Back

Karnivesh

Simplifying finance.... • 1m

ROCE is one of those metrics that quietly reveals business quality. I look at it as a simple test: For every ₹100 of capital a company uses, how much value does it actually generate? Revenue growth and profit numbers can look impressive, but ROCE shows whether that growth is efficient or wasteful. Why it matters more today? • Capital is expensive in a higher-rate world • Debt-funded growth carries real risk • Inefficient expansion gets exposed faster High ROCE businesses usually share a few traits: • Strong pricing power • Disciplined capital allocation • Ability to grow without constant funding. Low ROCE, even with rapid growth, often signals value destruction over time. My takeaway: Growth attracts attention, but ROCE tells you if a business deserves long-term capital. If you want to judge business quality beyond headlines, this is a metric worth tracking closely.

Replies (1)

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

Growth looks good on dashboards. But I’ve learned that not all growth actually creates value. Some companies grow organically, improving products, deepening customer trust, strengthening margins. It’s slower, but resilient. Others grow fast throug

See MoreKarnivesh

Simplifying finance.... • 27d

Not all capital spending creates growth. Some of it simply keeps a business from slipping backwards. This became clear to me after a conversation where a company proudly announced a large CapEx plan. It sounded impressive, until the question came up

See MoreAccount Deleted

Hey I am on Medial • 1y

SolarSquare’s Losses Surge Despite Revenue Growth in FY24 Rooftop solar provider SolarSquare saw a 63.5% YoY revenue growth in FY24, reaching ₹175 crore. However, its losses jumped 2.3X to ₹69 crore due to rising costs. Revenue from operations grew

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

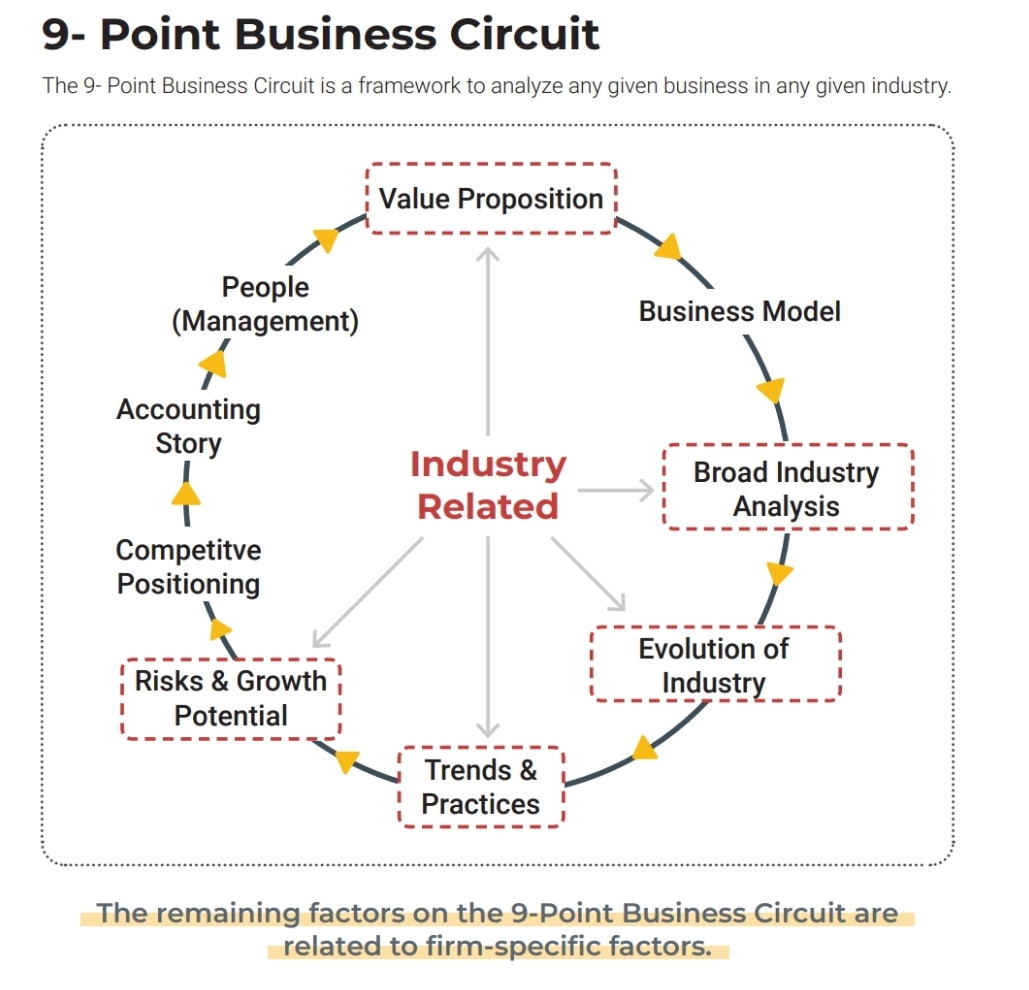

The 9 Point Business Circuit is a comprehensive framework for analyzing any business within its industry. It covers key aspects such as value proposition, business model, industry trends, competitive positioning and growth potential, helping entrepr

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)