Back

Hiral Jain

CA inter • 1y

Okay! Gst matlab woh tax joh common people and business people pay karte hai Upon purchase of some good or service( look at any product that you consume today you will find inclusive with Gst etc, this means ki agar aap 5₹ ka lays packet purchase karte Ho aur uske upar agar yey likhi hui hai then it means aapke 5₹ mey he tax included jo ki gov ko jayega,

More like this

Recommendations from Medial

Deepak Kumar

Founder @erizo.in • 6m

koi CA ya accountant ho toh mere ek sawal ka jawab dijiye maan lijiye amazon par kisi seller ka Rs.100 ka saman sale hota hai aur uski item ki MRP bhi 100 hai jisme 28% GST included hai, amazon sirf delivery fee aur platform fee le sakta hai, amazon

See MoreAditya Sahu

Big thinking always ... • 1y

idea validation 💡 jo loog daily gym jatte hai mere pass unke liye ek question hai ki abhi aap pre workout ka box 1200 to 1800 tak purchase karte hai jo Ek flavour me apko pura month use karna hota hai and Mai apko agar same chiz 20rs ke sachet me

See MoreAshutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreAditya Sahu

Big thinking always ... • 1y

I am a digital marketers... I have a idea for construction industry now in this ai trend we can make a software jo ki help karega engineers ki house ke dezine banane me bus apko apni land ka area dalna hai means. length and breadth and vo apko ka

See MoreSuman solopreneur

Exploring peace of m... • 7m

"Aap aksar kahan padhai/kaam karte hain?" "Akele kaam karte waqt sabse badi samasya (issue) kya hoti hai?" "Pichle hafte jab aap asamanya mehsoos kar rahe the, tab aapne kya kiya tha?" "Kya aapne kabhi socha hai ki kaash koi aapke saath kaam k

See MoreAditya Sahu

Big thinking always ... • 1y

kya koi founder Mera doubt clear kar dega kya pls ki suppose agar maine 100cr valuation pe 1 cr fund raise Kiya exchange of 1% equity tu mere company ka profit bhi mujhe iss investor ke sath share karna hoga kya ya Mai uss profit ko company ki growth

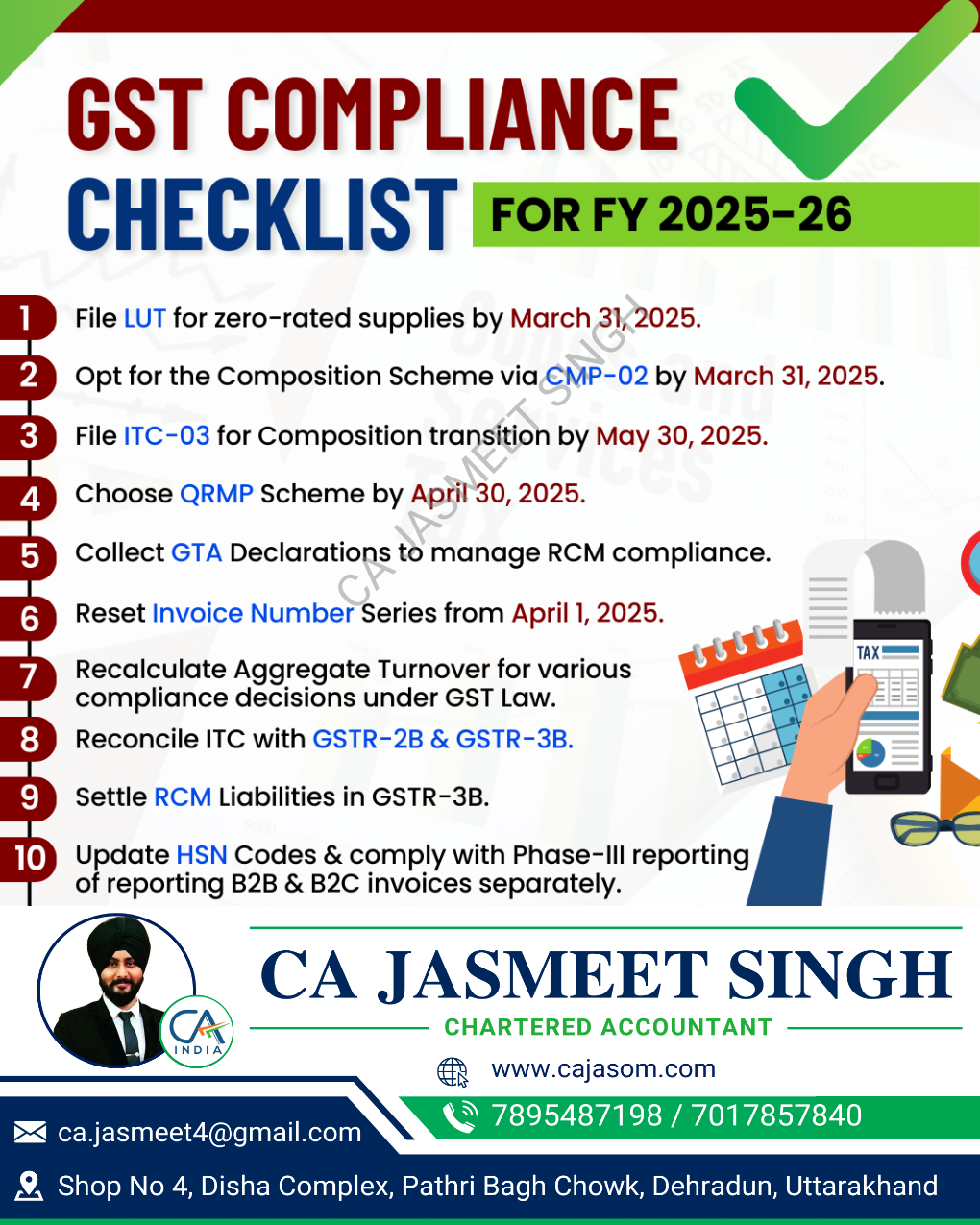

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)