Back

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 24d

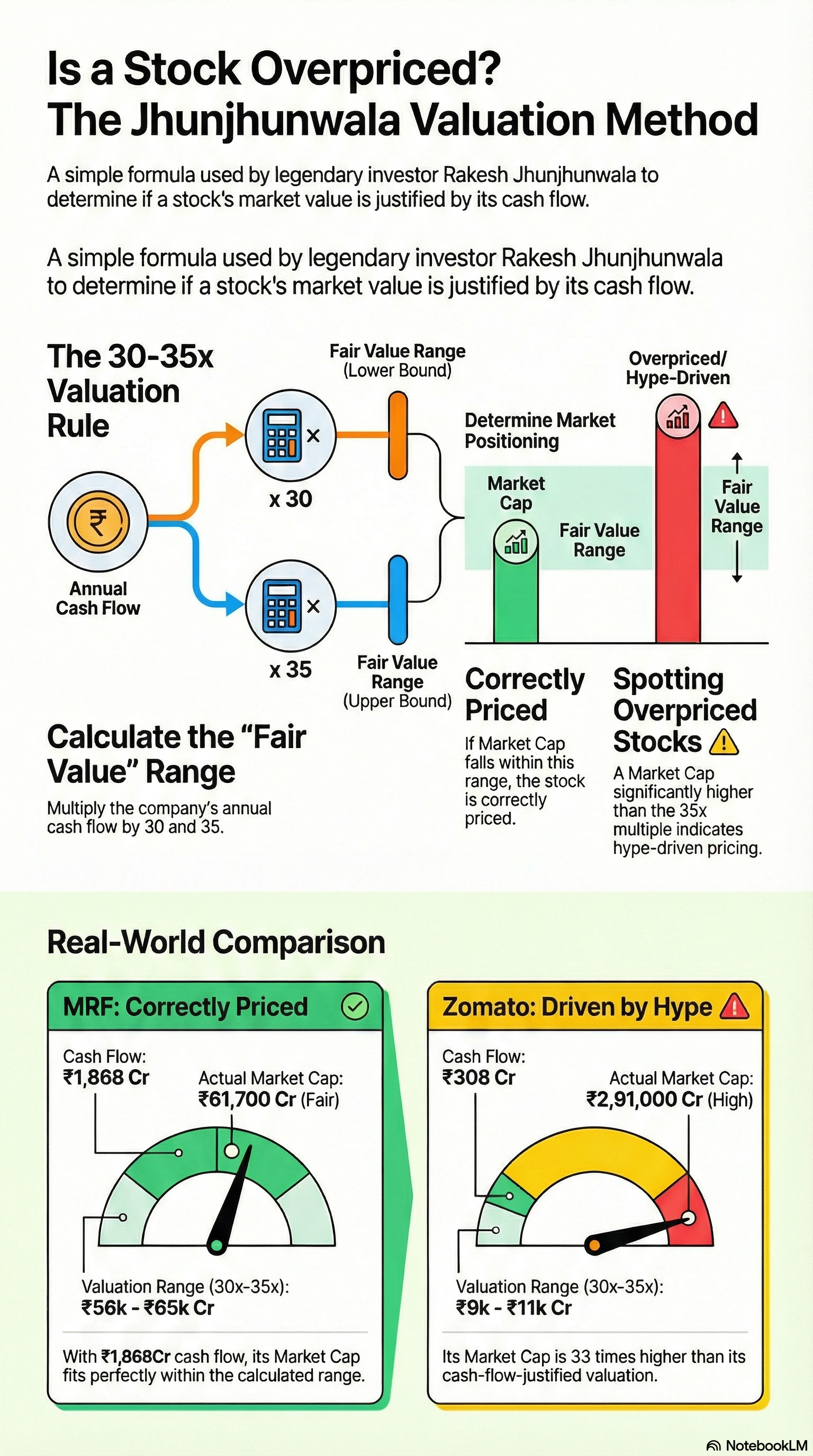

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

CA Rajat Agrawal

EaseValue Advisors • 9m

One of my startup clients recently struggled with severe cash flow issues — something I see quite often, especially in AI-driven or tech-based startups. Despite having a great product and market fit, they were stuck because of delayed receivables an

See MoreMahesh Reddy

Semi qualified CMA (... • 11m

Hey founder👋 Ever wondered how startups figure out their worth? Let me break down the Discounted Cash Flow (DCF) method—it’s easy! What’s DCF? It calculates a business’s current value by predicting its future cash flows and adjusting for risk usin

See MoreKarnivesh

Simplifying finance.... • 2m

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper i

See More

Maniraj N G

Marketing & Systems ... • 1y

📊 Why Revenue Modeling is Critical for Your Business – Backed by Data 📊 Revenue modeling isn’t just a forecasting exercise – it’s a roadmap for growth, stability, and innovation. Here's why it matters, with data to back it up: 1️⃣ Predicts Future

See MoreVedant SD

Finance Geek | Conte... • 1y

Financial Planning for Bangalore Entrepreneurs Bangalore, a thriving hub for startups, offers immense opportunities but navigating the financial landscape can be challenging. Here's a simplified guide: * Define Goals: What are your financial object

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)