Back

More like this

Recommendations from Medial

Reyansh Rathod

Entrepreneur • 11m

Friends, have you ever thought that paying tax is our responsibility, but why does it seem like a deep trap? India's tax system is so complicated that the common man gets confused! On one hand, the changing rules of GST, on the other hand, the high r

See MoreBhavya luthra

obsessed with why an... • 1y

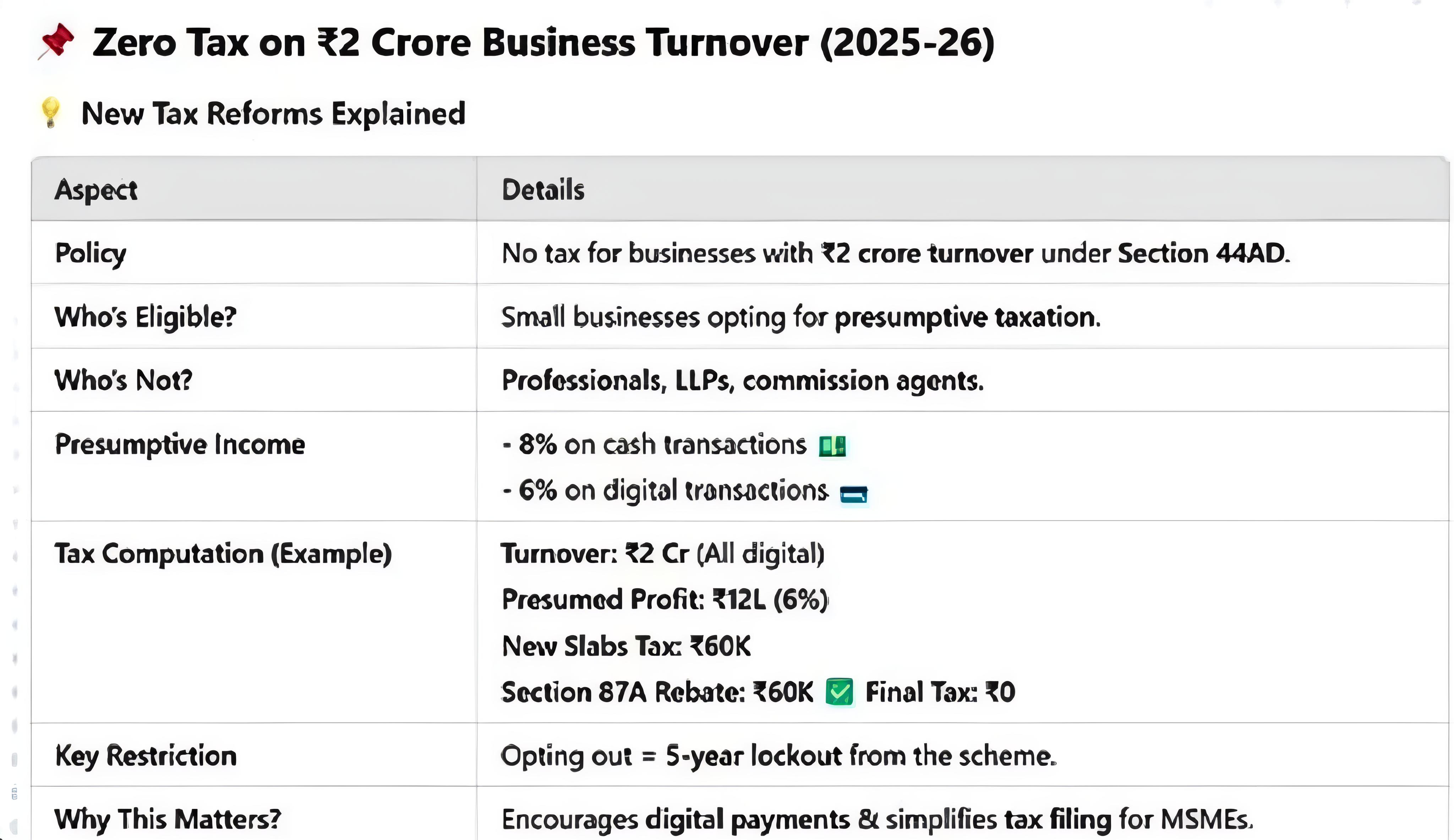

Budget 2025 – A Win for the Middle Class, But What About Businesses? 🤔 Here's what caught my eye: ✅ More spending power for consumers – Zero tax up to ₹12 lakh means a cash boost for the middle class. Great for businesses targeting this segment! �

See MorePriyesh Pansari

Business and Managem... • 1y

I’m thrilled to share an exciting initiative to simplify India’s complex tax system through AI-powered automation. Our platform aims to process bank statements, classify transactions, and generate tax-ready reports while ensuring compliance with regu

See MoreDownload the medial app to read full posts, comements and news.