Back

Vishu Bheda

•

Medial • 1y

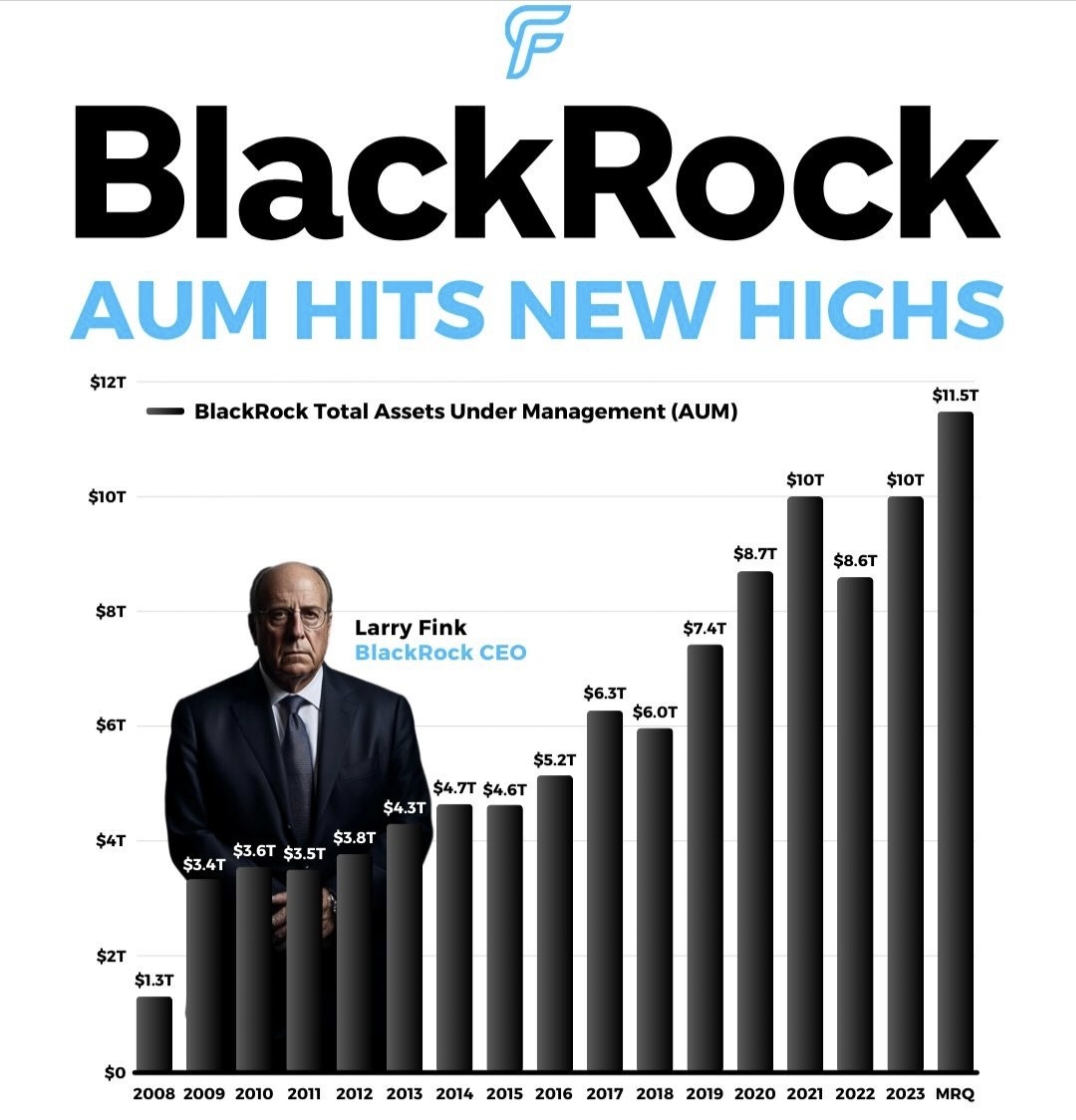

This is BlackRock. With over $11 trillion in assets, they have invested in Apple, Microsoft, Nvidia, Tesla, and even governments. Here's the story behind one of the wealthiest companies in the world—that no one's talking about: In 1988, Larry Fink turned a $90M failure into an opportunity by starting BlackRock with $5M and 8 co-founders. Competing against financial giants like JPMorgan and Goldman Sachs, Fink focused on something different: understanding risk better than anyone. This focus led to the creation of Aladdin (Asset, Liability, Debt, and Derivative Investment Network), a powerful system that could analyze risks, predict future scenarios, and handle complex investments far better and faster than others. BlackRock’s big break came when General Electric’s Kidder Peabody & Co. needed help managing complicated mortgage portfolios. While others took weeks, Aladdin delivered in hours. Then, in 1994, the bond market collapsed. Thanks to Aladdin’s ability to predict risks, BlackRock stood out while others panicked. What made Aladdin unique? It ran thousands of simulations to predict future scenarios. It analyzed risks in real-time across all types of investments. It showed how different markets were connected. Instead of keeping Aladdin to itself, BlackRock offered it to competitors. Today, over 200 institutions use Aladdin, which processes 200 million calculations weekly and oversees $21.6 trillion in assets. BlackRock gained even more trust in 2008 during the financial crisis, helping the U.S. government manage the portfolios of Freddie Mac, Fannie Mae, and AIG. In 2009, BlackRock acquired iShares, the world’s largest ETF provider, expanding its reach even further. Today, BlackRock manages over $10 trillion, making it the most influential financial firm in the world. Follow me for more bite-sized insights on business and innovation!

Replies (13)

More like this

Recommendations from Medial

Jagan raj

Founder & CEO of Tec... • 1y

Why does no one talk about this man? this man Larry fink manages 11.6 trillion AUM as of the latest report the total assets held by all Federal Reserve banks were $6.832 trillion no matter who is the president of America who controls the money s

See More

Aryan patil

Intern at YourStory ... • 1y

BlackRock dominance is wild : see where percent of your money ends up. BlackRock equity in MAANG- META : 7.16% AMAZON : 5.94% APPLE : 6.5% NETFLIX : 7.1% GOOGLE : 7% This means every 100 rupees paid towards this giants 6 to 7 rupees will end up in

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)