Back

Soumyadip Dey

Hesitation is Defeat... • 1y

It has both good and bad sides. Everyone knows about how easy it becomes to file tax with GST than previous tax processes. But more importantly, for a consumption surplus state it's a blessing and for a production surplus state it's a curse.

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreShubham Patel

•

E-Cell, IIT Bombay • 1y

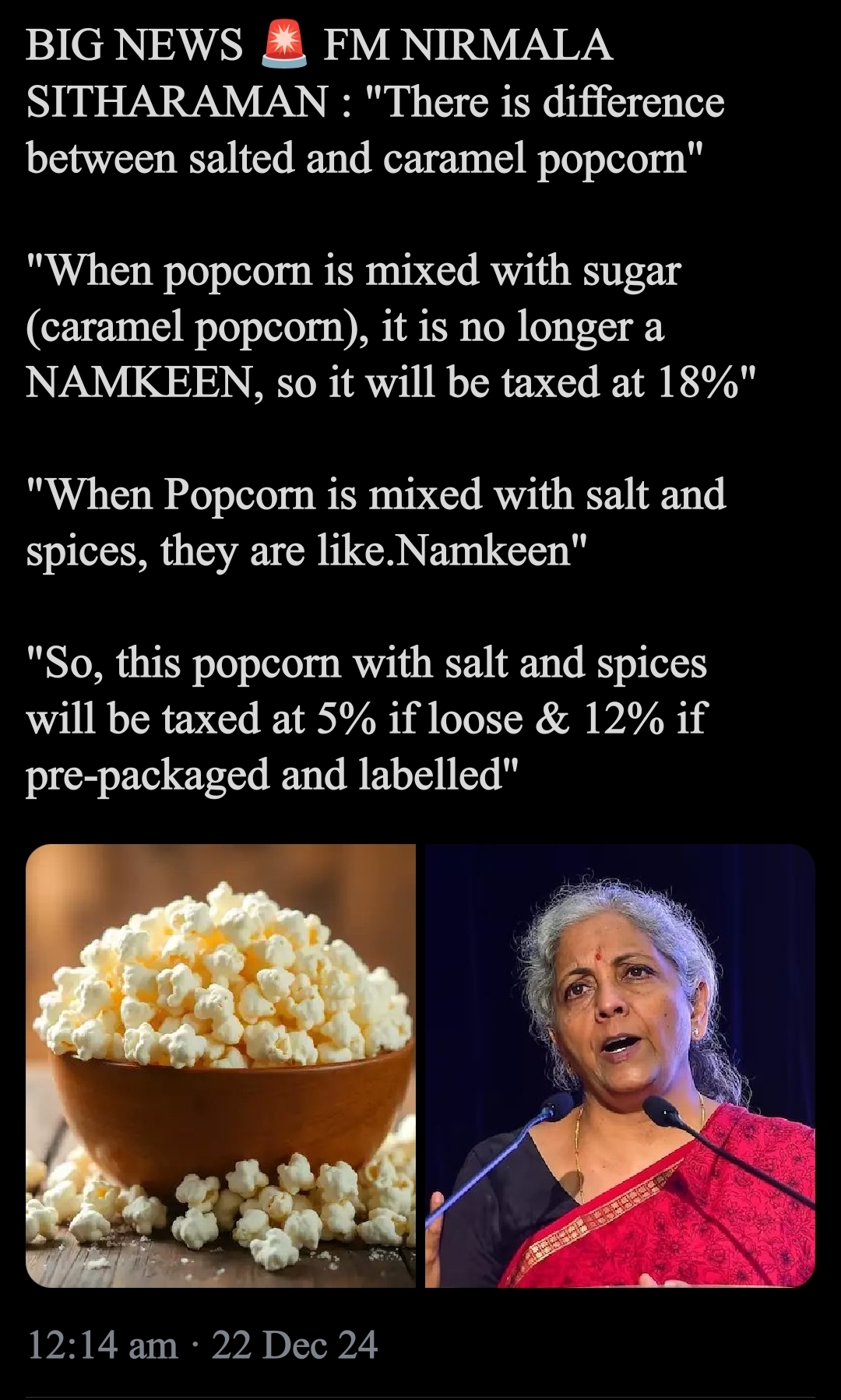

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representative

See More

Poosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)