Back

Arcane

Hey, I'm on Medial • 1y

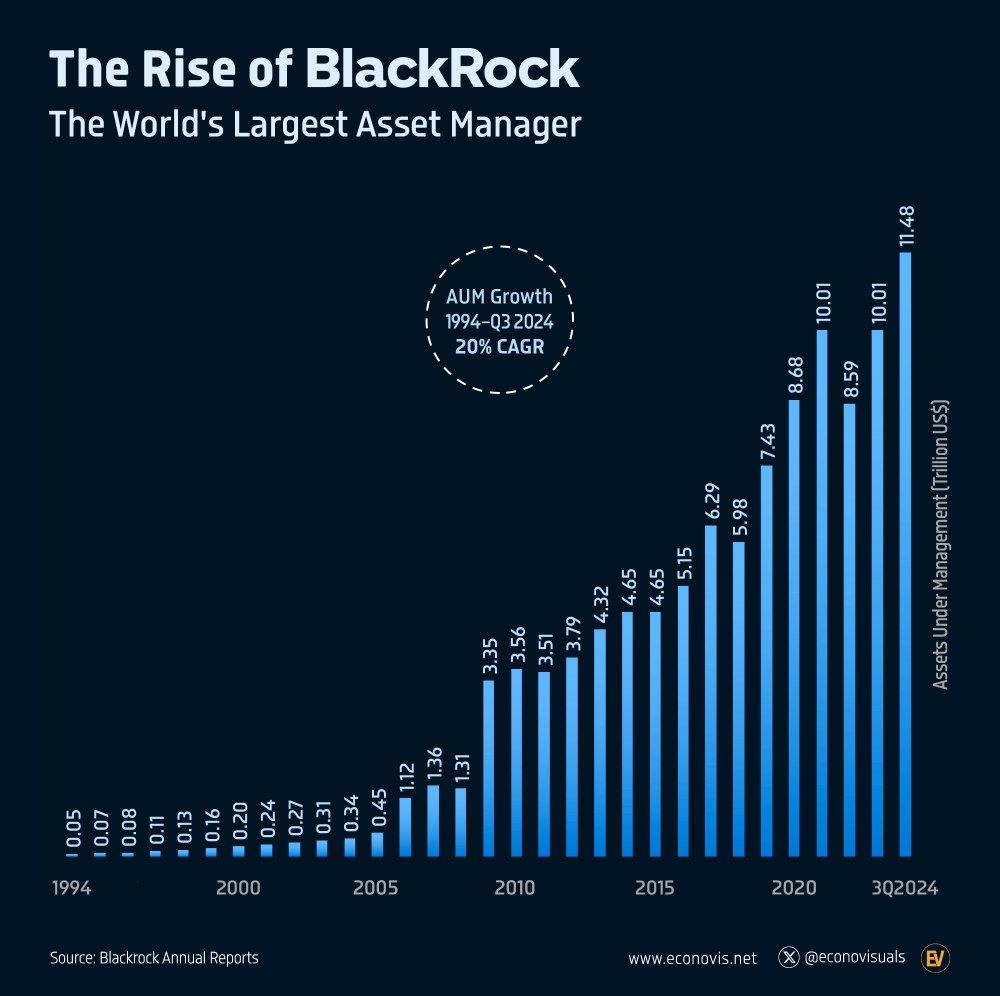

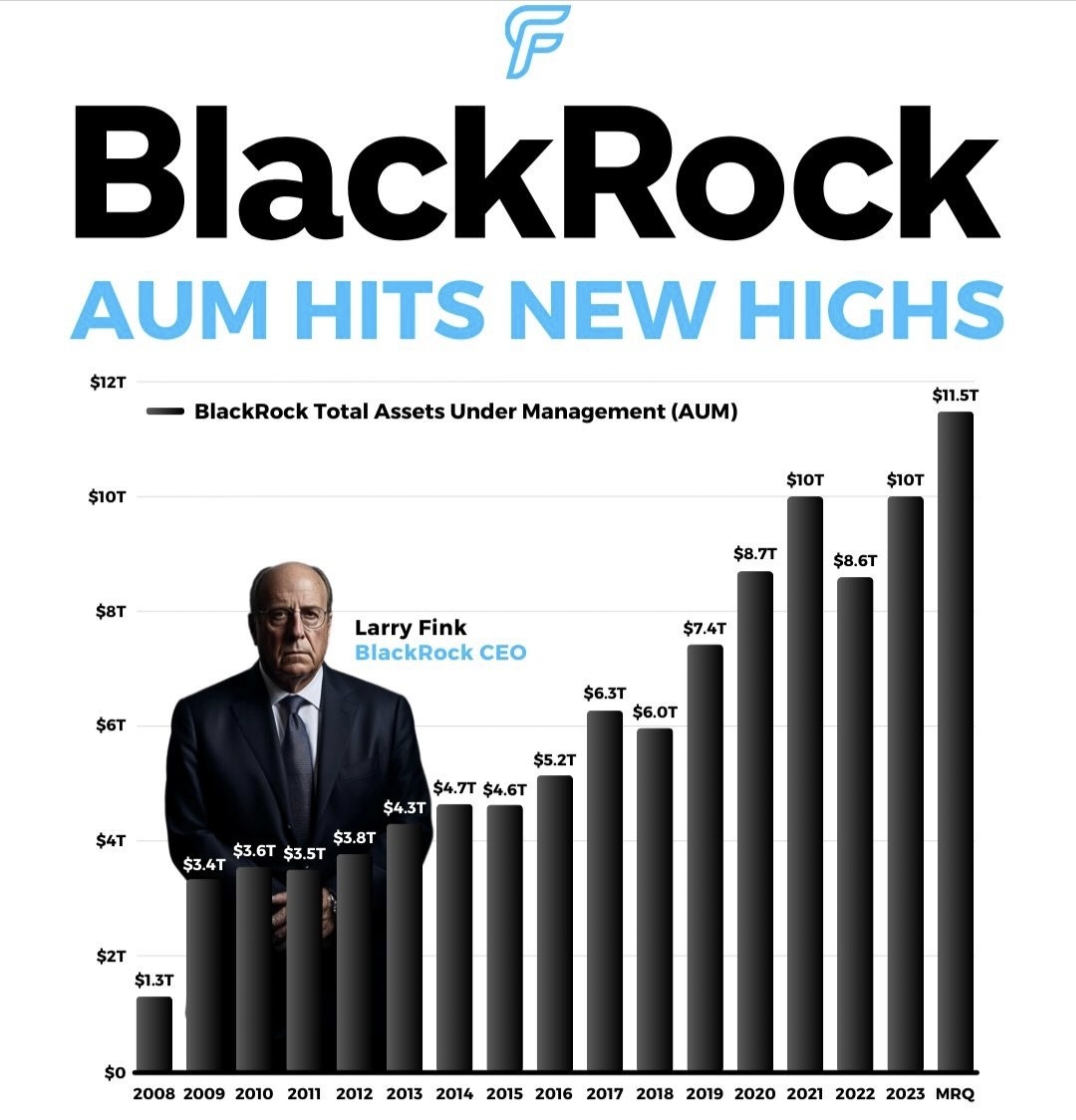

BLACKROCK'S RISE 1988: BlackRock was founded with a simple but powerful aim: to offer institutional clients asset management with a focus on advanced risk management. 1994: Within just six years, BlackRock had $53 billion in AUM. 1999: The company went public, expanding its offerings and positioned itself as a key player in the asset management industry. 2006: Here came the game changing move: BlackRock acquired Merrill Lynch Investment Managers (MLIM). Global reach expanded. AUM Doubled. This move made BlackRock the largest asset management firm worldwide. 2009: With the acquisition of Barclays Global Investors (BGI), BlackRock solidified its position in the ETF market, specifically due to the iShares ETF biz and evolved into a platform delivering innovative investment solutions. 2024: Today, BlackRock’s AUM stands at a massive $11,475 billion, a three decade journey with an impressive CAGR of 20% !!! FUN FACT: BlackRock holds significant stakes in major media companies, allowing it to influence narratives globally.

Replies (1)

More like this

Recommendations from Medial

Shrrinath Navghane

•

NexLabs • 4m

“We’re at the beginning of the tokenization of all assets.” - Larry Fink, CEO of BlackRock When the CEO of the world’s largest asset manager says this, it’s not speculation - it’s direction. BlackRock’s iBIT Bitcoin ETF just crossed $100B AUM, and

See MoreAccount Deleted

Hey I am on Medial • 2y

Hello Everyone, What do you think? Can Jio Financial Services be a full competitor to Paytm’s lending business, Zerodha’s asset management business, and the financial management company with a partnership with BlackRock? Let me know your thoughts?

See MoreRohan Saha

Founder - Burn Inves... • 8m

JIO AND BLACKROCK SEBI has given JIO BlackRock Advisors the green light to start their asset management business in India In the next few days they might launch three new debt funds in the market. But the big question is how long will BlackRock

See MoreJagan raj

Founder & CEO of Tec... • 1y

Why does no one talk about this man? this man Larry fink manages 11.6 trillion AUM as of the latest report the total assets held by all Federal Reserve banks were $6.832 trillion no matter who is the president of America who controls the money s

See More

BigLoot IN

BigLoot.in - Where S... • 1y

Navi has built a personal loan book size exceeding ₹10,439 crore and has an Asset Under Management (AUM) of ₹11,725 crore. The company charges interest rates as high as 45% on loans. For home loans, it's reported that they require full access to pers

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)