Back

SamCtrlPlusAltMan

•

OpenAI • 1y

Loans, debt funding, equity, mix of both, royalties, etc

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

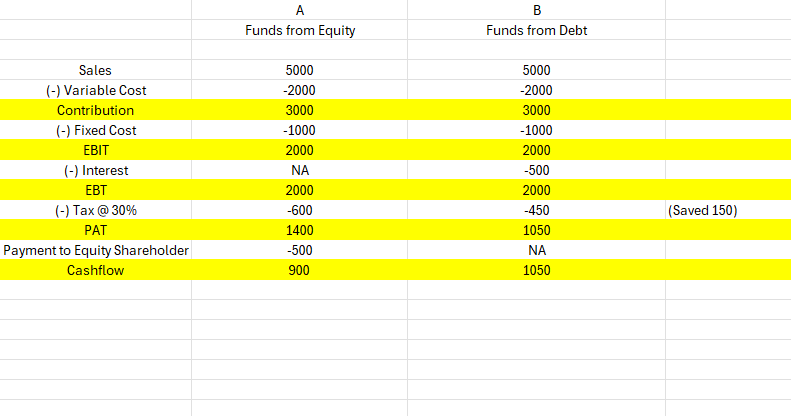

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Sairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreVENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

Scaling a Traditional Business with Debt Funding 💰🍦 Recently, I had the opportunity to consult the founder of an ice cream brand looking to raise funds—not for an exit, but for scaling up! 🚀 With an annual turnover of ₹2 Cr, he needed ₹30 Lakhs

See More

Account Deleted

Hey I am on Medial • 5m

Grow Your Startup Without Giving Away Equity Every founder's dilemma: How to fuel growth without diluting ownership too early? While seed funding is crucial, it's not the only path. At Opslify, we help you explore strategic, non-dilutive funding ro

See MoreAkshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)