Back

Anonymous 5

•

Atlan • 2y

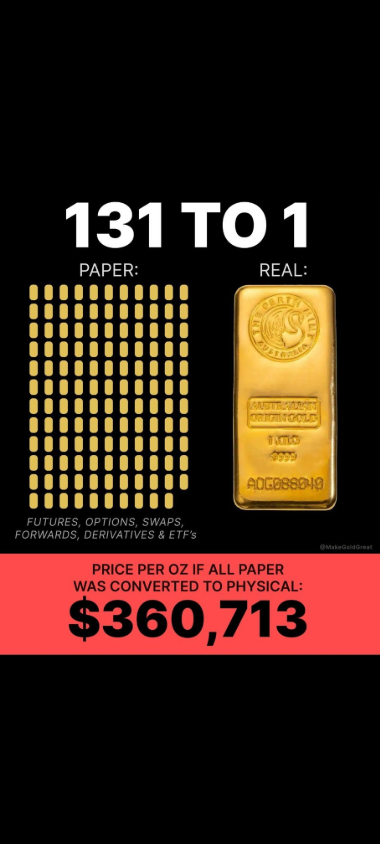

Fun story- I voluntarily ditched a lot of cash appraisal for years and traded it with Esop’s. I had insane belief that our startup will make it and I will be super rich by 28. Lost it all when the startup shutdown. Don’t depend on esop’s, even experienced founders will tell you that esop’s are never guaranteed. It’s paper wealth that rarely converts. Specially in India, there have been multiple instances of founders cashing out but employees getting nothing for their esop’s. Cash is king in downtimes and in other times too most of the times.

More like this

Recommendations from Medial

Vedant Patel

Hammer it until you ... • 8m

cash clarity tool I recently built a simple tool called Cash Clarity – it's designed for freelancers, solopreneurs, and startup founders who want to get a clear picture of their monthly inflows, outflows, and how long their cash will last. ✅ Track

See More

Manik Gruver

Investment Lead at M... • 9m

Our previous polls revealed the two main cash-killing criminals lurking in your startup... We will target them separately. Time to spill the tea, founders! Let your minds out - why are these villains SO good at emptying your bank account? (1/2) Why

See MoreAshish Singh

Finding my self 😶�... • 10m

Big Move by Paytm CEO! Vijay Shekhar Sharma, founder & CEO of Paytm, has voluntarily given up 21 million ESOPs worth over ₹1,800 crore. These ESOPs were granted under the 2019 One 97 Employee Stock Option Scheme. This decision follows SEBI’s show-c

See More

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio s

See MoreJayant Mundhra

•

Dexter Capital Advisors • 10m

It’s sad how Urban Company’s founders are being slandered for selling Rs 780cr worth of shares ahead of the IPO. Cuz, the truth is, THEY HAD NO OPTIONS. The stocks were sold over the 6-month period from Sep24 to Feb25 to settle a financial obligatio

See More

Sayan Ghosh

Hey I am on Medial • 1y

Co-Build a VC Fund in Public: Day 12 (Failing every day) Have you ever played darts? You might miss a few times but when you do hit the bullseye, you are the champion. As founders, we fail 99 times (feels like 9999 times) for every win. Failure is

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)