Back

Anonymous

Hey I am on Medial • 2y

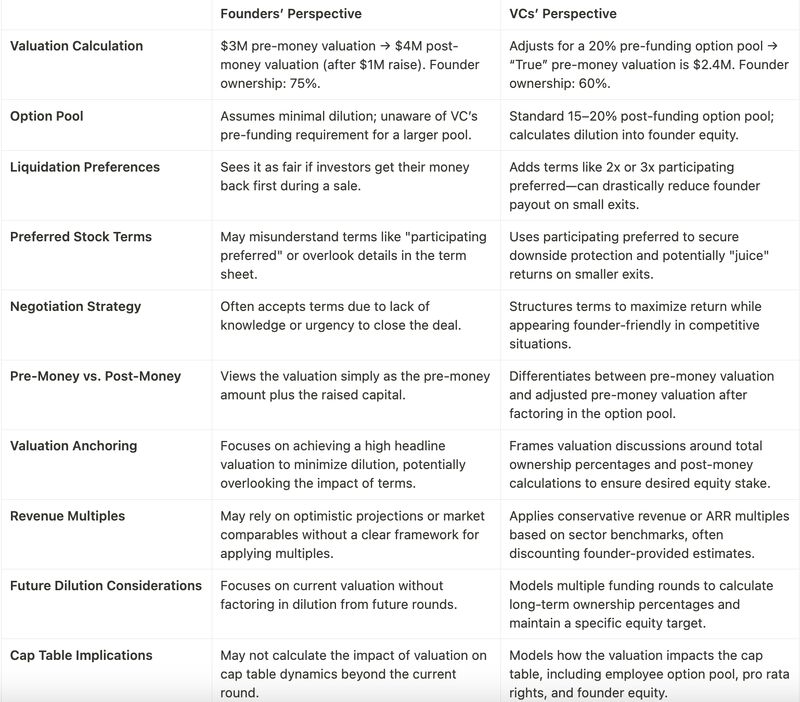

Valuation = money provided to the startup for the equity ownership I need. Equity ownership is a function of how we envisage the exit in the firm and what will be expected value then. Thus valuation is a function of money asked and equity diluted. Not the other way around. We invest below USD 500K

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Venture Capital (VC) term sheets often include clauses that can have significant implications for founders and the future of their startups. Below are some critical clauses that founders should carefully evaluate: 1. Valuation and Equity Pre-Money

See MoreAditya Malur

AI-Powered Product C... • 1y

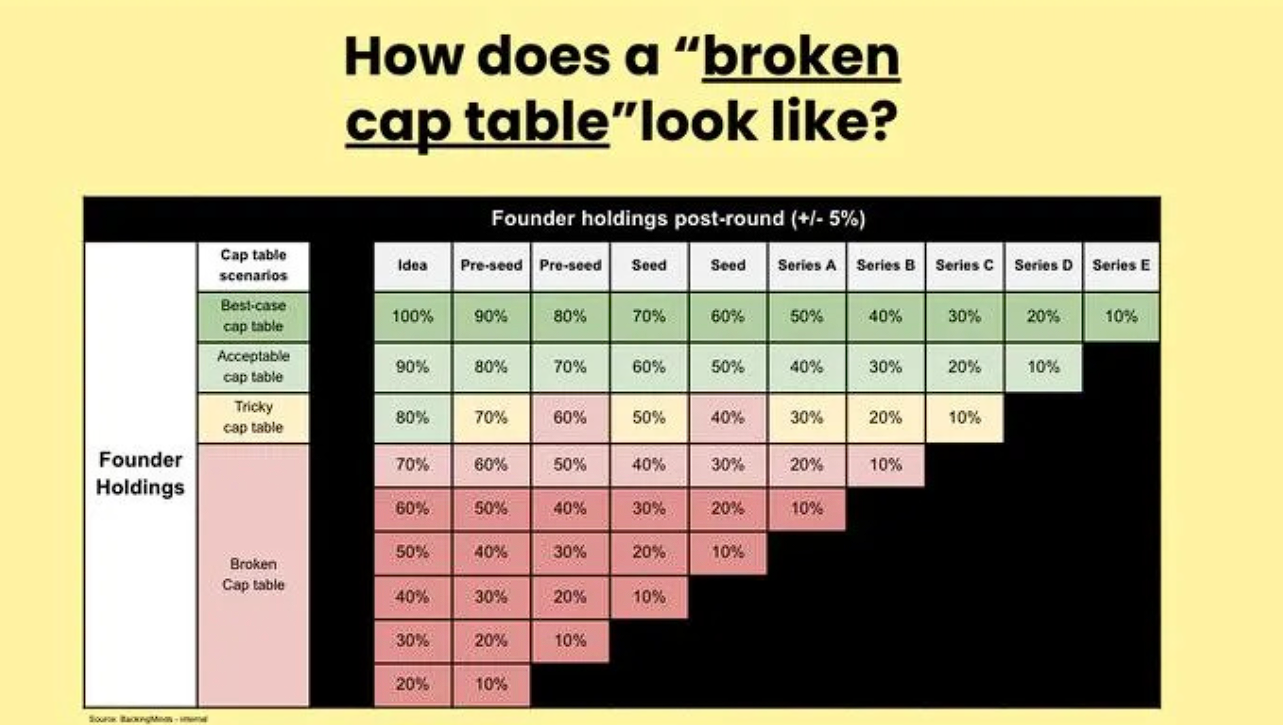

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)