Back

Hari kiran

Insight guru • 11m

Company A is growing at 30% YOY and is available at current p/e of 75 , ROCE of 25% and gives a dividend yield of 1% Company B is growing at 15% YOY and is available at current p/e of 30, ROCE of 50% and gives a dividend yield of 3% Assuming both the companies are from the same sector, reinvest all the profits back into business after dividend payment , takes no debt, have the same enterprise value and profit after earnings today, in which company would you invest your money for the next 5 years?

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

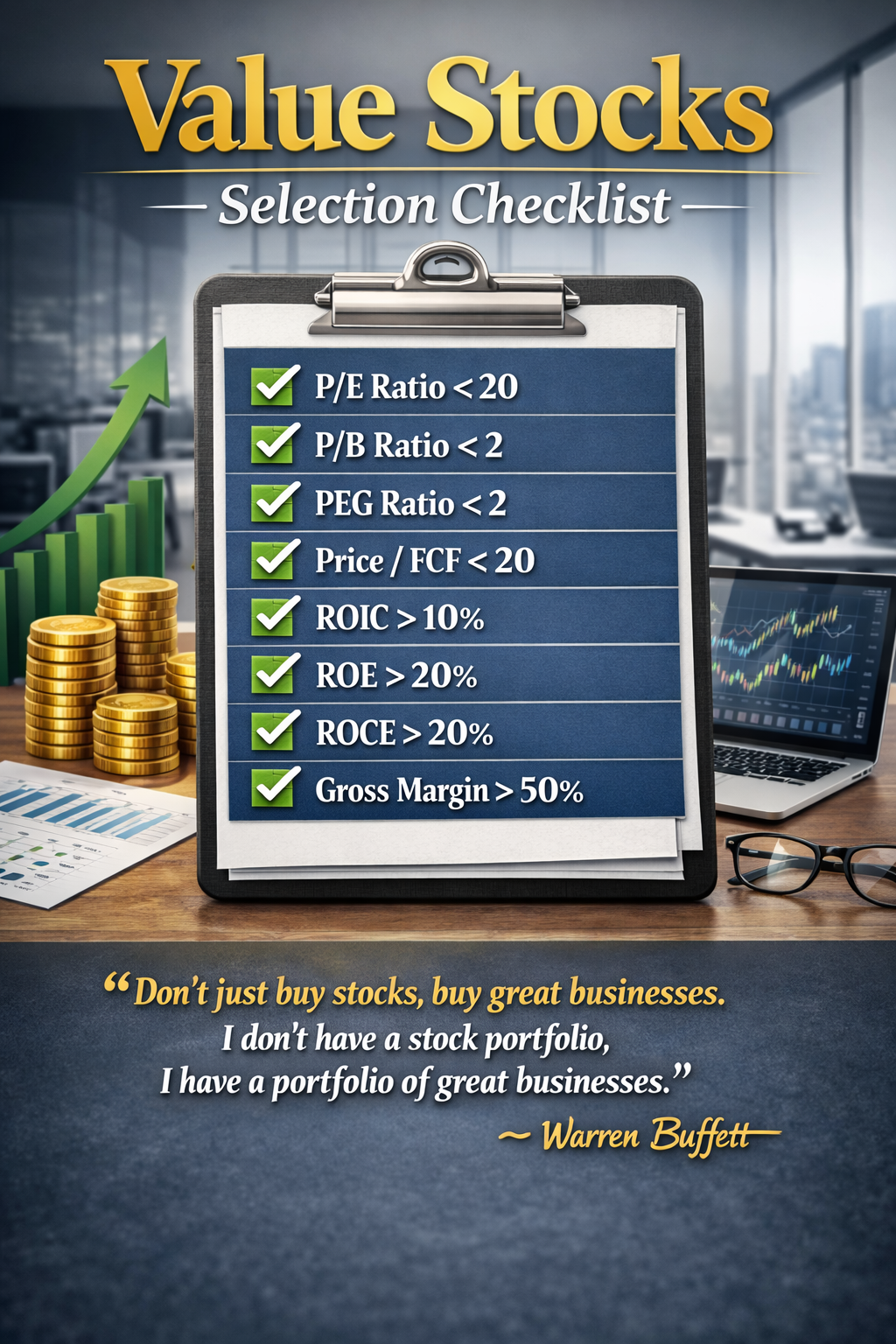

ROCE is one of those metrics that quietly reveals business quality. I look at it as a simple test: For every ₹100 of capital a company uses, how much value does it actually generate? Revenue growth and profit numbers can look impressive, but ROCE

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)