Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Let's discover potential of Quick - Commerce and what are challenges for Old E-commerce Giants like Amazon, Flipkart and DMart 💭 : • I think , the main reason behind the Quick Commerce is category creation and changing consumer behaviour and Consum

See More

Account Deleted

Hey I am on Medial • 1y

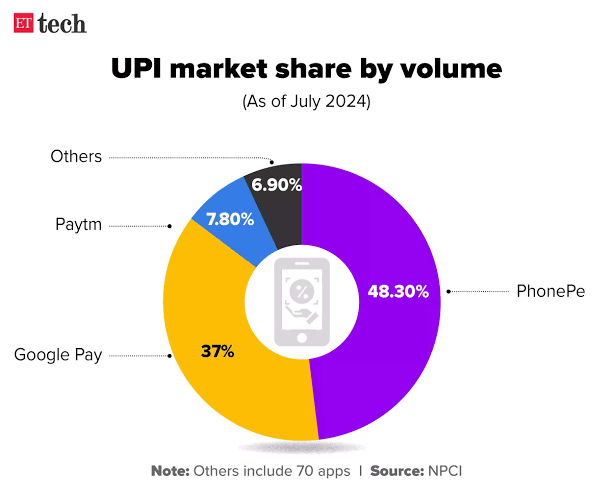

PhonePe IPO Is Coming! • PhonePe is planning an IPO to raise capital at a valuation of $8-10 billion. • In 2023, PhonePe raised $200 million from Walmart at a pre-money valuation of $12 billion. • PhonePe dominates the UPI payments business with a

See More

Only Buziness

Everything about Mar... • 1y

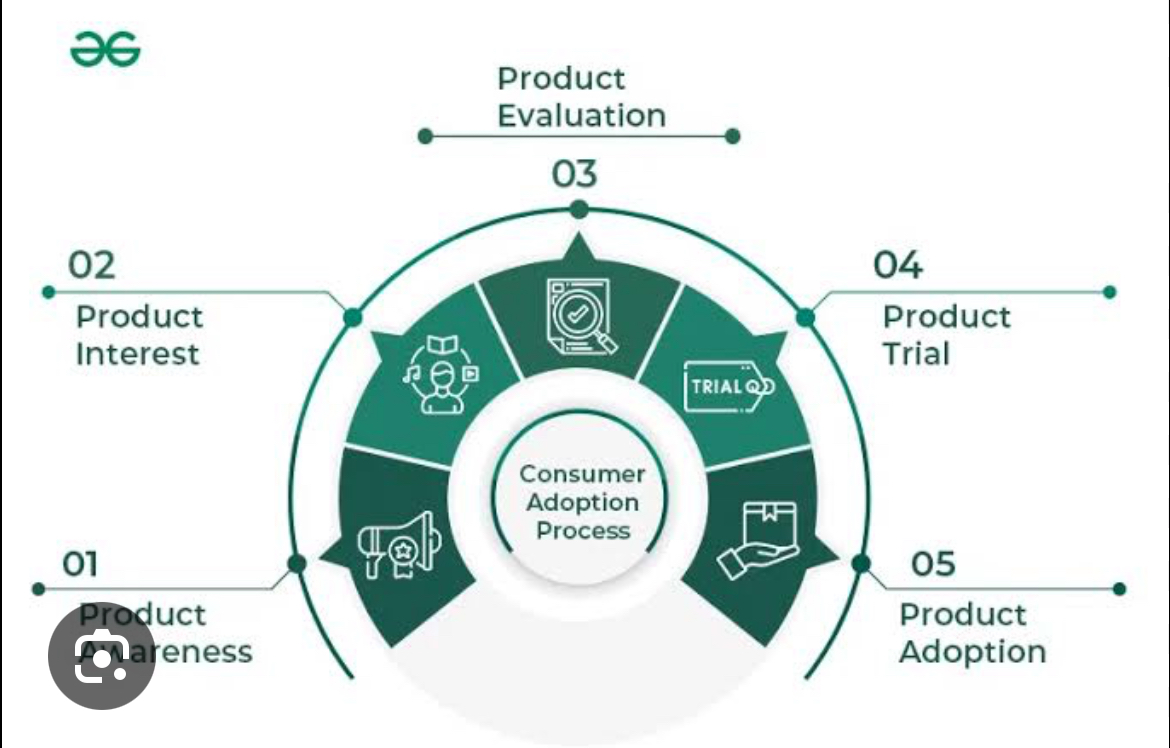

The Consumer Adoption Process The consumer adoption process involves five key stages: Awareness, Interest, Evaluation, Trial, and Adoption. 1. Awareness: Consumers first learn about the product. Example: Tesla created awareness for its EVs through

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreVinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: PhonePe – India's UPI Leader Founded in 2015, PhonePe dominates India's digital payments landscape. Stats: Users: 350M+ registered Market Share: 40%+ of UPI transactions Business Model: Transactions, financial services, advertising. R

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)