Back

Ashish Singh

Finding my self 😶�... • 1y

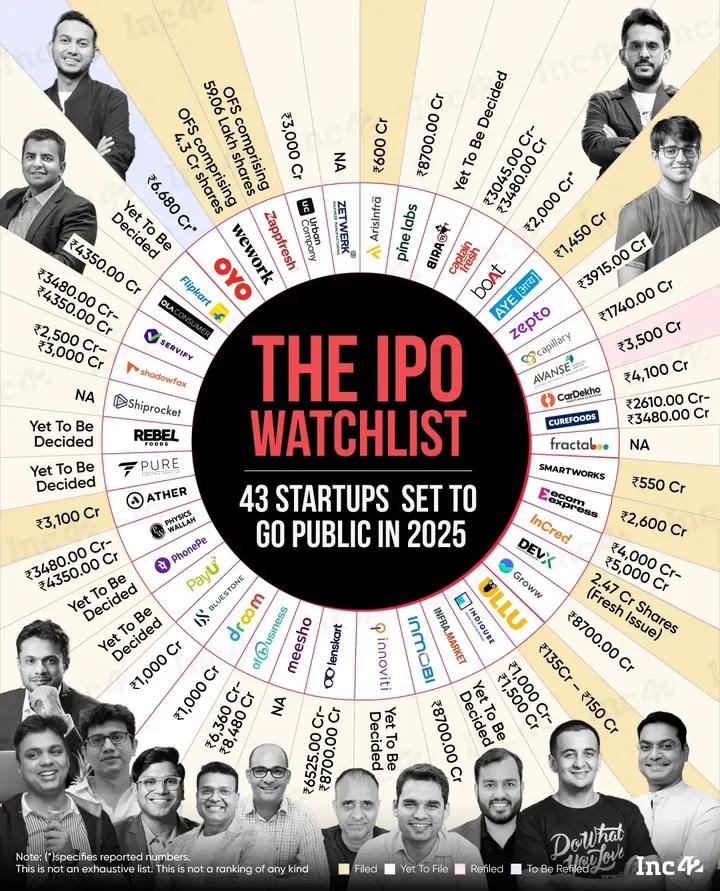

In 2025, the sectors expected to see the most startup IPOs include: 1. Fintech: Leading with six companies, including Aye Finance and Pine Labs. 2. Quick Commerce: Significant growth anticipated, with major players likely to list. 3. Edtech: Companies like PhysicsWallah are expected to go public. 4. Logistics: This sector is also poised for notable IPO activity. 5. Deep Tech and Clean Tech: Emerging as key areas for investment alongside traditional sectors like healthcare and infrastructure

More like this

Recommendations from Medial

Ashish Singh

Finding my self 😶�... • 1y

In 2025, several companies are expected to launch significant IPOs, potentially breaking records in the Indian market. Key players include: -- Reliance Jio: Valued over $100 billion, anticipated to be India's largest IPO. -- Flipkart: Expected to

See More

Account Deleted

Hey I am on Medial • 1y

India's IPO Boom: 43 Startups Set to Go Public in 2025! Spanning sectors from fintech to e-commerce, these anticipated listings could reshape the stock market and unlock new investment opportunities. From Zepto to Boat, here’s a look at the most

See More

ProgrammerKR

Founder & CEO of Pro... • 11m

India’s startup engine is revving up again! BlueStone and Aye Finance just got SEBI's nod for their IPOs. From handcrafted jewelry to fintech, Indian companies are stepping onto the public stage with confidence. #IPO #StartupIndia #Fintech #JewelryB

See MoreFarhan Raza

Founder And CEO Give... • 1y

2025: The Year Indian Startups Redefine the IPO Landscape The Indian startup ecosystem is poised for a groundbreaking year, with an unprecedented surge in IPOs expected to almost double the numbers from 2023. This momentum is a testament to the grow

See More

Business Digital Twenty Four

Innovation | Insight... • 10m

India’s startup ecosystem is making global headlines in 2025, firmly establishing itself as a powerhouse of innovation, investment, and entrepreneurship. With record-breaking funding, a surge in IPOs and M&A activity, and rapid advances in technology

See More

Ashish Singh

Finding my self 😶�... • 11m

🚀Here are 10 Indian startups likely to have received the highest funding in March 2025, based on Q1 2025 trends: 1. Impetus Technologies - $350M (Enterprise Solutions) 2. Innovaccer - $275M (Health Tech) 3. Zolve - $251M (FinTech) 4. Zepto -

See More

Ashish Singh

Finding my self 😶�... • 1y

🤯Lenskart is planning to go public by the end of 2025, targeting a valuation of $7-8 billion. The company aims to raise $750 million to $1 billion through its IPO. Despite reporting a minor loss of ₹10 crore on revenues of ₹5,427 crore in FY24, Lens

See More

VIJAY PANJWANI

Learning is a key to... • 1m

About 200 Companies are either Approved or in the Pipeline for the IPO✨ ✅ About ₹2.5 Lakh Crore Potential Fundraise! ✅ Here are some Awaited Big Sized IPOs for 2026: 👉 Reliance Jio IPO - Expected by to be India's Biggest Ever IPO (₹40,000 Cr+)

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)