Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

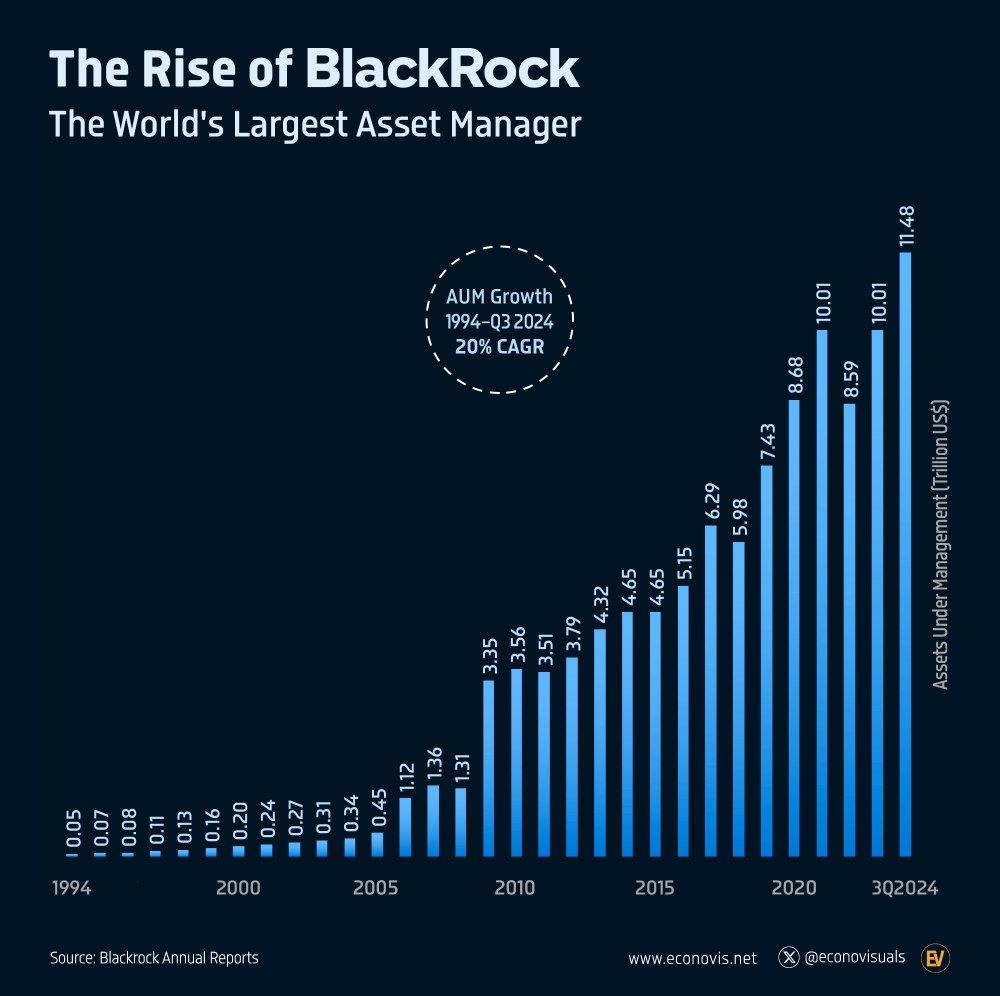

Wooh 🤯, This is interesting one ! • BlackRock Assets Value hits record value of $ 10.5 Trillion in Q1 2024 , 36% growth in Profits . • Now they are 1/3 the GDP of United States Of America and they are dominating Investing Markets followed by Van

See More

Rohan Saha

Founder - Burn Inves... • 8m

JIO AND BLACKROCK SEBI has given JIO BlackRock Advisors the green light to start their asset management business in India In the next few days they might launch three new debt funds in the market. But the big question is how long will BlackRock

See MoreAccount Deleted

Hey I am on Medial • 2y

Hello Everyone, What do you think? Can Jio Financial Services be a full competitor to Paytm’s lending business, Zerodha’s asset management business, and the financial management company with a partnership with BlackRock? Let me know your thoughts?

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Just like the way we go to our local kirana store for daily needs,we go to the stock market to shop for investments.Bombay Stock Exchange and National Stock Exchange are the two exchanges where you can buy or sell a stock via a registered intermediar

See MoreAccount Deleted

Hey I am on Medial • 1y

• Yesterday I already Said that There will be a Joint venture between Jio and BlackRock , Now it's confirm and official news . • This Joint Venture will be partnered at 50:50 Ownership and most focused on Stock Broking, Asset Management and I don't

See More

Saathvi SN

Attended Mangalore U... • 1y

Can someone give me the ideas of what are different softwares and their tools used in companies and why they are used like for Eg:- Softwares for data analyst, accounting and finance, operation management,HR, programming, developers, project manageme

See MoreAman Singh

Business Man and Ang... • 11m

Hii am preparing for IB &PE. I have immense knowledge in this sector. I have build so many models like CCA, DCF, Precedent Transactions etc... I'm finding a person with whom I can learn together and break in this Field. also side by side looking

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)