Back

Anonymous 3

•

Uber • 2y

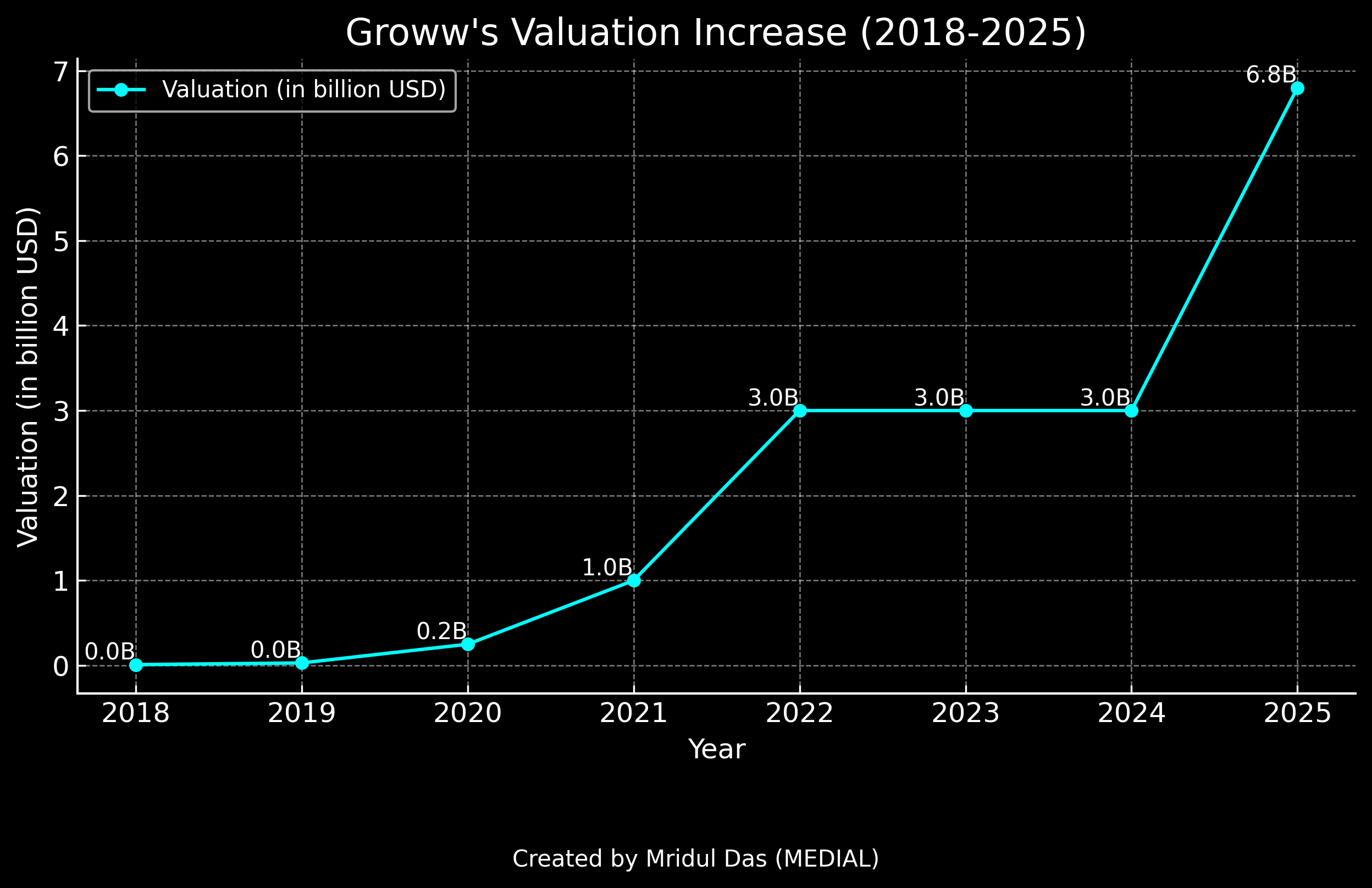

Lot of startups have been playing this valuation game while having no underlying business to support their valuations. Even investors just want an exit and intentionally bloat early stage valuations and exit the moment they can with a good return knowing very well that the company will tank eventually.

More like this

Recommendations from Medial

Vatan Pandey

Founder & CEO @Zyber... • 11m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Startup investing is glamourous, but not easy. And this may be the best example to explain. .. Trell was once one of the hottest and fastest growing startups around in India. And today, it's in really bad shape, hit by a dramatic loss of business

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

The next billionaire

Unfiltered and real ... • 1y

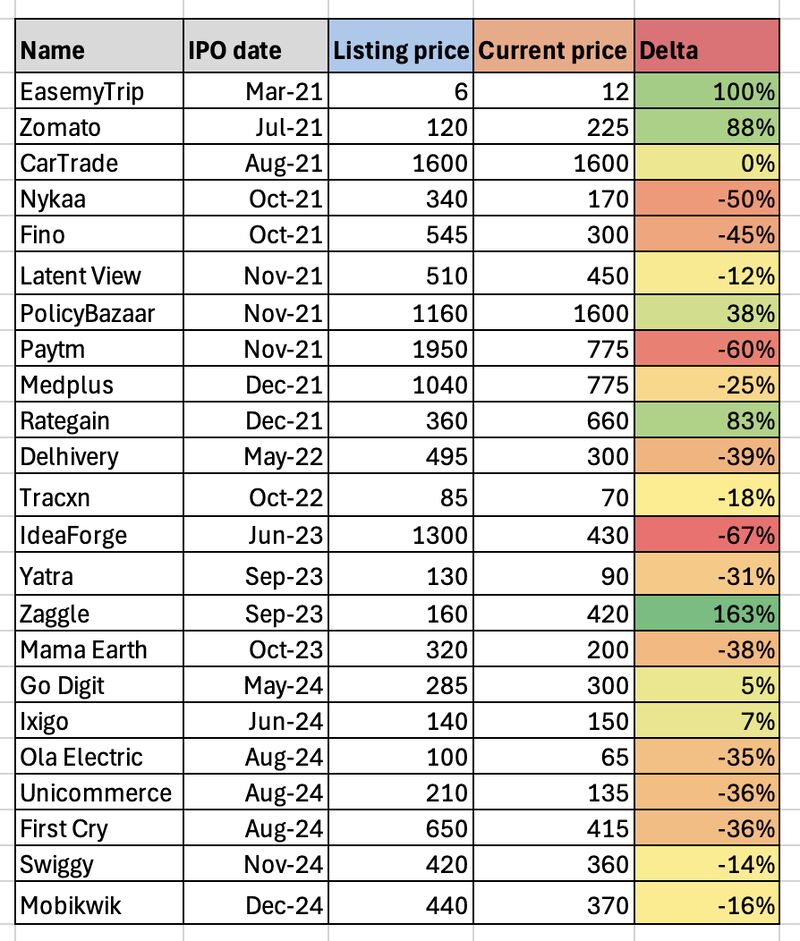

Are Startup IPOs Truly Creating Wealth—or Just Exit Liquidity for Founders and VCs? India has seen a wave of startup IPOs over the last three years - 23 companies went public, promising innovation, disruption, and wealth creation. But have they tru

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

Another Ed-tech Rollercoaster: Unacademy's $800M Journey Building a company from scratch, pouring years of sweat and passion into it, only to end up in a complex financial maze where success isn't as straightforward as it seems. Gaurav Munjal's Una

See More

Jayant Mundhra

•

Dexter Capital Advisors • 7m

I’ve been saying this for Lenskart & Peyush Bansal for 1.5+ years now: THEY ARE AN ANOMALY (in a super positive way)! And with founder Peyush Bansal’s latest move, that assertion only strengthens. What move? - The company is set to go for a Big Ban

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)