Back

Anonymous 4

Hey I am on Medial • 1y

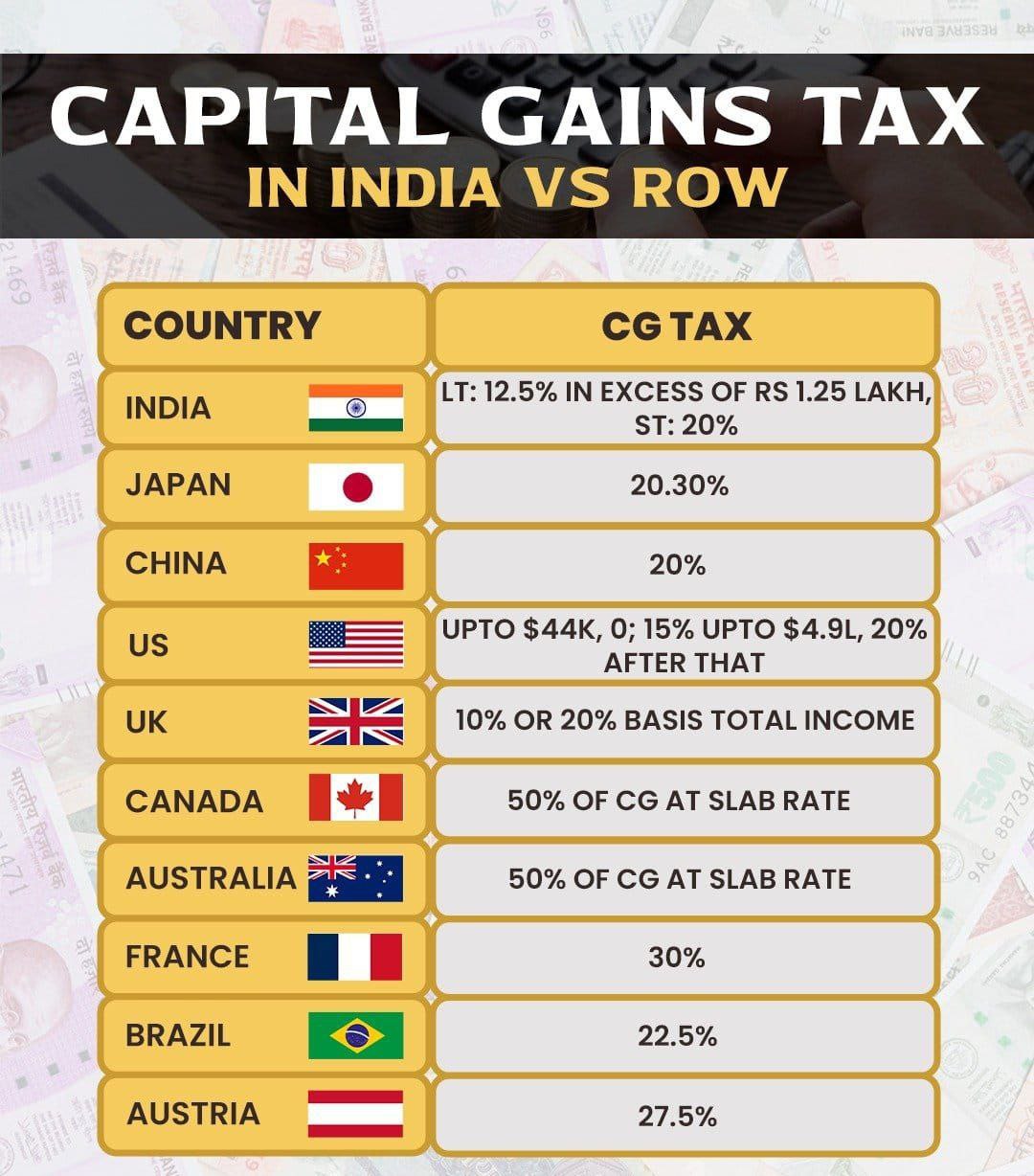

30% capital gains tax is absolutely unacceptable.

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 11m

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

CA Kakul Gupta

Chartered Accountant... • 11m

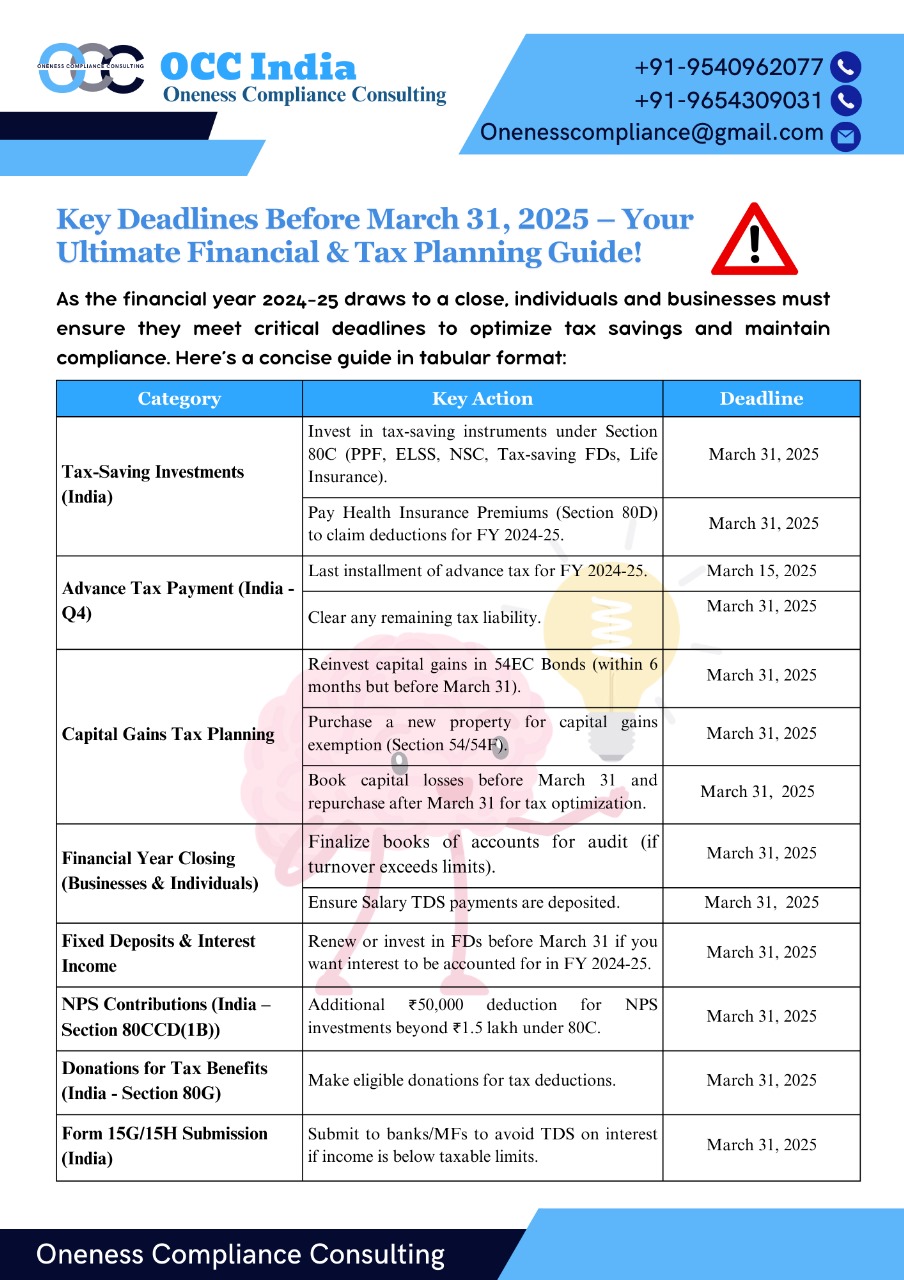

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)