Back

Iqbal Bawa

•

Amplio Invest • 1m

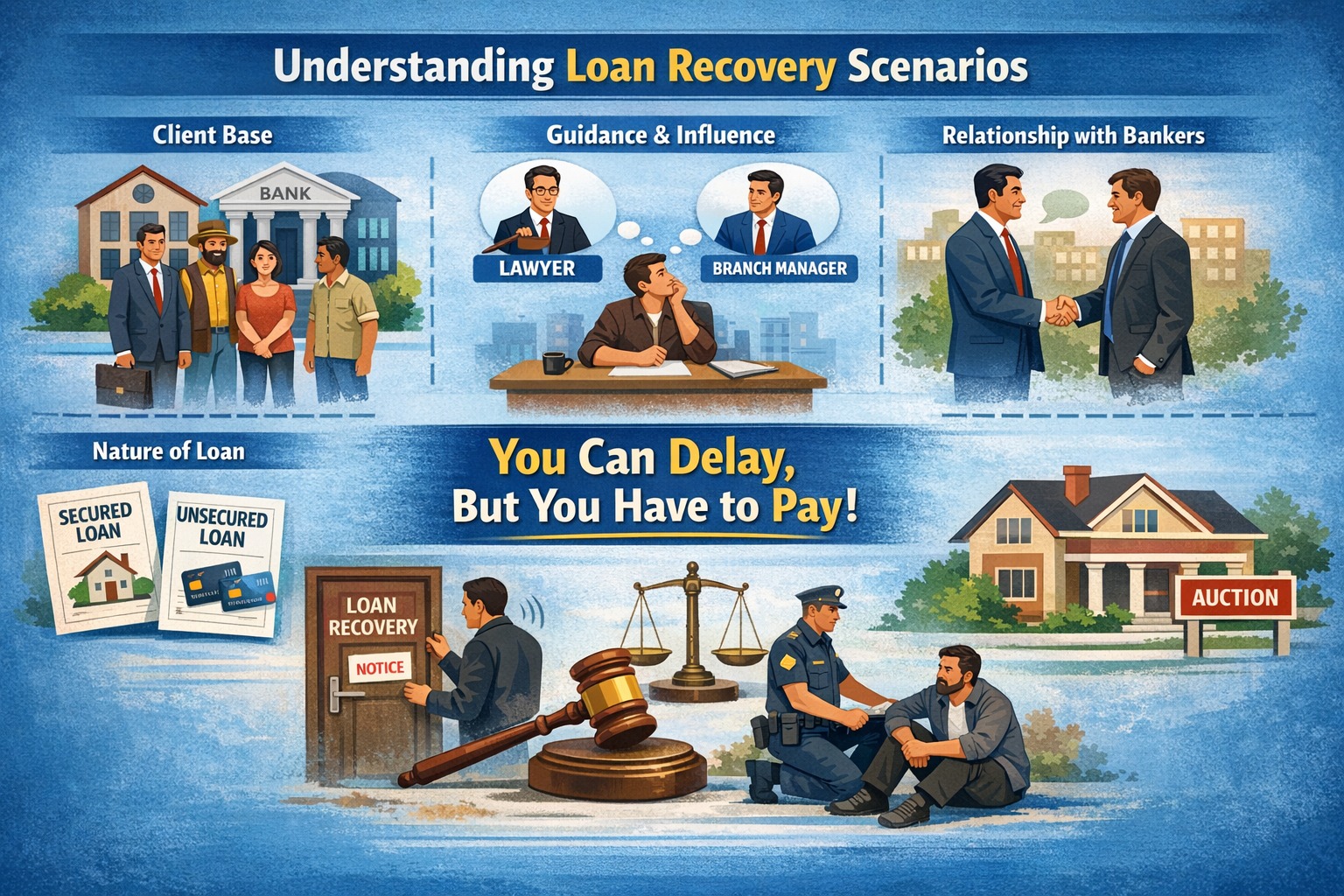

Based on my experience in Bank recovery as well as NBFC recovery, there is a clear difference in the collection and recovery scenarios across institutions. While the core objective remains the same, the approach and outcome often vary due to a few key factors: 1. Client Base The mindset, financial discipline, and risk appetite of borrowers differ significantly between banks and NBFCs, which directly impacts recovery strategies. 2. Guidance and Influence Borrowers often rely on different advisors—some immediately approach lawyers, while others believe that a branch manager or internal relationship can protect or delay their liability. 3. Relationship with Bankers The strength of a borrower’s relationship with bankers or relationship managers plays a crucial role in negotiations, restructuring, and temporary relief. 4. Nature of the Loan Recovery behavior also depends on the type of loan—secured vs unsecured, business vs personal, and the lending institution’s risk framework. However, the fundamental system remains unchanged: Payments can be delayed, but they cannot be avoided. Ultimately, every account must be resolved—either through settlement, restructuring, or legal recovery.

More like this

Recommendations from Medial

SettleMate NextGen

Pathway to Prosperit... • 1y

Introducing Our Innovative Startup: Loan Settlement with Blockchain Technology In today’s financial world, many loan borrowers, from individuals to large-scale clients, struggle with timely repayments. This often results in legal complications, high

See Moreaaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MoreVansh Khandelwal

Full Stack Web Devel... • 7m

In the blog titled "Bankruptcy: Understanding the Approaches," I explore essential strategies for businesses facing bankruptcy. The three primary approaches discussed are debt restructuring, deferment of payments, and emergency relief operations. D

See MoreRohan Saha

Founder - Burn Inves... • 9m

Good news for anyone taking gold loans and for gold loan companies too, The RBI has just increased the loan to value ratio from 75% to 85%. Simply put, if your gold is worth ₹1 lakh, you can now get a loan of up to ₹85,000 instead of the earlier ₹75,

See MoreSonu mewada rajput

Valture Finance owne... • 11m

We need people to work from all locations in Pan India who can give loan on Aadhar Card and PAN Card. People who have a good team or have daily customer visiting can contact us. You do not need to pay any fee for joining this and no fee or charge is

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)