Back

Inactive

AprameyaAI • 1y

Sometimes, the best tax strategy is location, location, location. Monaco: Where the Rich Play and Taxes Stay Away → Third of the population is millionaire → The per capita GDP in Monaco is the highest in the world, → Reaching an all time high of 228667.94 USD in 2022 → Tiny country, massive wealth. Let's break it down: • Size: Smaller than Central Park. Population: 38,000+ • Location: French Riviera. Views: Priceless Why it's famous: 1. Monte Carlo Casino: James Bond's playground 2. F1 Grand Prix: Where streets become racetracks 3. Royal Family: Grace Kelly made it Hollywood-famous Why it's wealthy: 1. Zero personal income tax for residents 2. No capital gains tax 3. Low business taxes Tax system in a nutshell: → Residents: Keep what you earn → Businesses: 33% tax, but lots of loopholes and casinos are just big bangz → Tourists: Indirectly fundz (hotels, casinos) The catch? Not everyone gets in. Strict residency rules. Follow for more Medial Exclusive Things

Replies (8)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreHavish Gupta

Figuring Out • 2y

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Aakash kashyap

Building JalSeva and... • 1y

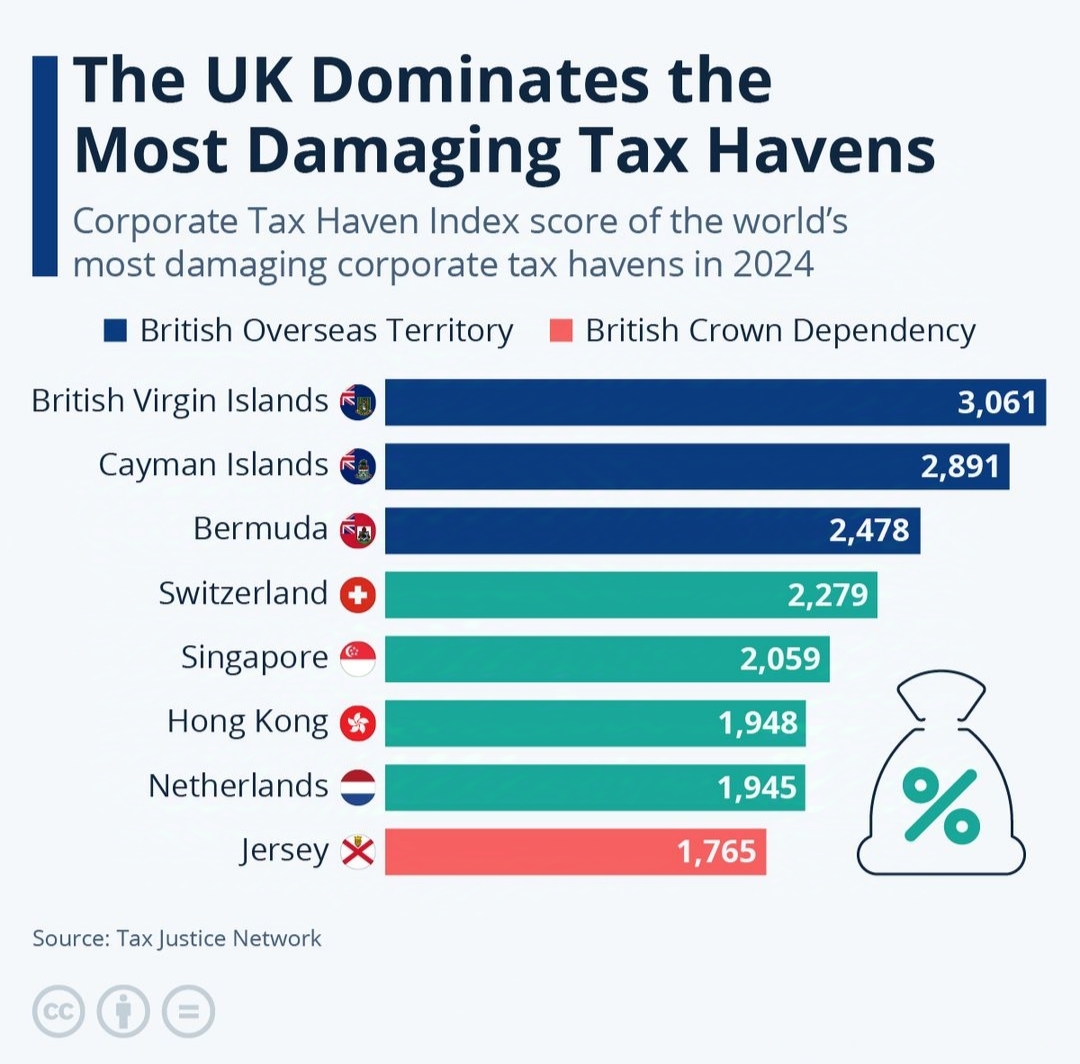

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)