Back

Karan Sahu

Founder • 1y

Yes, true, that's why I am saying no one knows other than what existing giants are offering. As much as about the point of making a platform around it, I think it's time to rethink the entire structure of fintech and social commerce in India. Fintech and social commerce combined can move mountains, as people are more likely to spend on trustable things. And yeah, the 'social' in social commerce provides that trust. Let's see how far my hypothesis can go. Thanks for the thoughtful reply.

More like this

Recommendations from Medial

Ashish Singh

Finding my self 😶�... • 11m

🚀Here are 10 Indian startups likely to have received the highest funding in March 2025, based on Q1 2025 trends: 1. Impetus Technologies - $350M (Enterprise Solutions) 2. Innovaccer - $275M (Health Tech) 3. Zolve - $251M (FinTech) 4. Zepto -

See More

Yash Barnwal

Gareeb Investor • 1y

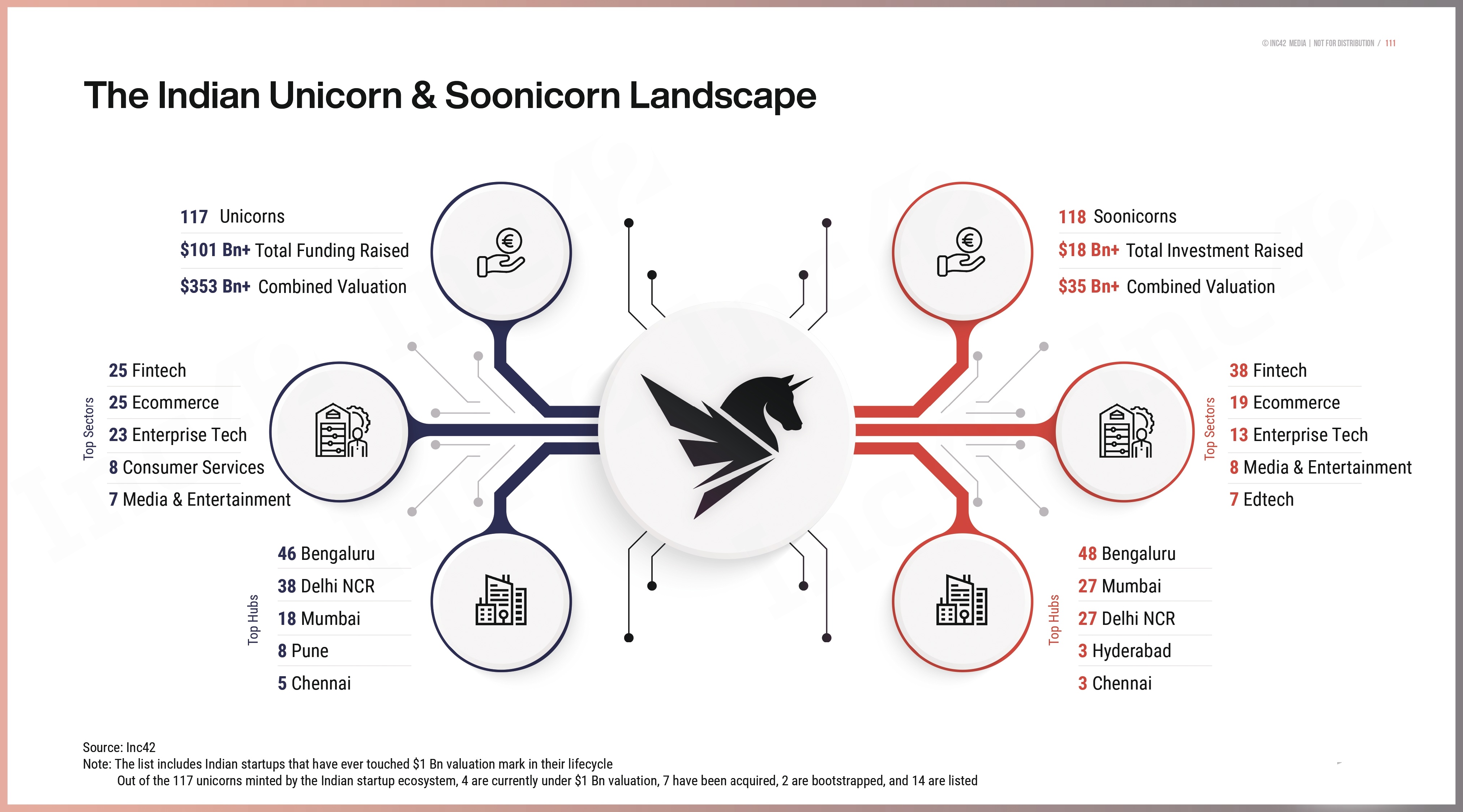

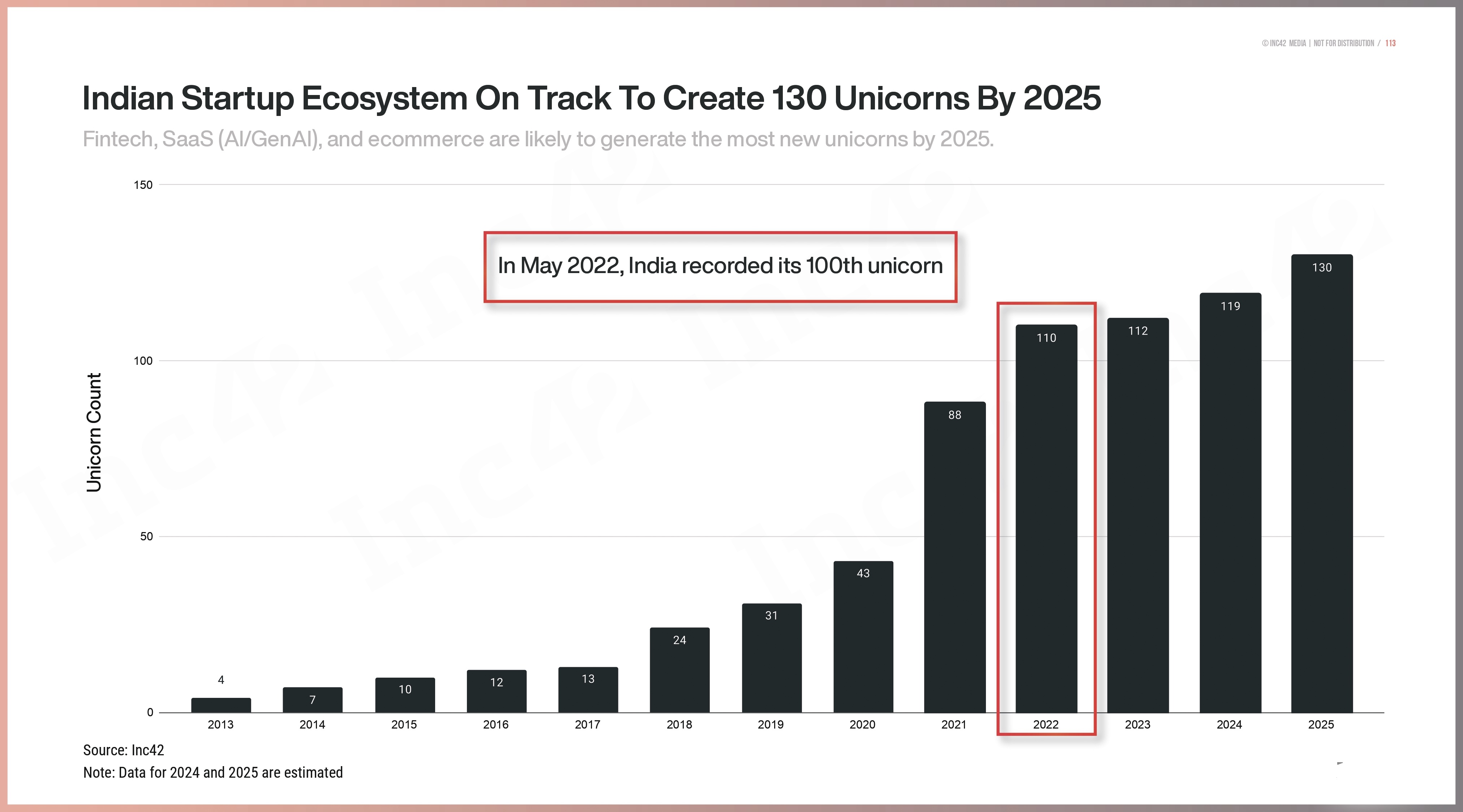

The Indian startup ecosystem is thriving with 117 unicorns and 118 soonicorns as of 2023. Unicorns have raised over $101 billion in funding with a combined valuation of $353 billion, while soonicorns have raised $18 billion with a $35 billion valuati

See More

Ashish Singh

Finding my self 😶�... • 1y

In 2025, the sectors expected to see the most startup IPOs include: 1. Fintech: Leading with six companies, including Aye Finance and Pine Labs. 2. Quick Commerce: Significant growth anticipated, with major players likely to list. 3. Edtech: Co

See MoreNiket Raj Dwivedi

•

Medial • 1y

India’s Unicorns and their valuations, a detailed list on Medial- 2024 1. Krutrim - AI: $1 billion 2. Ather Energy - Electric Vehicles: $1.4 billion 3. Perfios - FinTech (SaaS): $1.2 billion 4. Rapido - Ride-Hailing: $1.1 billion 5. Moneyview - Fi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)