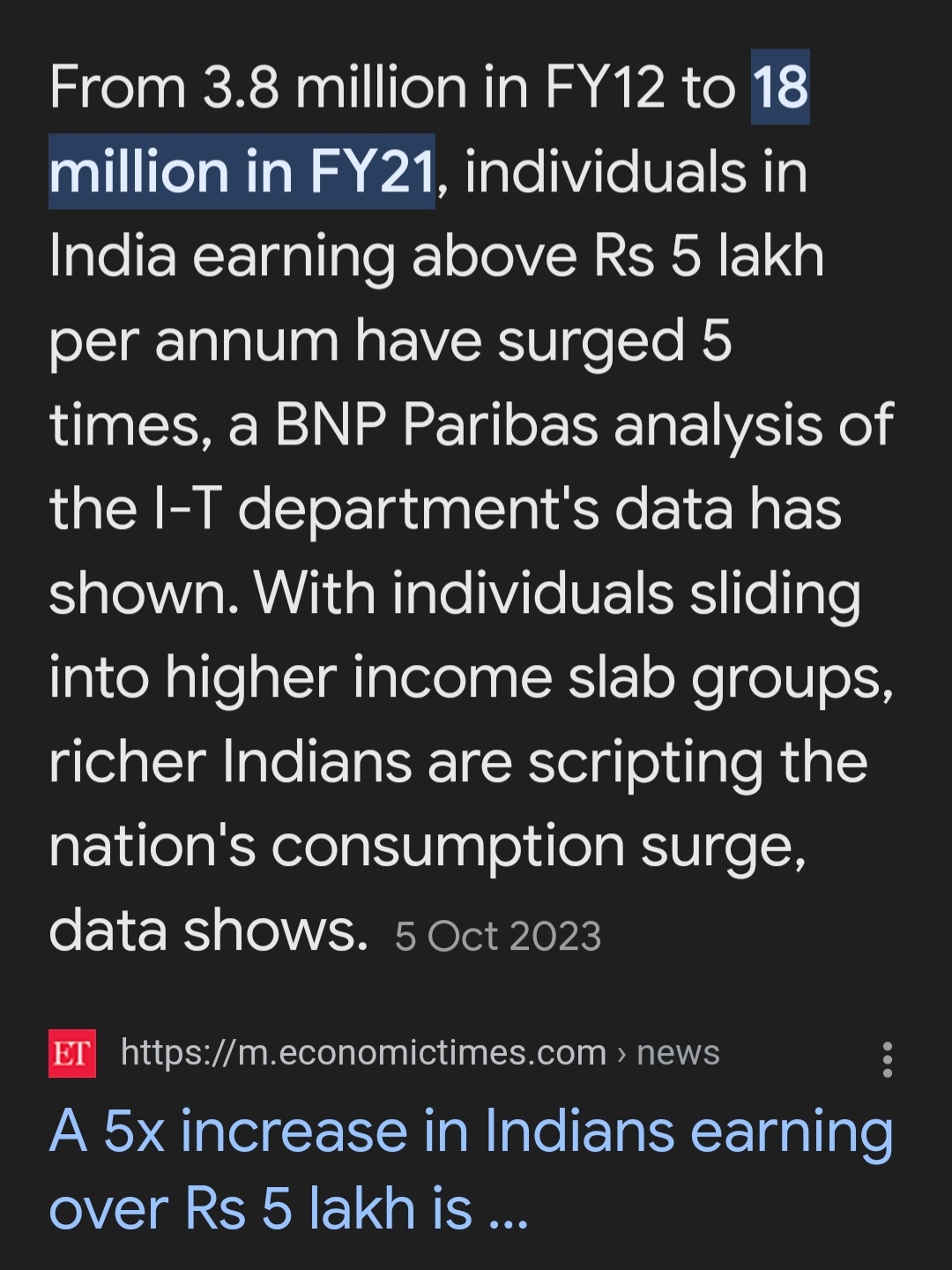

Havish Gupta

Figuring Out • 2y

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)