Back

More like this

Recommendations from Medial

Srinivas Sivaratri

Specialisation is fo... • 1y

My story: Last year in the month of September May I have been to Bombay to give biometric verification of passport. After giving my biometric verification, I had a sweet 4 days gap for the actual visa interview, in this gap I have been to many place

See MoreGyana Ranjan Dash

•

Gameberry Labs • 1y

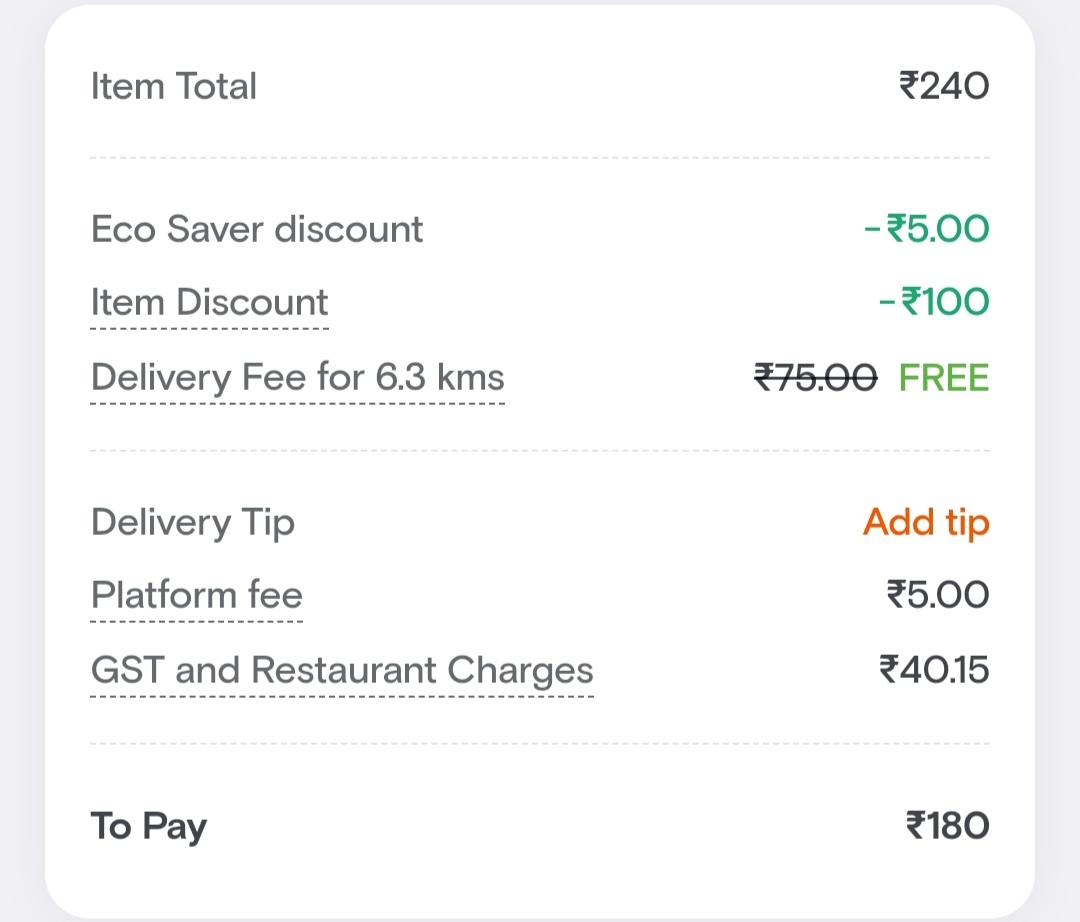

Yo, I'm a bit confused about something. I'm ordering a packaged food item, and the MRP (Maximum Retail Price) is supposed to include all taxes, right? But why is Swiggy charging me GST (Goods and Services Tax) on top of that? There's also a platform

See More

Hunny Soni Official

Hey I am on Medial • 11m

Buisness Idea #1 Something that my lost item can track or help me to find it. Example- I buy any item of packaging food,clothes Electronic item etc and I forgot it somewhere by putting it and I lost it or someone snacth it and runaway so We can tra

See MoreKanheiya Bansal

Hey I am on Medial • 1y

when a buyer goes to a shop but doesn't make a purchase, they might feel hesitant to visit that shop again in the future. I am thinking about creating an app where if a buyer needs an item, they can post it along with a photo or post a message.

See Morevivek kugasiya

business enthusiasts • 1y

I want to make srikhand company in diffrent flavour like kesar and fruit are top selling some company like amul use cheap item and sugar syrup to less price of sweet but they not get true flavour Shrikhand is a traditional Indian dessert made f

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)